Powerful Guide to Litecoin (LTC): Growth, Use & Forecast

Powerful Guide to Litecoin (LTC): Growth, Use & Forecast. This in-depth blog from the “About Coin” series explores (LTC), a fast, low-fee cryptocurrency known as the “Silver To Bitcoin’s Gold.” It covers its origin by Charlie Lee in 2011, key technological features, real-world use cases, market performance, and future outlook. Designed for both beginners and experts, the post offers insights into how to buy, store, and evaluate Litecoin (LTC) as a valuable digital asset in the evolving crypto landscape.

What is Litecoin (LTC)?

Litecoin (LTC) is a decentralized, open-source cryptocurrency designed for fast and low-cost peer-to-peer transactions. Often referred to as the “silver to Bitcoin’s gold,” (LTC) plays a crucial role in the broader cryptocurrency ecosystem by offering a more scalable and efficient alternative to Bitcoin. With its lower block time and minimal fees, Litecoin (LTC) has remained a favorite among users for everyday transactions since its inception.

Read All About: Bitcoin (BTC), Solana (SOL), Binance Coin (BNB), Dogecoin (Doge)

Owner and Establishment Year

Litecoin (LTC) was created by Charlie Lee, a former Google engineer and later the Director of Engineering at Coinbase. He launched the coin in October 2011, intending to improve upon Bitcoin’s limitations regarding transaction speed and scalability. Unlike many anonymous crypto founders, Charlie Lee has always been open about his involvement with Litecoin (LTC), further boosting its credibility and transparency in the market.

History and Development

The development of (LTC) was heavily inspired by Bitcoin’s codebase. In fact, it’s a fork of Bitcoin, tweaked to offer faster block generation times and a different hashing algorithm. Litecoin started with a block time of 2.5 minutes (four times faster than Bitcoin) and a maximum supply of 84 million coins, which is four times Bitcoin’s supply.

Since its launch, Litecoin (LTC) has gone through several important upgrades:

- SegWit Activation (2017): Enabled faster and more secure transactions.

- Lightning Network Support: Allows near-instant transactions with minimal fees.

- MimbleWimble Extension Blocks (2022): Enhanced privacy features for users who value transaction anonymity.

Its consistent innovation keeps Litecoin (LTC) relevant in an ever-evolving crypto space.

Key Features and Underlying Technology

1. Scrypt Algorithm

Unlike Bitcoin’s SHA-256, Litecoin (LTC) uses the Scrypt hashing algorithm, making it more accessible to individual miners and less susceptible to large mining farms dominating the network.

2. Fast Transactions

With a 2.5-minute block time, Litecoin processes transactions much faster than Bitcoin, making it ideal for small and medium-sized payments.

3. Low Transaction Fees

Average transaction fees on Litecoin (LTC) remain extremely low, typically under a cent, perfect for microtransactions.

4. Strong Developer Community

Being open-source, Litecoin (LTC) benefits from continuous development and community support, which ensures security and ongoing improvements.

Regulatory and Security Considerations

Litecoin (LTC) operates as a decentralized digital asset and is generally recognized as a legal cryptocurrency in most countries that support crypto trading and usage. However, regulations can vary significantly by jurisdiction. It is always advisable to check local laws regarding cryptocurrency transactions, taxation, and usage to ensure compliance.

From a security perspective, (LTC) has maintained a strong and reliable track record since its inception in 2011. The network is secured through a Proof-of-Work (PoW) consensus mechanism using the Scrypt algorithm, making it less vulnerable to 51% attacks compared to smaller-cap cryptocurrencies. In addition, Litecoin benefits from regular security upgrades, community oversight, and transparency from the Litecoin Foundation and core developers.

With no history of major hacks or network shutdowns, Litecoin is considered one of the most secure and time-tested blockchain networks in existence.

Use Cases and Adoption

Litecoin (LTC) serves several use cases in today’s digital economy:

- Daily Transactions: Its speed and low fees make it ideal for buying goods and services.

- Remittances: Users send cross-border payments quickly without high banking fees.

- Trading: Popular on almost every major exchange for its liquidity and stability.

- Merchant Payments: Over 3,000 merchants and payment processors accept (LTC), according to Litecoin Foundation.

Major companies like BitPay and Travala support Litecoin payments, further driving adoption across retail and travel sectors.

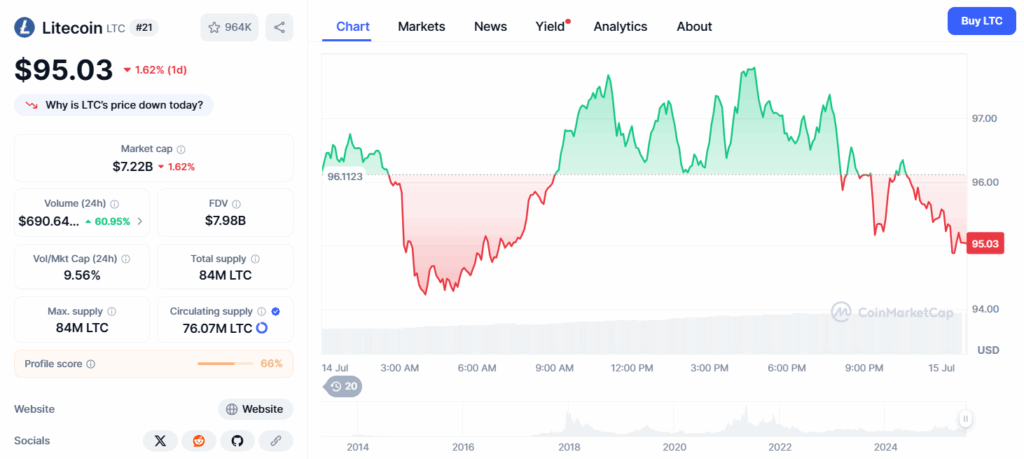

Price Trends and Market Insights

Since its early days trading at under $1, Litecoin (LTC) has seen dramatic growth. Here’s a brief look at its price journey:

- 2013–2016: Steady growth, moving between $1 to $10.

- 2017 Bull Run: Hit an all-time high of nearly $375 in December 2017.

- 2020–2021 Cycle: Saw another peak, reaching around $410 in May 2021.

- 2022–2024 Bear Phase: The coin corrected, finding support around $60–$80.

- 2025 Market Recovery: As of now, (LTC) trades with moderate volatility and strong support in the $90–$120 range.

It remains in the top 25 cryptocurrencies by market capitalization, indicating sustained investor trust and relevance.

For historical and current pricing data, reference platforms like CoinMarketCap.

Community and Ecosystem Support

The success and longevity of (LTC) can be largely attributed to its passionate and decentralized community. At the forefront is the Litecoin Foundation, a nonprofit organization headquartered in Singapore, committed to promoting the adoption, education, and development of the Litecoin ecosystem.

It has a vibrant online presence across platforms like Reddit, Twitter, Telegram, and GitHub. These communities actively engage in development discussions, wallet testing, promotional campaigns, and real-world use case sharing. Annual events like the Litecoin Summit further strengthen developer participation, partnerships, and user trust.

Thanks to its strong grassroots support, developer transparency, and nonprofit-led innovation, (LTC) continues to evolve as a reliable and community-driven digital asset.

How to Buy and Store Litecoin (LTC)

Where to Buy:

- Centralized Exchanges: Binance, Coinbase, Kraken, Bitfinex.

- Decentralized Exchanges (DEXs): Compatible with LTC tokens wrapped for DEX use.

Storage Options:

- Hot Wallets: Trust Wallet, Atomic Wallet – ideal for active users.

- Cold Wallets: Ledger Nano S/X, Trezor – best for long-term holders.

Always prioritize wallets that support (LTC) natively and offer 2FA and private key control for enhanced security.

Future Outlook and Predictions

The future of (LTC) appears cautiously optimistic and well-positioned for long-term sustainability in the ever-evolving crypto market.

- Increased Institutional Interest: As institutions diversify crypto holdings beyond Bitcoin and Ethereum, Litecoin is a natural addition due to its age, credibility, and technological maturity. Its strong performance history makes it a reliable hedge during market volatility.

- Enhanced Privacy via MimbleWimble: Litecoin’s recent privacy upgrades could make it a go-to asset for users looking for anonymous transactions without raising compliance issues. These features appeal to both everyday users and advanced traders who value optional privacy.

- Layer-2 and Cross-Chain Integration: With the rise of Layer-2 scalability solutions and cross-chain interoperability, (LTC) could be integrated more widely into DeFi platforms, decentralized exchanges, and blockchain-based games.

- Community-Driven Development: One of the unique strengths of (LTC) is its active, passionate community and nonprofit foundation that continuously advocates for real-world adoption and education.

Overall, (LTC) is expected to remain a strong contender in the market with further technological upgrades, real-world use cases, and broad market acceptance fueling its potential.

Final Thoughts

Litecoin (LTC) has proven itself over more than a decade as a reliable, scalable, and efficient cryptocurrency. With a strong development team, practical use cases, low fees, and a loyal community, it continues to be a cornerstone of the crypto space. Whether you’re a beginner investor or a seasoned trader, (LTC) deserves a serious look as part of any diversified digital asset portfolio.

Is Litecoin (LTC) a good investment in 2025?

Yes, Litecoin (LTC) remains a popular choice among investors due to its long-term market presence, low transaction fees, and ongoing development, including privacy upgrades.

How is (LTC) different from (BTC)?

Litecoin (LTC) processes transactions faster (2.5 minutes per block vs. Bitcoin’s 10 minutes), uses the Scrypt algorithm, and has a higher coin supply (84 million vs. 21 million).

Where can I buy and store (LTC) safely?

You can buy (LTC) on major exchanges like Binance and Coinbase, and store it in trusted wallets such as Ledger, Trezor, or Trust Wallet for security.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.