Upcoming Token Unlocks You Can’t Afford to Miss. The cryptocurrency market never sleeps, and one of the most anticipated events in the industry is token unlocks. Whether you’re a seasoned investor or just starting out in crypto, understanding what token unlocks are, why they happen, and how they affect the market can make a big difference in your trading decisions.

What Are Token Unlocks?

In simple terms, token unlocks refer to the scheduled release of a certain amount of cryptocurrency tokens into circulation after a vesting period. Many projects lock a portion of their tokens at launch to control supply and stabilize prices.

When the lock-up period ends, those tokens are “unlocked” and become available for sale, staking, or other uses. This can impact token prices, as the sudden increase in supply often leads to market volatility.

Why Token Unlocks Matter to Investors

For investors, token unlocks can be a double-edged sword:

- Opportunities – If you believe in the project, token unlocks may allow you to buy at a better price during short-term dips.

- Risks – Large unlocks can lead to price drops if investors or team members sell their newly unlocked tokens quickly.

Smart traders watch unlock schedules closely to position themselves ahead of the market.

Factors That Influence Token Unlock Impact

Not every token unlock event shakes the market. The effect depends on several factors:

- Percentage of Supply Released – A large percentage unlock is more likely to cause significant price swings.

- Market Sentiment – If overall crypto sentiment is bullish, unlock-related sell pressure might be absorbed quickly.

- Project Fundamentals – Strong projects with active communities can weather unlocks better than weak ones.

- Timing – Unlocks during bearish trends often have a larger negative price impact.

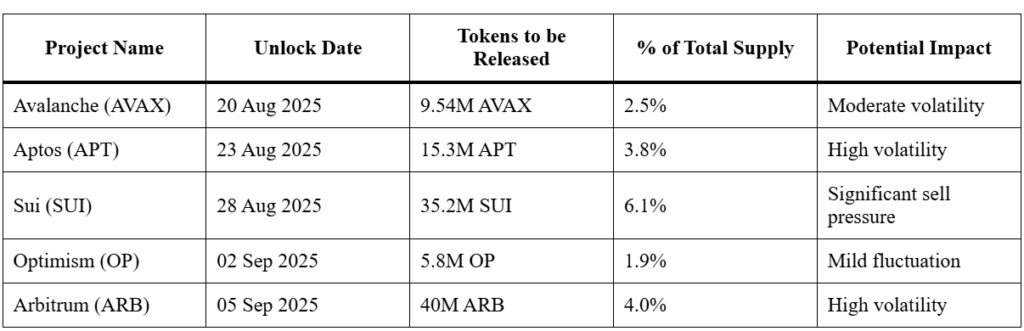

Upcoming Token Unlocks Worth Watching

Here’s a snapshot of some major token unlocks scheduled in the coming weeks. This table includes the project name, date of unlock, amount of tokens, and potential market implications.

Strategies for Trading Around Token Unlocks

Since token unlocks can cause both price drops and buying opportunities, here are a few ways to approach them strategically:

- Monitor Official Schedules – Use tools like TokenUnlocks.app or project announcements to track upcoming events.

- Set Alerts – Be notified before a token unlock so you can plan your moves.

- Analyze Liquidity – Check if the market can absorb the new supply without major impact.

- Avoid Panic Selling – Not all unlocks lead to a crash; sometimes the market reacts positively if the project’s fundamentals are strong.

- Consider Staggered Buys – If you expect a dip, buying in small chunks during and after the unlock can lower your average cost.

Real-Life Example of Token Unlock Impact

Take Avalanche (AVAX) as an example. In previous unlocks, AVAX saw a short-term drop due to increased supply. However, long-term holders who believed in the network’s growth used the dip as a buying opportunity. This strategy paid off as the price recovered within weeks.

Common Misconceptions About Token Unlocks

- They Always Crash the Price – While many token unlocks cause temporary drops, strong demand can offset the impact.

- Only Developers Benefit – Unlocks often include tokens for ecosystem growth, staking rewards, and community incentives.

- It’s Only for Traders – Long-term investors can also benefit by accumulating quality tokens during unlock-induced dips.

Tips for Staying Ahead of Token Unlock Trends

- Follow Social Media Channels – Many projects announce unlocks on X (Twitter), Discord, and Telegram.

- Subscribe to Crypto Newsletters – Regular updates keep you informed about major market events.

- Use On-Chain Analytics – Platforms like Nansen or Glassnode help track wallet movements before and after token unlocks.

- Diversify Your Portfolio – Don’t rely solely on one asset; spreading investments reduces risk from a single unlock event.

Final Thoughts

Token unlocks are one of the most important events to watch in the cryptocurrency market. They can trigger volatility, present buying opportunities, and influence long-term price trends. By understanding how they work and keeping track of upcoming events, you can make more informed investment decisions.

Remember, not all unlocks are bad news sometimes they signal project growth and community expansion. The key is to stay informed, think strategically, and never let emotions dictate your trades.

Know more here about Trading Fundamentals here.

Frequently Asked Questions (FAQs)

1. What is a token unlock in cryptocurrency?

A token unlock is when locked crypto tokens are released into circulation after a set period, often for team members, investors, or community rewards.

2. How do token unlocks affect prices?

Unlocks can increase supply, sometimes leading to short-term dips. However, strong demand and project fundamentals can limit negative impact.

3. How can I track upcoming token unlocks?

Websites like TokenUnlocks.app, CoinMarketCap, and project blogs provide detailed schedules for upcoming unlocks.

4. Should I sell before a token unlock?

It depends. If the unlock is large and market sentiment is weak, selling beforehand may avoid losses. But in bullish markets, holding could be better.

5. Do token unlocks happen all at once?

Not always. Some projects release tokens in stages to reduce supply shock and keep prices stable.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact