Top 5 Powerful Arbitrage Trading Platforms in India. The world of cryptocurrency is fast-paced, unpredictable, and filled with opportunities. Among the many strategies traders use to maximize profits, Arbitrage Trading stands out as one of the most practical and effective. Unlike speculative trading, which relies on market predictions, arbitrage involves exploiting price differences of the same asset across different exchanges.

For example, if Bitcoin is priced at ₹2,200,000 on one Indian exchange and ₹2,250,000 on another, a trader could buy low and sell high almost instantly. This difference, though small, adds up when repeated frequently. With crypto adoption rising in India, more traders are exploring Arbitrage Trading platforms to make profits in a structured, secure, and efficient way.

What is Arbitrage Trading?

It is the practice of taking advantage of price discrepancies in financial markets. In crypto, this means purchasing a digital asset on one exchange where the price is lower and simultaneously selling it on another exchange where the price is higher.

This approach is popular because it:

- Minimizes exposure to long-term volatility.

- Works even in bear markets, since profits depend on price differences, not overall trends.

- Can be automated with bots for efficiency.

In India, with increasing participation in the crypto market, It has become an attractive tool for both beginners and professionals.

Why Arbitrage Trading is Popular in India

Several factors explain why Indian traders are showing interest in Arbitrage Trading:

- High Price Gaps – Crypto prices often vary across Indian and global exchanges, creating profitable windows.

- Accessibility – Multiple exchanges like WazirX, CoinSwitch Pro, and global platforms give traders plenty of options.

- Automation Tools – Modern platforms now offer bots that make this faster and error-free.

- Reduced Risk – Unlike speculation, profits come from guaranteed price differences if executed quickly.

- Growing Crypto Awareness – As digital assets gain popularity in India, traders are eager to explore low-risk opportunities.

Top 5 Arbitrage Trading Platforms in India

Let’s explore the most powerful platforms available for Indian traders. Each platform has unique features, tools, and benefits that make Arbitrage Trading more efficient.

1. WazirX with CoinSwitch Pro

WazirX is one of India’s leading exchanges, and when combined with CoinSwitch Pro, it allows traders to conduct seamless Arbitrage Trading between INR-based and global exchanges.

- Supports INR deposits and withdrawals.

- Large liquidity pool for popular cryptocurrencies.

- CoinSwitch Pro enables arbitrage between Indian and foreign exchanges.

2. Bitsgap

Bitsgap is a global platform that connects to 25+ exchanges, making it a favorite for serious Arbitrage Trading.

- Offers automated bots that scan real-time price differences.

- Provides demo and backtesting tools.

- Suited for traders who prefer multi-exchange arbitrage strategies.

3. Pionex

Pionex is an exchange with built-in trading bots, including arbitrage bots designed specifically for beginners.

- Low trading fees (0.05%).

- Free access to arbitrage bots.

- Ideal for Indian traders looking for simplicity.

4. 3Commas

3Commas is known for its flexible trading tools and wide exchange integration. It helps traders automate Arbitrage Trading while maintaining control over strategies.

- Smart trading terminal with advanced settings.

- Supports copy trading and demo accounts.

- Works with multiple global exchanges.

5. Cryptohopper

Cryptohopper is a cloud-based platform that makes Arbitrage Trading accessible for everyone.

- AI-driven trading strategies.

- Marketplace for sharing and purchasing bots.

- 24/7 automation with minimal manual involvement.

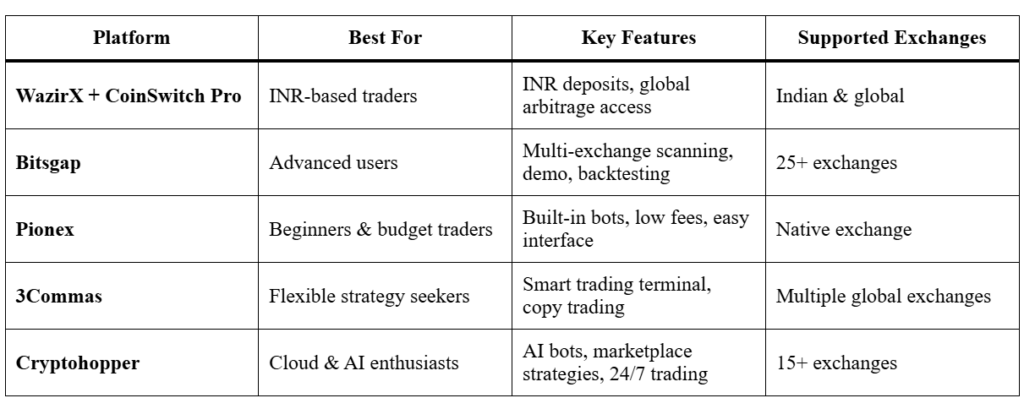

Comparison Table: Top 5 Arbitrage Trading Platforms in India

Advantages of Arbitrage Trading

- Low-Risk Strategy – Since profits depend on fixed price differences, market volatility has less impact.

- Consistent Profits – Even small gaps can generate steady earnings when executed often.

- Automation-Friendly – Platforms offer bots to execute trades instantly.

- No Market Predictions Needed – Traders don’t need to forecast long-term price movements.

Challenges of Arbitrage Trading in India

- Regulatory Uncertainty – Crypto regulations in India are still evolving, which impacts access to platforms.

- Transfer Delays – Moving assets between exchanges can sometimes take longer, reducing profit margins.

- Transaction Fees – Network fees and withdrawal charges can cut into profits.

- Competition – Many traders are using Arbitrage Trading bots, which means opportunities close quickly.

Tips for Successful Arbitrage Trading

- Choose Reliable Platforms – Stick to exchanges with strong liquidity and fast transactions.

- Factor in All Fees – Always calculate transaction costs before executing trades.

- Use Automation Wisely – Bots increase efficiency but should be configured carefully.

- Stay Updated – Follow global and Indian crypto regulations closely.

- Start Small – Beginners should practice with small trades before scaling up.

The Future of Arbitrage Trading in India

As more people adopt cryptocurrencies, the demand for Arbitrage Trading platforms will continue to grow. With advanced bots, AI-driven automation, and global integration, Indian traders can expect more efficient and profitable opportunities.

However, regulations will play a major role in shaping the industry. If India moves toward clearer guidelines, Arbitrage Trading could become one of the most accessible strategies for profit-making in the crypto space.

Final Thoughts

Arbitrage Trading is one of the smartest ways for Indian traders to profit from crypto without relying on speculation. By using platforms like WazirX with CoinSwitch Pro, Bitsgap, Pionex, 3Commas, and Cryptohopper, traders can access advanced tools that make the process faster, safer, and more profitable.

While challenges like fees and regulations remain, the benefits of Arbitrage Trading low risk, consistent profits, and automation make it an attractive strategy. For those seeking smarter ways to trade, exploring these platforms is an excellent first step.

more here on crypto platform here.

Frequently Asked Questions (FAQs)

1. Is Arbitrage Trading legal in India?

Yes, It is legal in India because it involves buying and selling crypto assets across exchanges. However, traders must comply with taxation rules, including the 1% TDS on crypto transactions, and stay updated on regulatory changes.

2. How profitable is Arbitrage Trading for beginners?

Profitability in Arbitrage Trading depends on transaction fees, transfer speed, and market opportunities. Beginners can earn small but consistent returns by starting with reliable platforms and low amounts before scaling up.

3. Which is the best platform for Arbitrage Trading in India?

The best platform for this in India depends on your needs. WazirX with CoinSwitch Pro is great for INR trades, while Bitsgap and 3Commas are ideal for cross-exchange arbitrage. Pionex and Cryptohopper are beginner-friendly with automation tools.

4. What risks are involved in Arbitrage Trading?

The main risks of Arbitrage Trading include transfer delays, network fees, regulatory uncertainty, and shrinking profit margins due to competition. Using automation and calculating fees before trading can help reduce risks.

5. Can Arbitrage Trading be done automatically with bots?

Yes, many platforms like Bitsgap, Pionex, and Cryptohopper offer automated bots for Frequently Asked Questions (FAQs)

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact