Powerful Tips to Build Your Cryptocurrency Portfolio. In today’s digital economy, managing a this has become as essential as building a stock or real estate investment strategy. With Bitcoin, Ethereum, and a wide range of altcoins creating new opportunities, investors—both beginners and professionals—are looking for ways to diversify and grow their wealth.

However, building a profitable cryptocurrency portfolio requires more than simply buying a few coins and hoping for the best. Like any investment, it demands research, strategy, diversification, and risk management. In this guide, we’ll explore powerful, easy-to-implement tips to help you optimize your cryptocurrency portfolio while avoiding common pitfalls.

Why a Cryptocurrency Portfolio Matters

This is simply a collection of digital assets that an investor holds. Just like traditional portfolios balance stocks, bonds, and mutual funds, a cryptocurrency portfolio should balance Bitcoin, Ethereum, and other altcoins depending on your goals.

The primary benefits of building a well-structured cryptocurrency portfolio include:

- Diversification: Reducing risk by spreading investments across multiple assets.

- Growth Potential: Exposure to innovative blockchain projects with high upside.

- Hedge Against Inflation: Cryptocurrencies like Bitcoin are often considered digital gold.

- Accessibility: Unlike traditional assets, you can build a this from anywhere with just a smartphone and internet connection.

Steps to Build a Strong Cryptocurrency Portfolio

1. Define Your Investment Goals

Before buying coins, ask yourself: What do I want from my cryptocurrency portfolio? Are you looking for short-term gains, long-term wealth preservation, or exposure to innovative blockchain projects?

Your goals will determine how you allocate your assets. For example, a risk-averse investor may prioritize Bitcoin and Ethereum, while a high-risk trader might include small-cap altcoins.

2. Diversify Your Holdings

The golden rule of investing applies to crypto too—don’t put all your eggs in one basket. A good cryptocurrency portfolio balances different types of assets:

- Large-Cap Coins (BTC, ETH): Reliable, lower-risk core holdings.

- Mid-Cap Coins (ADA, SOL, DOT): Higher growth potential but more volatile.

- Small-Cap & Emerging Tokens: High risk, high reward speculative plays.

3. Allocate Assets Wisely

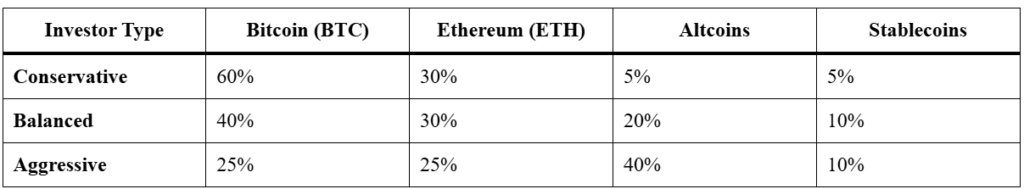

Your cryptocurrency portfolio should have a percentage-based allocation strategy. Conservative investors may put 60% into Bitcoin, 30% into Ethereum, and 10% into altcoins. More aggressive investors might invert this balance.

Here’s a comparison table to illustrate different allocation strategies:

This table shows how a this can be structured differently depending on your risk appetite.

4. Keep Stablecoins for Safety

Including stablecoins such as USDT or USDC in your cryptocurrency portfolio provides liquidity and protection during market volatility. They act as a buffer, allowing you to quickly rebalance or buy dips.

5. Use Dollar-Cost Averaging (DCA)

One of the smartest ways to build thia is by using DCA. Instead of investing a lump sum, you spread your purchases over weeks or months. This reduces the impact of volatility and helps you accumulate assets steadily.

6. Regularly Rebalance Your Portfolio

Markets move fast, and a coin that was once 20% of your cryptocurrency portfolio might suddenly grow to 40%. Rebalancing ensures you maintain your desired risk levels. For instance, you can sell part of an overperforming coin and redistribute to other assets or stablecoins.

7. Keep Security a Priority

Your cryptocurrency portfolio is only as safe as your storage method. Always use hardware wallets or reputable custodians, enable two-factor authentication, and avoid keeping large sums on exchanges. Hacks and phishing remain common in crypto, so security cannot be ignored.

8. Stay Updated with Market Trends

Building a strong cryptocurrency portfolio requires ongoing research. Follow market news, blockchain project updates, and regulatory changes. Joining communities and using portfolio-tracking apps also helps you make informed decisions.

Common Mistakes to Avoid in a Cryptocurrency Portfolio

Even seasoned investors can make errors. Some of the biggest mistakes when managing a cryptocurrency portfolio include:

- Over-Diversification: Holding too many coins dilutes gains and makes tracking difficult.

- Chasing Hype: Buying a coin simply because it’s trending often leads to losses.

- Ignoring Risk Management: Not setting stop-loss levels can drain your portfolio.

- Lack of Patience: Constantly trading instead of holding strong projects reduces long-term gains.

Tools to Manage Your Cryptocurrency Portfolio

Managing a cryptocurrency portfolio becomes easier with the right tools:

- CoinMarketCap / CoinGecko: Track prices, rankings, and project details.

- Portfolio Trackers (Blockfolio, Delta): Monitor your holdings in real-time.

- Exchanges with Analytics (Binance, Coinbase Pro): Provide advanced tracking features.

- Secure Wallets (Ledger, Trezor): Ensure safe storage of your assets.

These tools help you visualize and adjust your cryptocurrency portfolio with confidence.

Long-Term vs. Short-Term Portfolio Strategies

A long-term cryptocurrency portfolio strategy focuses on holding major assets like Bitcoin and Ethereum for years, betting on adoption and scarcity. A short-term strategy, however, emphasizes active trading, capturing gains from volatile altcoins.

Smart investors often combine both, keeping a strong long-term foundation while reserving a smaller portion for active trading.

The Future of Cryptocurrency Portfolios

As adoption grows, the importance of a cryptocurrency portfolio will continue to increase. Institutional investors are entering the market through ETFs, decentralized finance (DeFi) is reshaping how portfolios are managed, and tokenized assets are expanding diversification opportunities.

In the near future, we might see cryptocurrency portfolios become as mainstream as retirement accounts and stock portfolios, integrated directly into banking apps and investment platforms.

Conclusion

Building a strong cryptocurrency portfolio is no longer just for tech-savvy traders—it’s becoming a core part of modern wealth building. With clear goals, smart allocation, diversification, regular rebalancing, and strong security, anyone can create a portfolio that balances risk and reward.

Remember, your cryptocurrency portfolio should reflect your unique financial objectives and risk tolerance. With discipline, strategy, and patience, you can turn digital assets into a powerful component of long-term financial success.

❓ FAQ on Building a Cryptocurrency Portfolio

Q1. What is a cryptocurrency portfolio?

A cryptocurrency portfolio is a collection of digital assets such as Bitcoin, Ethereum, and altcoins that an investor holds. It helps track performance, diversify risk, and achieve financial goals.

Q2. How do I start building a cryptocurrency portfolio?

To start a cryptocurrency portfolio, define your goals, choose a secure exchange or wallet, allocate assets wisely, and use strategies like dollar-cost averaging to reduce volatility.

Q3. How often should I rebalance my cryptocurrency portfolio?

It’s best to review and rebalance your cryptocurrency portfolio every few months or after significant market movements. Rebalancing helps maintain your desired asset allocation and risk levels.

Q4. What is the safest way to store a cryptocurrency portfolio?

The safest way to store a cryptocurrency portfolio is by using hardware wallets like Ledger or Trezor. Always enable two-factor authentication and avoid storing large amounts on exchanges.

Q5. Can a cryptocurrency portfolio replace traditional investments?

A cryptocurrency portfolio can complement traditional investments but should not completely replace them. While it offers high growth potential, diversification across stocks, bonds, and real estate remains important for long-term stability.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact