Introduction: Why Learn Trading Fundamentals?

In today’s financial world, understanding trading fundamentals isn’t just for stockbrokers or crypto experts, it’s essential knowledge for anyone looking to grow wealth, preserve capital, or simply understand how global markets work. Whether you’re a curious beginner or someone taking their first step into trading, this guide will build your foundational understanding in a structured and easy-to-digest way.

With the rise of digital platforms and 24/7 market access, even retail investors now participate in global trading activities. But many beginners rush in without understanding core concepts, leading to poor decisions and financial losses. This guide is designed to help you build a strong foundation before risking any capital.

What Is Trading and Investing?

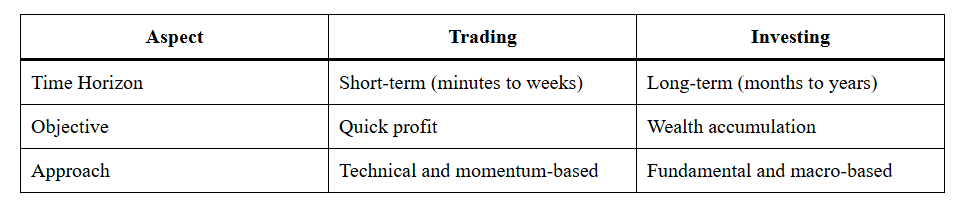

At its core, trading refers to buying and selling assets such as stocks, cryptocurrencies, commodities, or currencies to make short-term profits. Traders often take advantage of price fluctuations that can occur in minutes, hours, or days.

On the other hand, investing involves purchasing assets with a long-term perspective, often based on the fundamental strength and future potential of those assets. Investors aim to build wealth steadily over months or years.

Successful investors like Warren Buffett focus on value and long-term compounding, while traders like Paul Tudor Jones rely on timing, price action, and market sentiment.

Key Differences:

What Are Fundamental and Technical Analysis?

Fundamental Analysis:

This approach focuses on evaluating the intrinsic value of an asset. Analysts study economic indicators, company earnings, interest rates, and industry trends.

This type of analysis is essential for long-term decision-making. For example, if you’re investing in a stock or cryptocurrency, you’d want to know the project’s leadership team, revenue model, partnerships, or utility.

Examples of Fundamental Factors:

- Financial Statements (Revenue, Profit Margins)

- Economic Reports (GDP, Inflation, Employment)

- News & Events (Government policy, earnings releases)

Technical Analysis:

Technical analysis uses historical price charts and trading volume to forecast future price movements. Traders use this to identify patterns, momentum, and signals.

Even though technical analysis doesn’t consider the underlying value of the asset, it helps traders make decisions based on price behavior and market psychology.

Common Tools Used:

- Moving Averages (e.g., 50-day, 200-day)

- Relative Strength Index (RSI)

- MACD (Moving Average Convergence Divergence)

- Support & Resistance Levels

Utilizing Fundamental and Technical Analysis

Smart traders don’t rely solely on one method. In fact, combining both forms of analysis gives a more complete picture:

- Fundamental Analysis tells you what to trade (is it undervalued or overvalued?).

- Technical Analysis tells you when to trade (is it a good time to enter or exit?).

In real-world scenarios, large investors often wait for technically favorable conditions before executing large trades, regardless of how fundamentally sound an asset is.

Example:

You discover that a tech stock is fundamentally undervalued due to strong quarterly earnings (fundamental analysis), and the RSI shows it’s currently oversold (technical analysis). That’s a potential buy signal.

Understanding both types of analysis also reduces emotional decision-making by grounding your trades in data, logic, and probability, not just hype or fear.

Understanding Market Trends and Cycles

Markets move in patterns called trends and cycles. Recognizing these helps traders position themselves strategically and avoid chasing false breakouts or buying during unsustainable rallies.

Markets rarely move in a straight line. Instead, they breathe in waves, up and down, driven by various economic, political, and emotional factors.

Types of Market Trends:

- Uptrend: Price consistently moving higher (bullish)

- Downtrend: Price consistently moving lower (bearish)

- Sideways/Range-Bound: No clear direction

Market Cycles:

Markets also go through recurring psychological and economic phases:

- Accumulation Phase: Smart money starts buying quietly

- Markup Phase: Trend becomes visible, public joins in

- Distribution Phase: Institutions start selling

- Decline Phase: Panic selling and market drops

Understanding where the market is in its cycle can help you time entries and exits, avoid buying at the top, and manage risk more effectively.

How Does Psychology Impact the Market?

Market psychology refers to the emotional and mental state of investors and traders. Human emotions like fear, greed, hope, and panic can drive irrational decisions and cause volatile price swings.

Inexperienced traders often fall victim to emotional triggers. They may buy out of FOMO when prices are surging or sell in panic during a temporary dip—both costly mistakes.

Key Psychological Concepts:

- Herd Mentality: Following what the crowd is doing (often late)

- FOMO (Fear of Missing Out): Entering a trade too late due to hype

- FUD (Fear, Uncertainty, Doubt): Selling in panic due to bad news

- Confirmation Bias: Only accepting information that supports your belief

The most successful traders learn to master their emotions, stick to a plan, and execute trades based on logic and analysis—not noise.

Conclusion: Start With Strong Foundations

The path to becoming a successful trader or investor starts with mastering the fundamentals of trading. By understanding the difference between trading and investing, learning both technical and fundamental analysis, recognizing market trends and cycles, and controlling your own emotions, you equip yourself with powerful tools to navigate any market.

Remember, success in trading isn’t about making quick money. It’s about building discipline, continuously learning, and protecting your capital. The market rewards those who are patient, prepared, and emotionally stable.

Frequently Asked Questions

1. Is trading riskier than investing?

Yes. Trading involves short-term price movements, which are more volatile and unpredictable. Investing is typically more stable over the long term.

2. Can I learn trading without a finance background?

Absolutely. Many successful traders come from non-finance backgrounds. It takes time, education, and discipline, not a degree.

3. What tools do beginners need to start trading?

You’ll need a brokerage account, charting software (like TradingView), basic risk management knowledge, and a clear trading plan.

4. How much capital should I start with?

Start small. Focus on learning the process rather than making quick profits. As your confidence grows, increase your position sizes gradually.