Stablecoin Explained Secure or Risky Digital Asset

Stablecoins are reshaping the digital finance world by offering the benefits of cryptocurrency without the extreme volatility.

What is a Stablecoin?

It is a type of cryptocurrency designed to maintain a stable value by pegging it to a reserve asset like a fiat currency (USD, EUR), commodity (like gold), or algorithmic mechanisms. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which experience high price fluctuations, it aims to provide consistency in value.

They serve as a bridge between the traditional financial system and the crypto market, making them an ideal tool for trading, remittances, and hedging against market volatility.

Types

There are four main types based on how their value is stabilized:

1. Fiat-Collateralized

Backed 1:1 by traditional currencies such as USD. Funds are held in reserve by regulated custodians.

Example: USDT (Tether), USDC (USD Coin)

2. Crypto-Collateralized

Backed by other cryptocurrencies. These require over-collateralization due to crypto volatility.

Example: DAI by MakerDAO

3. Commodity-Collateralized

Backed by physical assets like gold or oil.

Example: PAXG (Paxos Gold)

4. Algorithmic

Stabilize their price using smart contracts and algorithms without collateral backing.

Example: Ampleforth, TerraClassicUSD (formerly UST)

Why Do Companies Offer Stablecoin?

Companies create it for several strategic reasons:

- Liquidity Generation: Companies mint stablecoins to create liquidity in their ecosystem.

- Financial Inclusion: Allows unbanked users access to digital financial tools.

- Transaction Efficiency: Low fees and faster settlements make it ideal for global payments.

- Customer Retention: Offering a proprietary stablecoin enhances user loyalty and engagement.

- Revenue Streams: Some companies profit from reserve interest or issuance fees.

- Decentralized Finance (DeFi) Integration: Stablecoins play a critical role in smart contract protocols, enabling borrowing and lending services.

How to Qualify to Use Stablecoins ?

Stablecoins are typically permissionless and available to anyone with access to a digital wallet. However, users should:

- Complete KYC/AML Verification: Most exchanges require basic identification checks.

- Use Reputable Platforms: Choose licensed and regulated exchanges.

- Understand Regional Laws: Check if they are permitted under local financial regulations.

- Digital Wallet Setup: Ensure your wallet supports the blockchain (ERC-20, BEP-20, etc.) used by the stablecoin.

Once these steps are complete, you can buy, sell, transfer, and earn using it across various platforms globally.

Benefits Of Using

- Stability: They protect against crypto market volatility.

- Speed: Near-instant transactions across borders.

- Cost-effective: Lower transaction fees than banks or traditional remittance services.

- Accessibility: Available to anyone with internet access.

- Smart Contract Integration: Ideal for DeFi applications and automated financial products.

- Savings Opportunities: High-yield DeFi platforms and custodial exchanges offer APYs on stablecoin deposits.

- Transparency: Blockchain-ledgers ensure public and auditable transaction histories.

Risks & Precautions

Despite their perceived stability, stablecoins carry certain risks:

- Centralization Risk: Fiat-backed, it may rely on centralized custodians.

- Transparency Issues: Some issuers fail to disclose full reserve audits.

- Depegging: Algorithmic it can collapse if not properly managed.

- Regulatory Risk: Sudden bans or enforcement can affect access and legality.

- Technical Vulnerabilities: Bugs in smart contracts or custody systems could lead to losses.

- Liquidity Risk: In times of market panic, even stablecoins may suffer redemption delays.

How to Stay Safe:

- Always choose it with transparent audits.

- Avoid algorithmic options unless you understand the mechanics.

- Diversify your holdings to reduce exposure.

- Use hardware wallets or multisig protection for high-value stablecoin storage.

Where to Find Legit Stablecoins

To find trustworthy stablecoins:

- Reputable Exchanges: Platforms like Coinbase, Binance, and Kraken list verified stablecoins.

- Blockchain Explorers: Use tools like Etherscan to verify contract authenticity.

- Regulatory Approval: Look for stablecoins that operate under financial oversight.

- Ratings & Audits: Platforms such as Chainlink Proof of Reserve or third-party audit reports offer insight into stablecoin backing.

When researching the stablecoins, check for daily trading volume, reserve attestations, and compliance status in your region.

Best Strategies to Maximize The Use

- Yield Farming: Earn interest through lending or staking it in DeFi platforms.

- Hedging: Use it to lock in gains during crypto market downturns.

- Cross-Border Transfers: Send and receive money globally with minimal fees.

- Savings: Park funds in high-yield savings accounts offered by exchanges or wallets.

- Dollar-Cost Averaging (DCA): Hold it while waiting for better crypto entry points.

- Stablecoin Arbitrage: Exploit small price differences across exchanges for profit.

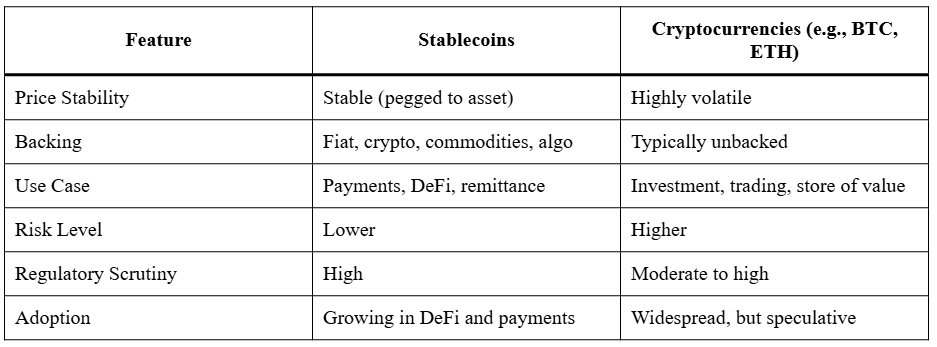

Difference Between Stablecoins and Other Cryptocurrencies

Tax Implications

In many countries, Stablecoins are considered taxable assets despite their stable nature.

- Capital Gains Tax: Using it to buy other cryptocurrencies may trigger capital gains.

- Income Reporting: Earnings from yield farming or staking it must be reported.

- Transfers: May not be taxed directly, but can have implications when converting or withdrawing.

- Airdrops and Promotions: If received as part of promotions, these may be classified as income.

Tax authorities in jurisdictions like the U.S., U.K., and India have begun issuing more explicit guidelines. Always keep a record of transactions and consult with a tax advisor to ensure compliance.

Read All About: Crypto Taxes in India: Save More, Stay Legal

Future Outlook

The future of Stablecoin technology looks both promising and regulatory-heavy:

- Institutional Adoption: Central banks are exploring Central Bank Digital Currencies (CBDCs), which function similarly to stablecoins.

- Increased Regulation: Governments are moving towards regulating it’s issuance to prevent money laundering and ensure transparency.

- DeFi Growth: It will continue powering DeFi ecosystems, enabling lending, insurance, and decentralized exchanges.

- Cross-Border Settlements: Corporations are exploring it for B2B cross-border transactions due to their speed and low cost.

- Tokenization of Real-World Assets: It may be integrated into real estate, commodities, and security tokens as part of a broader blockchain infrastructure.

However, algorithmic models may see declining trust unless backed by robust governance and transparency.

Conclusion

Stablecoin offers a powerful alternative for those seeking the benefits of cryptocurrency without the price swings. With various types available, each offering unique advantages, users can leverage it for payments, savings, investing, and more. While the benefits are vast, potential risks and regulatory challenges must be navigated carefully. Understanding it’s structures and using secure platforms are essential steps in maximizing their potential safely.

As the world moves towards a more digital economy, it will play an integral role in shaping decentralized finance and global monetary transactions.

Frequently Asked Questions (FAQs)

1. How is it different from Bitcoin and other cryptocurrencies?

2. Do I need to pay taxes when using it?

3. Is it safe to use for saving or sending money?

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.