What is Cryptocurrency A Powerful Guide for Beginners

Understanding the cryptocurrency market is essential in today’s rapidly evolving digital economy. This guide breaks down the core concepts, types, benefits, and risks associated with cryptocurrency, making it easy for beginners to get started confidently.

What is Cryptocurrency?

Cryptocurrency refers to a form of digital or virtual money that relies on advanced cryptographic techniques to secure financial transactions, regulate the creation of new units, and verify the transfer of assets across decentralized networks. Unlike traditional currencies issued by governments, cryptocurrencies operate on blockchain technology, ensuring transparency, immutability, and freedom from central authority control.. Unlike traditional currencies issued by governments and managed by banks, cryptocurrencies operate on decentralized networks built on blockchain technology. Every transaction is recorded on a public ledger, ensuring transparency and reducing the risk of fraud.

These currencies are not physical coins or notes. Instead, they are digital tokens that can be traded or used to purchase goods and services where accepted. Bitcoin was or founded in 2009, and it is the first and is still the most well-known cryptocurrency.

Types of Cryptocurrency

Thousands of cryptocurrencies exist today, each with its own purpose and features. Here are the main types you should know:

- Bitcoin (BTC): The original and most widely used in the crypto market.

- Ethereum (ETH): Known for enabling smart contracts and decentralized apps.

- Stablecoins (e.g., USDT, USDC): Pegged to traditional assets like USD to minimize volatility.

- Altcoins: All cryptocurrencies other than Bitcoin. Examples include Litecoin, Cardano, and Solana.

- Privacy Coins: Designed to protect user anonymity, like Monero and Zcash.

- Utility Tokens: Provide access to services or applications on a particular blockchain platform.

Benefits of Using Cryptocurrency

Cryptocurrency offers numerous advantages for users and investors:

- Decentralization: Eliminates reliance on banks or central authorities.

- Lower Transaction Costs: Especially for cross-border payments.

- Speed: Transactions can be completed within minutes.

- Security: Advanced encryption and blockchain immutability.

- Accessibility: Open to anyone with internet access, even the unbanked.

- Transparency: A public ledger ensures open and transparent access to all recorded transactions globally.

Risks and Precautions

Despite its benefits, cryptocurrency comes with inherent risks:

- Volatility: Prices can fluctuate drastically in short periods.

- Cybersecurity Threats: Exchanges and wallets are susceptible to hacks.

- Scams and Fraud: Ponzi schemes, pump-and-dump tactics, and fake ICOs are common.

- Lack of Regulation: Legal uncertainty can affect market stability and investor confidence.

Read All About: Cryptocurrency Scams Guide

Precautions to Take:

- Use hardware wallets or trusted platforms.

- Always enable two-factor authentication.

- Keep your private keys secure and offline.

- Do thorough research before investing in any new crypto project.

Where to Find Legitimate Cryptocurrency

To buy or trade cryptocurrency safely:

- Use reputed exchanges registered with regulatory bodies.

- Check for platforms offering KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

- Review user feedback, security protocols, and trading volume before signing up.

Avoid platforms that make unrealistic promises or have no transparency about team or technology. You Can Find Out Legitimate Cryptocurrency on CoinMarketCap

Best Strategies to Maximize Cryptocurrency Investment

Investing in cryptocurrency can be profitable if approached wisely. Here are effective strategies:

- HODLing: Hold on for the long term, especially for established coins like Bitcoin or Ethereum.

- Diversification: Don’t put all your funds into one token or platform.

- Dollar-Cost Averaging (DCA): Invest a fixed amount periodically to reduce impact of volatility.

- Staking and Yield Farming: Earn Passive Income by participating in blockchain validation or liquidity pools.

- Research-Based Investment: Study the whitepaper, use case, team, and community support before committing funds.

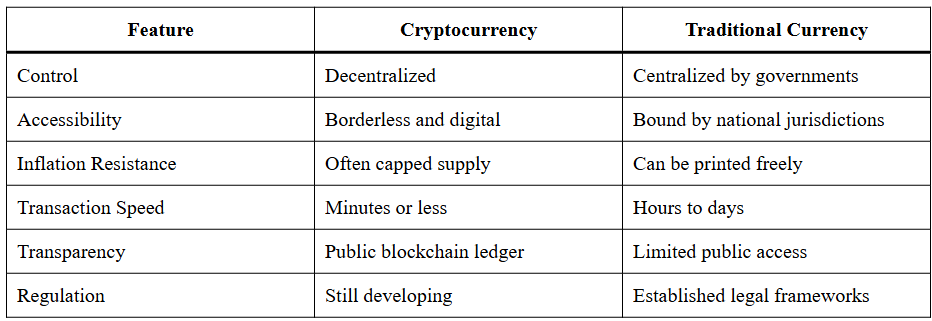

Cryptocurrency vs Traditional Currency

Tax Implications of Cryptocurrency

Taxation on crypto varies across countries but is becoming increasingly regulated:

- Capital Gains Tax: Profits from selling crypto are taxable in many regions.

- Income Tax: Mining rewards, staking earnings, or payments received in crypto are often treated as income.

- Record Keeping: Investors must maintain accurate records of all transactions, including purchase date, amount, and value.

Countries like the U.S., U.K., and India now require mandatory disclosure of cryptocurrency holdings during income tax filings. Non-compliance may result in heavy penalties or legal action. It’s essential to remain updated with the latest tax laws and keep detailed records of all crypto activity.

Future Outlook of Cryptocurrency

The future of cryptocurrency is promising but not without challenges:

- Regulatory Evolution: Countries are working toward clearer frameworks to protect users and stimulate innovation.

- Mass Adoption: Increasing merchant acceptance and institutional interest signal long-term potential.

- Technological Advancement: Developments like Layer-2 solutions, interoperability protocols, and eco-friendly consensus mechanisms are driving growth.

Another promising development is the rise of Central Bank Digital Currencies (CBDCs), which may coexist with traditional crypto, offering more use cases and broader acceptance. As blockchain technology improves, issues like high energy consumption and scalability are expected to be addressed, making cryptocurrency more sustainable and efficient.

Common Myths About Cryptocurrency

Myth 1: Cryptocurrency is only for tech-savvy people

Reality: Many user-friendly apps and platforms now make it easy for anyone to get started.

Myth 2: It’s just a bubble

Reality: While volatility exists, the technology and real-world use cases indicate long-term viability.

Myth 3: Cryptocurrency is illegal

Reality: It is legal in most countries with varying degrees of regulation.

How to Start with Cryptocurrency

- Educate Yourself: Read beginner guides, watch tutorials, and stay updated with news.

- Choose a Platform: Pick a regulated exchange with good reviews.

- Create a Wallet: Choose between a hot wallet (online) or cold wallet (offline) depending on your needs.

- Start Small: Begin with a small amount for investment to understand the crypto market.

- Monitor Trends: Follow credible sources and join online communities.

Conclusion

Crypto is transforming how we think about money, investing, and global finance. From decentralization and low-cost transactions to high returns and transparency, the opportunities are vast. However, it’s equally important to understand the risks, tax responsibilities, and strategies for making informed decisions.

For beginners, learning the basics and starting small with well-researched investments can be a smart entry into the world of crypto. With careful planning, ongoing education, and a long-term mindset, you can take full advantage of this revolutionary financial frontier.

Frequently Asked Questions (FAQs)

1. Do I need to pay taxes on it?

- Yes, tax rules apply to trading, selling, or earning from digital assets.

- Even rewards or transfers may require reporting in many jurisdictions.

2. Is it safe for sending or saving money?

- It can be safe when using trusted platforms and secure wallets.

- Always use strong passwords and enable two-factor authentication to reduce risks.

3. How do I start investing as a beginner?

- Choose a regulated exchange, create a wallet, and verify your identity.

- Start with a small amount and research each asset before buying.

4. What is the main difference compared to traditional money?

- This asset is decentralized, digital, and operates independently of banks.

- Traditional currency is government-backed and centrally regulated.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.