The Stablecoin Market Achieves $270B Global Valuation, setting a remarkable milestone in the fast-evolving world of digital assets. This surge highlights the growing importance of stablecoins as a critical bridge between traditional finance and blockchain based ecosystems. Over the last few years, these digital currencies pegged to stable assets like the US dollar or gold—have gained tremendous traction among traders, institutions, and even regulators.

What’s Driving the $270B Milestone?

The growth of the stablecoin market can be attributed to several factors:

- Institutional Adoption – Major payment processors, banks, and fintech companies have started integrating stablecoin transactions into their offerings.

- DeFi Expansion – Decentralized finance platforms heavily rely on stablecoins for lending, borrowing, and liquidity pools.

- Global Payment Needs – With cross-border payments often expensive and slow, stablecoins provide faster, low-cost alternatives.

- Crypto Volatility Hedge – Stablecoins act as a safe haven during turbulent crypto market conditions.

In 2024 alone, stablecoin transaction volume exceeded trillions of dollars, showing how deeply these assets are embedded in the digital economy.

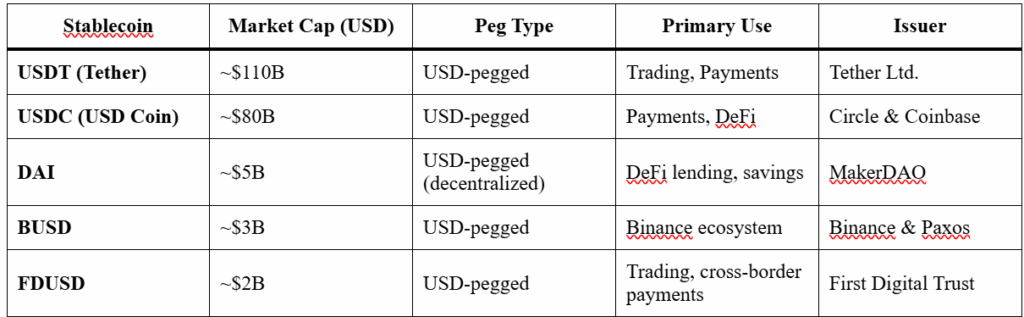

Top Stablecoins Dominating the Market

To better understand the current landscape, here’s a comparison of the top stablecoins by market share, features, and primary use cases:

Market Trends and Regulatory Outlook

While the Stablecoin Market Achieves $270B Global Valuation, its future growth will depend largely on how regulators approach this sector. Many governments are drafting guidelines to ensure that stablecoin reserves are transparent and fully backed. In the U.S., for instance, proposals are being discussed to treat stablecoin issuers similarly to banks, ensuring better consumer protection.

Meanwhile, Asia and Europe are seeing progressive developments. Singapore and Hong Kong have rolled out regulatory sandboxes, allowing stablecoin projects to operate with clear compliance guidelines. The European Union’s Markets in Crypto-Assets (MiCA) framework is also paving the way for cross-border stablecoin adoption.

The Role of Stablecoins in Mainstream Finance

As adoption grows, stablecoins are increasingly viewed not just as a crypto trading tool, but as a viable global payment system. Businesses can use them to settle invoices instantly, travelers can pay without high currency conversion fees, and remittance services can operate at a fraction of traditional costs.

For developing nations with volatile currencies, stablecoins offer a level of financial stability that local currencies sometimes cannot match. This positions them as a key player in the global push for financial inclusion.

Final Thoughts

The fact that the Stablecoin Market Achieves $270B Global Valuation is not just a milestone—it’s a signal of a paradigm shift in the financial world. Stablecoins are no longer experimental; they are becoming foundational to both crypto ecosystems and traditional payment systems.

As technology evolves and regulations mature, the stablecoin market is poised for further growth. The coming years could see not just a bigger valuation, but deeper integration into everyday transactions, from online shopping to global trade settlements.

With speed, low cost, and stability as their core strengths, stablecoins are set to play an even bigger role in reshaping how money moves worldwide.

🔺 Top 3 Gainers (24h Performance)

Juventus Fan Token (JUV) – Price surged to $1.523983, marking an impressive +36.95% gain.

OG Fan Token (OG) – Climbed to $13.13, up by +17.13% as fan engagement and sports token demand grew.

LayerZero (ZRO) – Rose to $2.261836, gaining +14.94% driven by strong project interest.

🔻 Top 3 Losers (24h Performance)

Heima (HEI) – Dropped to $0.500594, down -14.98% amid market selling pressure.

Hashflow (HFT) – Fell to $0.106432, losing -9.33% as trading volumes decreased.

AS Roma Fan Token (ASR) – Declined to $7.352789, slipping -9.49% in today’s trading session.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact