Top 3 Crypto Weekly Picks July 7 – July 13, 2025

Top 3 Crypto: Weekly Picks July 7 – July 13, 2025. The cryptocurrency landscape in this week is marked by renewed investor confidence, institutional integration, and technological advancement. As traditional markets adapt to the growing presence of blockchain solutions, a select group of crypto assets continues to set the pace for innovation and capital growth.

At the forefront are Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). The three most influential coins shaping the digital economy. Their roles extend beyond speculative trading into real-world utility, financial infrastructure, and ecosystem development. This detailed guide explores these Top 3 Crypto picks of the week, offering insights into what makes them essential holdings today.

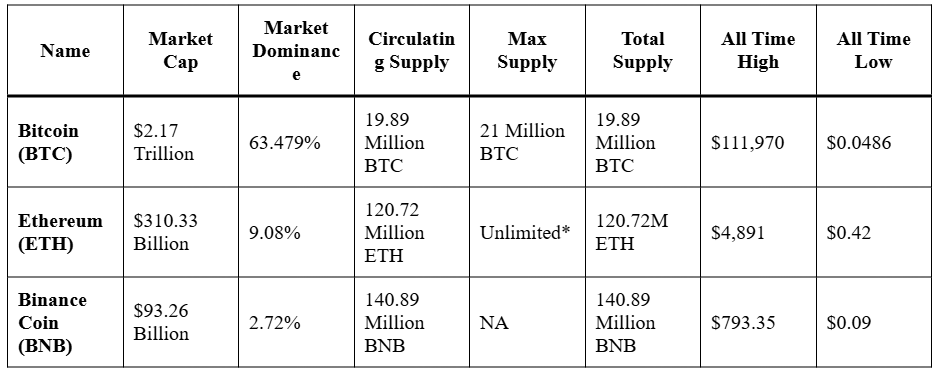

Top 3 Cryptocurrencies Comparison Table

Disclaimer: This article is for educational purposes only. Always do your deep dive research before making any crypto investment decisions.

1. Bitcoin (BTC)

Current Price: $108,842

Market Cap: $2.17 Trillion

Circulating Supply: 19.89 Million BTC

Max Supply: 21 Million BTC

24hr Volume: $7,685

1-Year Change: +79.16%

Market Catalyst

Bitcoin remains the most secure, decentralized digital currency in existence. With the April 2024 halving now behind us, mining rewards have reduced to 3.125 BTC per block, placing upward pressure on scarcity and price. However, the introduction of Bitcoin spot Exchange-Traded Funds (ETFs) across multiple jurisdictions, including the United States and some parts of Europe, has driven record institutional inflows.

Governments and hedge funds are increasingly treating Bitcoin as a treasury reserve asset. These developments reinforce its position as a reliable hedge against currency devaluation and geopolitical uncertainty.

Key Insight

Bitcoin’s limited supply, institutional trust, and unmatched security model position it as the reserve asset of the digital age. This week, its relevance has expanded from tech-savvy investors to traditional wealth managers. Its resilience through past bear cycles proves it’s not only dominant, but foundational to the entire crypto market.

2. Ethereum (ETH)

Current Price: $2,567

Market Cap: $310 Billion

Circulating Supply: 120.72 Million ETH

Max Supply: Unlimited*

24hr Volume: $310,822 Billion

1-Year Change: -0.27%

Market Catalyst

Ethereum has seen substantial technical improvements since the transition to Proof-of-Stake. The “Shanghai” and “Dencun” upgrades brought major efficiency gains, paving the way for mass adoption through rollups and Layer-2 scaling solutions.

New financial primitives like restaking (via EigenLayer) have enhanced capital efficiency and yield opportunities on-chain. Simultaneously, renewed developer activity has reignited DeFi’s growth, with platforms such as Lido, Aave, and Uniswap seeing surges in total value locked (TVL).

Key Insight

Ethereum is not just surviving, it’s evolving into a decentralized global computer. Its network effect, combined with real economic activity in DeFi, gaming, and enterprise blockchain, sets ETH apart. The deflationary pressure from EIP-1559 has also started to create long-term upward price potential.

3. Binance Coin (BNB)

Current Price: $661.61

Market Cap: $93 Billion

Circulating Supply: 140.89 Million BNB

Max Supply: NA

24hr Volume: ₹$8,181

1-Year Change: +22.12%

Market Catalyst

BNB’s strength lies in its real-world application within the Binance ecosystem. It offers users fee discounts, access to launchpad tokens, staking rewards, and more. Additionally, the BNB Smart Chain (BSC) has carved out a niche for fast, low-cost transactions ideal for GameFi, NFTs, and decentralized exchanges.

Binance continues its quarterly token burns, systematically reducing the total supply. This deflationary mechanism, combined with growing BNB Chain activity, sustains long-term investor interest. Even amid increased regulatory scrutiny, Binance has preserved market share and strengthened its compliance frameworks globally.

Key Insight

BNB’s utility is closely tied to the world’s largest exchange and a rapidly growing smart contract chain. This week, the coin demonstrates how centralized and decentralized finance can coexist. It delivers value across user fees, developer incentives, and cross-chain infrastructure, making it indispensable within the broader ecosystem.

Top 3 Crypto Key Takeaways

- Bitcoin leads with unmatched dominance, strengthened by the 2024 halving and institutional ETF growth.

- Ethereum gains momentum from Layer-2 expansion, DeFi resurgence, and restaking protocols.

- Binance Coin stands resilient due to BNB Chain usage, regular burns, and ecosystem-wide utility.

Conclusion

The Top 3 Crypto coins of the week, Bitcoin, Ethereum, and Binance Coin, represent the strongest blend of security, innovation, and practical utility in the market today. Each has carved a distinct space:

- Bitcoin serves as the bedrock for decentralized finance and digital store of value.

- Ethereum powers the application layer, enabling smart contracts, decentralized applications, and tokenized economies.

- Binance Coin fuels one of the most actively used blockchain ecosystems with widespread exchange utility.

While thousands of coins come and go, these three maintain a proven track record of resilience, user trust, and developer activity. Whether you’re a retail investor or institutional stakeholder, understanding and following these market leaders is essential in this week.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.