Introduction to Web3 & Metaverse

The internet is evolving, and at the forefront of this transformation are two key ideas, Web3 and the Metaverse. These aren’t just buzzwords, they represent a seismic shift in how we interact with data, assets, and each other online.

Web3 is the decentralized version of the internet where users own their data and digital assets. It’s powered by Blockchain technology, enabling transparency, trustless transactions, and direct ownership without relying on centralized platforms like banks or big tech companies.

On the other hand, the Metaverse is an immersive digital space where people can socialize, build, play, and even earn, all in a virtual world. From attending concerts to buying virtual land, the Metaverse is creating entirely new economies.

Together, Web3 and the Metaverse are creating opportunities for a new kind of trading and investing, which requires a strong understanding of market tools, behavior, and trends.

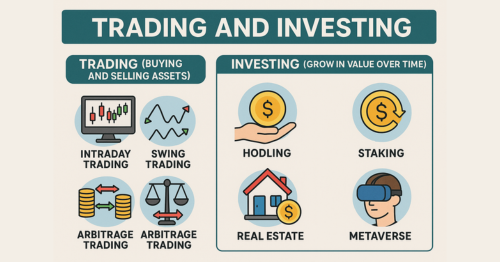

What is Trading and Investing?

Trading

Trading refers to buying and selling assets, like cryptocurrencies, NFTs, or tokens, on a short-term basis to profit from price movements. Web3 platforms like Uniswap, PancakeSwap, and Metaverse environments like Decentraland enable such trading.

- Trading Styles in the Crypto Market:

1. Intraday Trading – Involves executing multiple trades within a single day to benefit from rapid price fluctuations.

2. Swing Trading – Focuses on capturing medium-term trends by holding positions for days or weeks.

3. Arbitrage Trading – Takes advantage of price discrepancies across different platforms to earn instant profits. - Common goal: Profit from market volatility

Investing

Investing is a long-term strategy where you put your money into assets expecting them to grow in value over time. In the Metaverse, this could mean buying digital land or holding tokens from a promising DeFi project.

- Types of investing: HODLing, Staking, real estate in the Metaverse

- Common goal: Wealth accumulation and passive income

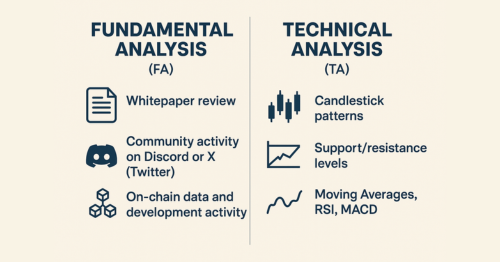

What are Fundamental Analysis and Technical Analysis?

Fundamental Analysis (FA)

FA involves studying the core aspects of a project, its team, roadmap, use case, tokenomics, and partnerships, to evaluate its long-term value.

In Web3, this might include:

- Whitepaper review

- Community activity on Discord or X (Twitter)

- On-chain data and development activity

Use case example: Researching the utility of a metaverse token like MANA or SAND before investing.

Technical Analysis (TA)

Technical analysis relies on charts, market patterns, and indicators to forecast short-term price trends and identify potential entry or exit points for trades. It doesn’t rely on news or fundamentals but instead studies:

- Candlestick patterns

- Support/resistance levels

- Moving Averages, RSI, MACD

Use case example: Identifying a breakout zone in ETH or BTC price chart using volume indicators.

Utilizing Fundamental and Technical Analysis Together

Successful traders and investors in Web3 often combine FA and TA.

- Fundamental analysis helps choose the right project or token.

- Technical analysis helps determine when to enter or exit the market.

Scenario: After finding a strong DeFi project through FA, you use TA to time your entry point for maximum profit.

This hybrid approach is especially useful in the fast-moving Metaverse world, where news and social media can trigger both long-term interest and short-term volatility.

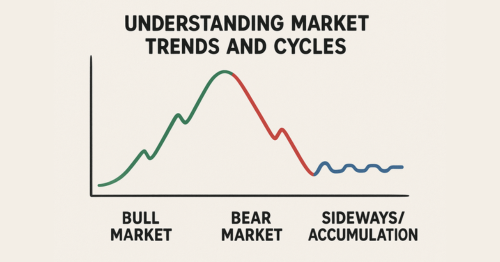

Understanding Market Trends and Cycles

Markets move in cycles, especially in crypto and Web3. Recognizing these patterns can protect your capital and enhance decision-making.

Bull Market

- Prices are rising

- Strong optimism

- New investors enter the space

Bear Market

- Prices decline

- Fear dominates

- Long-term holders stay strong

Sideways/Accumulation

- Prices remain stable

- Smart investors accumulate tokens quietly

Web3 projects often follow these patterns, just like traditional assets. Understanding this helps you avoid buying high and selling low.

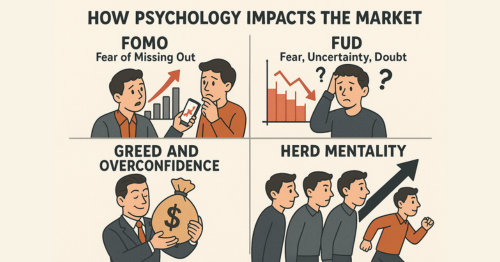

How Does Psychology Impact the Market?

Trading is as much about mindset as it is about data. Market Psychology refers to the collective emotions, attitudes, and behaviors of traders, which play a critical role in shaping price movements, often driving markets more than logic or fundamentals.

Common Psychological Triggers

- FOMO (Fear of Missing Out): Buying impulsively during price surges

- FUD (Fear, Uncertainty, Doubt): A psychological trigger that causes investors to sell in panic, often sparked by negative news or rumors, leading to sharp market declines driven by emotion rather than facts.

- Greed and Overconfidence: Holding too long and ignoring warning signs

- Herd Mentality: The tendency to mimic the actions of the majority instead of making independent, informed decisions.

In the volatile landscape of Web3 and Metaverse trading, developing self-awareness and maintaining emotional discipline can provide a significant advantage over reactive, crowd-driven behavior.

Final Thoughts

Web3 and the Metaverse are revolutionizing how we trade, invest, and engage with digital assets, shifting control from centralized entities to users and enabling immersive, decentralized financial experiences. As a beginner, learning how to combine fundamental and technical analysis, recognize market cycles, and manage your emotions can set you apart from the average investor.

Stay curious. Keep learning. And remember: in Web3, you own your journey, literally and financially.

Frequently Asked Questions

What is the difference between Web3 and the Metaverse?

Web3 refers to the decentralized internet built on blockchain technology, while the Metaverse is a virtual world where people can interact, trade, and play using digital avatars. Web3 powers the backend; the Metaverse offers the immersive experience.

Is it safe to invest in Web3 and Metaverse projects?

Like all investments, Web3 and Metaverse projects carry risk. It’s important to conduct thorough fundamental and technical analysis and only invest what you can afford to lose. Scams and rug pulls are common, so research is critical.

What is the best way to start trading in Web3?

Start by creating a secure crypto wallet (like MetaMask), choose a reputable exchange (like Coinbase or Binance), and study technical and fundamental analysis. Begin with small amounts and avoid emotional trading decisions.

How can I buy land in the Metaverse?

You can buy virtual land using the native tokens of Metaverse platforms like Decentraland (MANA) or The Sandbox (SAND) through marketplaces such as OpenSea or directly on the project’s own platform.

What tools should I use for market analysis in Web3?

1. For technical analysis: TradingView, CoinMarketCap, and CoinGecko.

2. For fundamental analysis: Token Terminal, Dune Analytics, Nansen.

3. For sentiment tracking: Crypto Fear & Greed Index, LunarCrush.