The world of blockchain and crypto is evolving fast, and one of the most intriguing concepts to emerge is the Wrapped Token. This deep dive will walk you through everything you need to know about wrapped tokens, from their definition and types to benefits, risks, strategies, and future outlook.

What is a Wrapped Token?

A Wrapped Token is a digital asset pegged to the value of another cryptocurrency or real-world asset. It acts as a “wrapper” allowing that asset to exist on a different blockchain. This process enhances interoperability between blockchains that would otherwise be incompatible.

For example, Wrapped Bitcoin (WBTC) is a token on the Ethereum blockchain that represents Bitcoin. Even though it behaves like an ERC-20 token, each WBTC is backed 1:1 by Bitcoin held in reserve.

Types of Wrapped Tokens

Wrapped Tokens can represent a variety of assets. Here are the main types:

1. Wrapped Cryptocurrencies

These include tokens like WBTC, WETH (Wrapped Ethereum), and renBTC. They let native coins operate on other blockchain networks.

2. Wrapped Real-World Assets

Real estate, stocks, and commodities can also be tokenized. These wrapped assets enable fractional ownership and faster trading.

3. Wrapped Stablecoins

Examples include wrapped versions of USDT or USDC on non-native chains. This improves liquidity across networks.

4. Synthetic Wrapped Tokens

These are more complex, representing indices or bundles of assets, often used in decentralized finance (DeFi) protocols.

Why Do Companies Offer Wrapped Tokens?

Companies and blockchain protocols create wrap tokens to:

- Enable cross-chain compatibility

- Boost liquidity in decentralized exchanges

- Support DeFi applications that only accept certain token standards

- Facilitate interoperable Smart Contracts

- Attract a broader investor base

Wrapped Tokens help companies bridge the gap between isolated blockchain ecosystems, leading to more inclusive and efficient digital finance.

How to Qualify for Using Wrapped Tokens

To use or access a Wrap Token, you typically need:

- A compatible crypto wallet (like MetaMask)

- Access to a DeFi platform that supports wrapping (like BitGo, RenVM, or others)

- Some native currency to pay gas fees (e.g., ETH or BNB)

- An understanding of bridging protocols or wrapping/unwrapping mechanisms

Most platforms will require KYC (Know Your Customer) only if fiat or centralized custodians are involved.

Benefits of Wrapped Tokens

Wrapped Tokens bring several strong advantages to the crypto world:

- Interoperability: Use Bitcoin on Ethereum or Solana, breaking blockchain silos.

- Increased liquidity: Enables more tokens to be traded on DEXs.

- DeFi access: Native coins that weren’t DeFi-compatible can now be used.

- Faster transactions: Wrapped versions of slow coins benefit from faster blockchains.

- Token standard compliance: Essential for interacting with smart contracts.

Risks and Precautions

Despite their advantages, Wrap Tokens also carry risks. Key concerns include:

- Centralized custodianship: Many wrap tokens depend on third parties to hold the underlying asset, creating trust issues.

- Smart contract vulnerabilities: Bugs in wrapping or unwrapping protocols can lead to loss of funds.

- Depegging: If the token loses its 1:1 peg due to poor management, it can create massive losses.

- Liquidity risk: Low trading volume may lead to slippage or asset unavailability.

Always research the provider and understand the smart contract and custodial arrangements before engaging with any wrapped asset.

Where to Find Legitimate Wrapped Tokens

Legitimate Wrap Tokens are usually offered by trusted platforms and DeFi protocols. Look for:

- Audited smart contracts

- Transparent custodial reserves

- Real-time proof-of-reserve data

- Established wrapping platforms like BitGo, Ren Protocol, and Anyswap

- Listings on reputable exchanges such as Uniswap, Aave, Curve, and Sushiswap

Avoid unknown or unverified wrapping platforms to reduce exposure to fraud or vulnerabilities.

Best Strategies to Maximize Wrapped Token Utility

Wrapped Tokens aren’t just for transferring value—they can be a strategic asset. Here’s how to optimize their use:

- Yield Farming: Use wrap tokens in liquidity pools for passive income.

- Collateralization: Use wrapped assets as collateral in lending platforms like Aave or Compound.

- Cross-Chain Arbitrage: Exploit price differences of the same asset on different chains.

- Staking in Layer-2 Solutions: Earn rewards while saving on gas fees.

- DeFi Index Participation: Some protocols use wrap tokens to simulate diversified exposure.

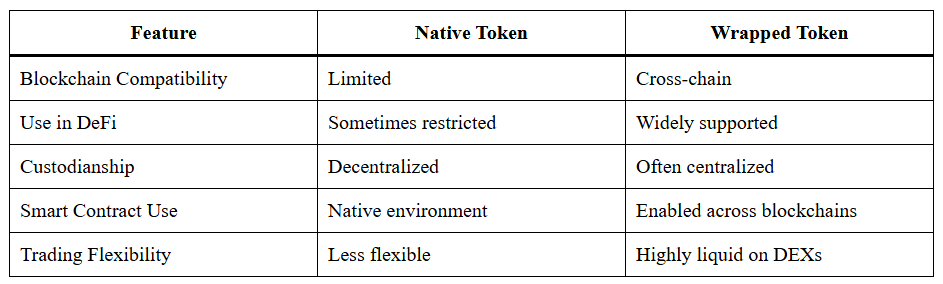

Wrapped Token vs Native Token: A Quick Comparison

Tax Implications of Wrapped Tokens

While jurisdictions vary, wrap tokens often trigger tax events:

- Wrapping/Unwrapping: Some tax authorities may consider these as taxable events.

- Gains from Yield: Earnings from farming or staking are typically taxable income.

- Capital Gains: Selling a wrap token for profit may incur capital gains tax.

- Cross-Chain Transfers: These may be considered disposals in tax terms.

Always consult a crypto tax expert or use tax tools like Koinly or CoinTracker to remain compliant.

Future Outlook of Wrapped Tokens

The role of Wrapped Tokens is only expected to grow as the blockchain ecosystem matures. Key future developments include:

- Interoperability-focused chains like Polkadot and Cosmos reducing reliance on wrap tokens

- More decentralized custodianship models to address trust issues

- Real-world asset tokenization to open access to stocks, bonds, and real estate on-chain

- Enhanced regulation bringing greater transparency and institutional interest

With the continued rise of DeFi, NFTs, and Web3, wrap tokens will remain an essential component of digital finance.

Conclusion

Wrapped Tokens have emerged as a game-changing innovation in the blockchain space. They enable interoperability, increase liquidity, and open new doors for DeFi adoption. However, like any financial instrument, they come with risks that need careful consideration. As regulations improve and decentralized custody evolves, Wrap Tokens are poised to remain at the forefront of cross-chain solutions and real-world asset integration.

Frequently Asked Questions

What is the main purpose of a Wrapped Token?

The primary purpose of a Wrapped Token is to enable a cryptocurrency to be used on a blockchain other than its native one. For example, Wrapped Bitcoin (WBTC) allows Bitcoin to function on Ethereum-based DeFi platforms, increasing cross-chain interoperability and liquidity.

Is it safe to use Wrapped Tokens in DeFi?

Wrapped Tokens can be safe if issued by reputable platforms with audited smart contracts and transparent custodianship. However, risks such as smart contract bugs, centralized custody vulnerabilities, and depegging events still exist, so users should always research before use.

Do I need to pay taxes on Wrapped Tokens?

Yes, in many jurisdictions, wrapping or unwrapping tokens can trigger taxable events. Additionally, profits from using wrapped tokens in yield farming, lending, or trading may be subject to income or capital gains taxes. Always consult a tax advisor for accurate guidance.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.