What is DEX is a question that has become increasingly relevant in the age of blockchain technology and decentralized finance. As centralized systems face mounting scrutiny over user control, privacy, and financial freedom, decentralized exchanges or DEXs emerge as game-changers.

This guide will help you understand what is DEX, how it operates, who created it, and why it plays a pivotal role in the next generation of finance. Whether you are a beginner entering the crypto space or a seasoned DeFi trader, this comprehensive blog offers valuable insights into the growing DEX landscape.

What is DEX? The Fundamentals Explained

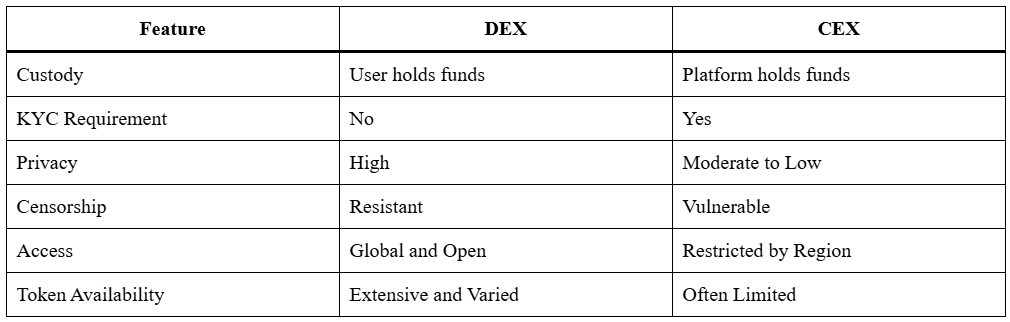

A DEX or Decentralized Exchange is a blockchain-based platform that enables direct cryptocurrency transactions between users without any intermediary or central authority. Unlike centralized exchanges such as Binance or Kraken, DEXs are non-custodial and peer-to-peer. This means you retain complete control over your funds and private keys during the entire trading process.

So, what is DEX at its core? It is a decentralized protocol powered by smart contracts that automate order matching, execution, and settlement, eliminating the need for middlemen.

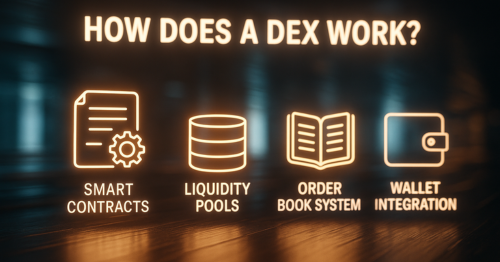

How Does a DEX Work?

To fully understand what is DEX, it’s essential to break down its internal mechanism:

Smart Contracts

At the heart of every DEX are smart contracts, which are self-executing programs deployed on blockchains like Ethereum or Solana. These contracts manage the trading logic, asset swaps, and fund custody in a fully transparent and secure manner.

Read all About: Smart Contracts

Liquidity Pools

Many DEXs operate using Automated Market Makers, where liquidity is provided by users who deposit pairs of tokens into pools. These pools facilitate instant swaps, with prices adjusted based on supply and demand through pre-set mathematical formulas.

Order Book Systems

Some DEXs like dYdX or Loopring use on-chain or off-chain order books that allow users to place limit or market orders. This model closely mimics centralized platforms while maintaining decentralization.

Wallet Integration

Users connect their crypto wallets such as MetaMask, Phantom, or WalletConnect directly to the DEX, ensuring full custody of funds and eliminating the need for KYC or account creation. This setup emphasizes privacy and true ownership.

Who Created DEXs and When?

Understanding what is DEX also involves knowing its origin and evolution. Let’s look at the most influential decentralized exchanges and their creators:

Uniswap

- Founder: Hayden Adams

- Established: November 2018

- Blockchain: Ethereum

- Overview: Uniswap pioneered the AMM model, allowing users to trade tokens without relying on order books. It remains one of the most used DEXs globally.

dYdX

- Founder: Antonio Juliano

- Established: 2017

- Blockchain: Initially Ethereum, currently transitioning to a Cosmos-based chain

- Specialization: Offers decentralized perpetual contracts and leveraged trading.

SushiSwap

- Creator: Anonymous developer “Chef Nomi”

- Launched: August 2020

- Purpose: Forked from Uniswap, it brought innovative features like yield farming and community governance.

PancakeSwap

- Launched: September 2020

- Blockchain: Built on BNB Chain

- Focus: Lower fees, staking opportunities, and NFT marketplaces tailored for retail traders.

These platforms revolutionized how users interact with blockchain-based finance and showcase how the concept of what is DEX has matured.

Why DEXs Matter in Modern Finance

User Sovereignty

Users always maintain control over their assets. There is no need to trust a third party with your crypto holdings.

No Censorship

Since DEXs operate on decentralized protocols, they are inherently resistant to censorship or government interference.

Enhanced Privacy

Most DEXs do not require any form of identification, offering higher privacy compared to traditional platforms.

Global and Open Access

Anyone with a crypto wallet and internet access can use a DEX, regardless of their location or jurisdiction.

DeFi Integration

DEXs are closely integrated with decentralized finance applications, allowing users to lend, borrow, and earn interest on their assets.

Risks Associated with DEXs

While understanding what is DEX reveals a range of benefits, it is equally important to consider the associated risks:

- Smart Contract Vulnerabilities: Bugs in code can be exploited if not properly audited.

- Impermanent Loss: Liquidity providers can face temporary losses when the market price shifts.

- Front-Running: Bots may reorder transactions to gain unfair advantage.

- Limited Support: Most DEXs do not offer customer support, which can be a concern for beginners.

The CoinGecko DEX Rankings offers real-time data on leading decentralized exchanges.

Use Cases That Define What is DEX

Global Payments

DEXs allow cross-border payments without delays or restrictions imposed by traditional banking systems.

Yield Generation

Users can earn passive income through liquidity provision, farming, or staking on supported DEXs.

Token Launchpads

Initial DEX Offerings enable new projects to launch tokens directly to a global audience.

NFT and Gaming Markets

DEXs increasingly support NFT trading and in-game asset swapping, expanding their ecosystem relevance.

Learn More in Our Blockchain Deep Dives

For a closer look at how DEXs integrate with DeFi tools, visit our DeFi Architecture Overview

DEX vs. CEX: Quick Comparison Table

Conclusion: Why You Should Care About What is DEX

Grasping what is DEX is vital in today’s digital economy. Decentralized exchanges put the power back in users’ hands, giving them control over their assets, trading options, and privacy. As blockchain adoption grows, DEXs are expected to become more efficient, scalable, and integrated with emerging technologies like AI, Layer-2 scaling, and cross-chain interoperability.

Whether you aim to trade tokens, provide liquidity, or explore Web3 finance, understanding what is DEX is your gateway to a decentralized future. This innovation is not just a trend, it is a financial movement you can no longer afford to ignore.

Frequently Asked Questions

What is DEX in cryptocurrency?

A DEX, or decentralized exchange, is a platform that allows users to trade cryptocurrencies directly with one another without relying on a central authority or intermediary. Transactions are facilitated through smart contracts on blockchain networks like Ethereum or Solana. DEXs offer higher privacy, lower fees, and full user control over funds compared to centralized exchanges.

How does a DEX work compared to a CEX?

A DEX works through blockchain-based smart contracts that execute trades between users directly from their wallets. In contrast, a centralized exchange (CEX) acts as a middleman that holds users’ funds and executes trades within a centralized order book. DEXs are non-custodial, require no KYC, and offer greater transparency, while CEXs provide faster execution and often better liquidity for major assets.

Is it safe to use a DEX for crypto trading?

Yes, using a DEX is generally safe if the platform is well-audited and reputable. Since DEXs are non-custodial, you maintain control of your private keys and funds. However, risks include potential smart contract bugs, phishing attacks, and impermanent loss for liquidity providers. It’s crucial to use verified DEXs and connect only with trusted wallets.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.