Smart Crypto SIP Guide -A Powerful Path to Wealth. Investing in cryptocurrencies often feels overwhelming due to extreme volatility, sudden price swings, and uncertainty about timing the market. For many investors, trying to buy at the “right moment” ends up in losses rather than gains. This is where Crypto SIP (Systematic Investment Plan) comes in as a game-changer. Similar to traditional SIPs in mutual funds, a Crypto SIP allows investors to put in small, fixed amounts of money at regular intervals, removing the stress of timing the market.

This strategy is gaining momentum among both new and seasoned investors who want to build wealth steadily while minimizing risk. In this guide, we’ll break down how a Crypto SIP works, its benefits, risks, and how it compares to lump-sum investing in digital assets.

What is a Crypto SIP?

A Crypto SIP is a systematic method of investing a fixed sum of money in cryptocurrencies, usually on a weekly, bi-weekly, or monthly basis. Instead of investing a lump sum all at once, you spread out your investments over time.

For example, instead of buying $1,200 worth of Bitcoin today, you might invest $100 every month for the next 12 months. This approach averages out your purchase cost, protecting you from the short-term ups and downs of the crypto market.

By following this disciplined method, this helps reduce the emotional stress associated with crypto investing while encouraging long-term wealth creation.

Why Should You Consider a Crypto SIP?

- Reduces Market Timing Risk – Timing the crypto market is nearly impossible. A Crypto SIP averages your cost over time.

- Builds Discipline – Consistent investing ensures you don’t get swayed by market hype or panic selling.

- Encourages Long-Term Wealth – By holding assets through ups and downs, you benefit from long-term price appreciation.

- Budget-Friendly – You don’t need large sums to start. Even small, regular contributions can grow significantly.

- Compounding Benefits – Regular investments and reinvestments can compound over time, especially if you stake certain assets.

How Does a Crypto SIP Work?

Here’s a step-by-step look at how this works:

- Choose an Exchange – Select a reliable crypto exchange that offers SIP or recurring buy options.

- Pick Your Asset – Most investors start with Bitcoin or Ethereum, though some platforms allow SIPs in multiple tokens.

- Decide the Frequency – Daily, weekly, or monthly investments depending on your comfort.

- Set the Amount – Fix a budget that doesn’t strain your finances.

- Automate Investments – Many exchanges let you automate purchases, ensuring consistency.

Benefits of a Crypto SIP vs Lump-Sum Investing

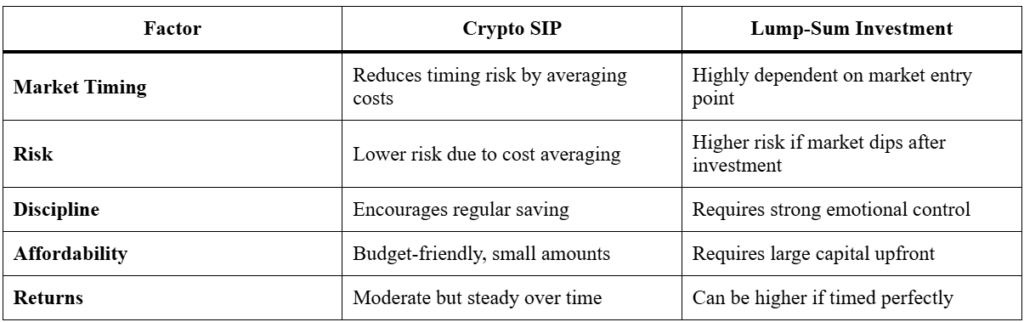

One of the biggest questions investors ask is whether this is better than investing a lump sum at once. Let’s compare the two approaches:

As seen, a Crypto SIP is ideal for those who prefer stability, while lump-sum investing is better for high-risk takers who can afford volatility.

Risks Involved in a Crypto SIP

While a Crypto SIP reduces risks compared to lump-sum investing, it is not completely risk-free. Some risks include:

- Market Volatility – Prices may remain low for long periods.

- Regulatory Concerns – Governments are still forming policies around digital assets.

- Exchange Security – Ensure you use trusted platforms with strong security measures.

- Asset Selection – Choosing the wrong cryptocurrency can impact returns significantly.

To mitigate these risks, investors should diversify, use secure wallets, and stay updated with market regulations.

Best Practices for a Successful Crypto SIP

- Start Small – Begin with a manageable amount and gradually increase.

- Stay Consistent – Don’t pause investments based on short-term market trends.

- Choose Strong Assets – Focus on established coins like Bitcoin, Ethereum, or high-potential altcoins.

- Secure Storage – Transfer your holdings to a hardware wallet for maximum safety.

- Review Periodically – Assess your portfolio every 6–12 months to rebalance if necessary.

Real-World Example of Crypto SIP Growth

Imagine you started a Crypto SIP in Bitcoin at $100 per month for 3 years. Over 36 months, your total investment would be $3,600. If Bitcoin appreciated at an average annual rate of 25%, your portfolio could grow significantly higher compared to keeping money idle in a savings account.

This example highlights how consistency beats timing the market in the long run.

Who Should Invest in a Crypto SIP?

A Crypto SIP is suitable for:

- New investors who are unsure of timing the market.

- Professionals with steady incomes who want disciplined investments.

- Long-term believers in blockchain and cryptocurrency adoption.

- Risk-conscious individuals who want exposure without betting everything at once.

The Future of Crypto SIPs

With growing adoption, many exchanges and fintech companies are introducing Crypto SIP features. As regulations mature, these systematic plans are likely to become mainstream, just like mutual fund SIPs in the stock market.

Experts predict that a Crypto SIP could become one of the safest entry points for retail investors in the digital economy.

Conclusion

A Crypto SIP is not just a strategy but a disciplined path to wealth creation. By spreading investments over time, reducing emotional stress, and encouraging consistency, it gives investors the chance to build wealth in one of the fastest-growing asset classes.

While risks remain, adopting best practices and focusing on strong assets can make this a powerful tool for long-term financial growth. For those looking to step into the world of digital assets with confidence, starting a Crypto SIP could be the smartest first step

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact