Ultimate Crypto Wallet Guide: Unlock Secure Crypto Access

Ultimate Crypto Wallet Guide: Unlock Secure Crypto Access. In the evolving digital finance landscape, a crypto wallet plays a crucial role as a secure tool for storing, accessing, and managing cryptocurrencies. From daily transactions to long-term storage, crypto wallets are essential for anyone involved in the crypto ecosystem.

What is a Crypto Wallet?

The Crypto wallet is a digital tool that allows users to store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and others. It stores the private keys that provide secure access to your digital assets on the blockchain. Without a crypto wallet, participating in the crypto economy is virtually impossible.

Unlike a physical wallet that carries cash, a crypto wallet doesn’t hold digital coins. Instead, it secures the cryptographic keys that prove ownership and enable transactions on the blockchain.

Types of Crypto Wallets

Gaining a clear understanding of the various types of crypto storage is essential for choosing the one that best aligns with your specific security preferences, usage habits, and investment goals. Understanding the different types of crypto storage helps in selecting the right one for your needs:

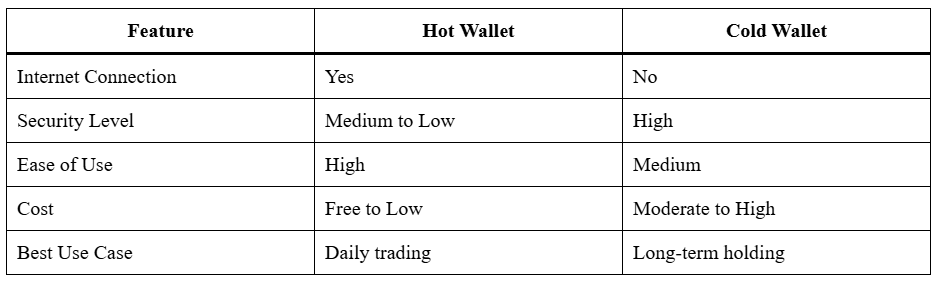

1. Hot Crypto Wallet

- Connected to the internet

- Examples: Mobile apps, desktop software, web-based extensions

- Convenient for frequent transactions

- Higher risk of online attacks

2. Cold Crypto Wallet

- Offline storage solutions

- Examples: Hardware (like Ledger), paper wallets

- Best for long-term holders

- Safer from cyber threats

3. Custodial Crypto Wallet

- Managed by third-party services (e.g., exchanges)

- Simplifies user experience

- Users don’t control private keys

4. Non-Custodial Crypto Wallet

- Users control their private keys

- Offers greater autonomy and responsibility

Why Do Companies Offer Crypto Wallets?

Companies in the crypto space offer services to:

- Onboard new users easily

- Integrate services like staking or trading

- Increase platform engagement

- Collect service fees

- Build trust through secure asset storage

It serve as a gateway for consumers to interact with DeFi protocols, NFTs, exchanges, and more. They also allow platforms to create user-friendly environments that encourage adoption and reduce entry barriers for newcomers to the crypto space.

As Web3 adoption grows, Crypto wallets are becoming critical for onboarding the next billion users by abstracting complex blockchain operations into intuitive interfaces. Many Crypto wallets now offer fiat on-ramps, educational tools, and integrated customer support to create seamless onboarding journeys.

How to Qualify for a Crypto Wallet

Getting started with a Crypto wallet is simple. Most platforms only require:

- A valid email address

- A password

- Optional KYC (Know Your Customer) verification for custodial wallets

For non-custodial or hardware Crypto wallets, no personal data is necessary, just a secure environment and the willingness to manage your own keys. It’s important to choose a wallet that aligns with your security preferences and trading frequency.

Benefits of Using a Crypto Wallet

Using a crypto wallet provides a range of benefits:

- Security: Protects digital assets from unauthorized access

- Accessibility: Enables anytime, anywhere crypto transactions

- Control: Gives users full ownership of their funds

- Functionality: Many support staking, swaps, NFTs, and multi-chain access

- Backup Options: Recovery phrases allow account restoration

- Flexibility: Easily switch between crypto assets, networks, and dApps for a smooth, versatile experience.

Many modern crypto solutions go beyond simple storage by offering integrated features like real-time asset tracking, market analysis, and staking opportunities. These added tools help users manage their portfolios more efficiently while staying informed about price trends and performance.

Some platforms even include built-in access to decentralized applications (dApps), allowing seamless interaction with DeFi services, NFT marketplaces, and token swaps, all in one place. This not only streamlines the user experience but also increases engagement by turning basic tools into powerful gateways to the broader crypto ecosystem.

Risks & Precautions

Despite the advantages, using a crypto wallet carries some risks:

- Loss of Private Keys: Results in permanent asset loss

- Phishing Attacks: Fraudulent attempts to steal your credentials

- Hardware Damage: For physical, device malfunction can be disastrous without backups

Precautionary Measures:

- Always back up your seed phrase

- Use two-factor authentication (2FA)

- Never share private keys

- Keep software and firmware updated

- Prefer cold for large holdings

Security hygiene is non-negotiable in the crypto world. Mistakes can be costly, so investing in education and protective measures is critical.

Where to Find Legit Crypto Wallets

To ensure authenticity and security, users should download Crypto wallets from:

- Official app stores (Google Play, Apple Store)

- Verified company websites

- Hardware wallet manufacturers’ official portals

Avoid third-party links or suspicious download sources at all costs. Only trust sources with strong community support and verifiable credibility.

Best Strategies to Maximize Usage

Optimize your Crypto wallet experience with these strategies:

- Diversify: Use separate storage for trading and long-term holding

- Enable Multi-Sig: Adds an extra layer of transaction approval

- Integrate DeFi: Leverage wallet dApp browsers to earn yields

- Monitor Activity: Regularly check transaction history for suspicious activity

- Use Decentralized IDs: For added privacy and data control

- Participate in Airdrops: Connect eligible to earn free crypto

Building habits around safety, diversification, and functionality unlocks the full power of decentralized finance.

Tax Implications

Using a crypto wallet can trigger tax events in many jurisdictions. Common taxable actions include:

- Selling Crypto: Capital gains tax may apply

- Swapping Tokens: Considered a taxable event

- Receiving Airdrops or Staking Rewards: Often treated as income

Key Tax Tips:

- Maintain detailed transaction records

- Use tax tracking tools integrated

- Consult tax professionals for jurisdiction-specific advice

Regulatory clarity is increasing globally, so staying compliant is essential for responsible participation in crypto.

Future Outlook of Crypto Wallets

The evolution of crypto wallet technology is central to the future of Web3. Emerging trends include:

- Smart Wallets: Automate actions based on smart contracts

- Biometric Authentication: Enhances security and accessibility

- Cross-Chain Integration: Enables interaction across multiple blockchain networks

- Social Recovery Features: Reduces risks associated with lost private keys

They are no longer just storage tools; they’re becoming essential interfaces for the decentralized internet. As the industry matures, it to play an even more central role in identity, finance, and communication within the digital world.

Conclusion

In the world of digital finance, it is much more than a storage device; it’s your gateway to the decentralized economy. With different crypto wallet types designed for diverse user needs, effective management is key to ensuring both security and flexibility. By understanding key benefits, minimizing risks, navigating tax responsibilities, and keeping up with innovations, users can fully unlock the potential of their crypto journey.s, users can unlock the full potential of their crypto experience.

FAQ

What is a crypto wallet storage tool, and how does it work?

It is a digital solution that holds your private keys and enables you to send, receive, and manage cryptocurrencies securely. It connects to the blockchain to authorize and validate transactions.

Which method is safest for storing digital assets?

Offline storage solutions like hardware devices are considered the most secure as they are not exposed to online threats such as malware or hacking attempts.

What if I lose access to my private keys?

Losing access to your private keys or recovery phrase can lead to permanent loss of funds. It’s essential to create secure backups and store them safely offline.

Can one tool manage multiple cryptocurrencies?

Yes, many solutions support a wide range of digital currencies across different blockchains. They allow users to manage diverse portfolios in one place.

Do transactions through these tools have tax consequences?

Yes, in most countries, transactions like selling or exchanging cryptocurrencies are taxable. It’s important to keep records and consult tax professionals.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.