Powerful Guide to Tokenomics Meaning Explained. The rise of cryptocurrencies has introduced a range of new financial concepts, and one of the most essential among them is tokenomics. For anyone stepping into the crypto ecosystem, grasping Tokenomics Meaning is like learning the rules of the game. It not only defines how tokens are created and distributed but also explains their purpose, value, and sustainability in the long run. Without understanding Tokenomics Meaning, it becomes difficult to evaluate whether a crypto project has real potential or is just another speculative bubble.

In this guide, we will break down the Tokenomics Meaning in simple terms, explore its core components, and compare how different projects structure their token economies.

What is Tokenomics?

To put it simply, Tokenomics Meaning refers to the economics of a token. It combines two words: “token” and “economics.” Just as traditional economics studies the flow of money, goods, and services, tokenomics studies how digital tokens are issued, distributed, and utilized within a blockchain ecosystem.

It explains:

- How tokens are created (minting or mining)

- The total supply available

- The circulation of tokens in the market

- Incentives for users and developers

- Rules that ensure sustainability

Understanding Tokenomics Meaning is crucial because it tells investors and users whether a token will gain value or lose relevance over time.

Why Tokenomics is Important

Every token represents more than just a digital asset it is the backbone of a project’s economy. Without solid tokenomics, a blockchain project cannot thrive. Here are the main reasons why knowing Tokenomics Meaning matters:

- Investor Confidence – Projects with clear tokenomics attract more investors.

- Price Stability – Proper token allocation reduces volatility.

- Utility and Adoption – Good tokenomics ensures tokens are actually used, not just traded.

- Sustainability – Strong design prevents token supply from crashing the project’s value.

If you want to avoid scams or short-lived projects, understanding Tokenomics Meaning should be your first step.

Key Components of Tokenomics

To fully grasp Tokenomics Meaning, it’s essential to understand its components:

1. Token Supply

- Maximum Supply: The total number of tokens that can ever exist.

- Circulating Supply: The number of tokens currently available in the market.

- Inflation/Deflation: Some tokens reduce supply over time (burning), while others increase supply (minting).

2. Token Distribution

How tokens are distributed during launch is critical. A fair distribution supports community trust, while a centralized one raises concerns.

3. Utility

Utility defines why the token exists. For example, it might be used for governance, staking, transaction fees, or access to special features.

4. Incentives

Incentives encourage participation. Staking rewards, governance rights, or discounts keep users engaged.

5. Governance

Some tokens allow holders to vote on decisions, shaping the future of the project. This is an integral part of Tokenomics Meaning in decentralized finance.

Tokenomics in Action – Examples

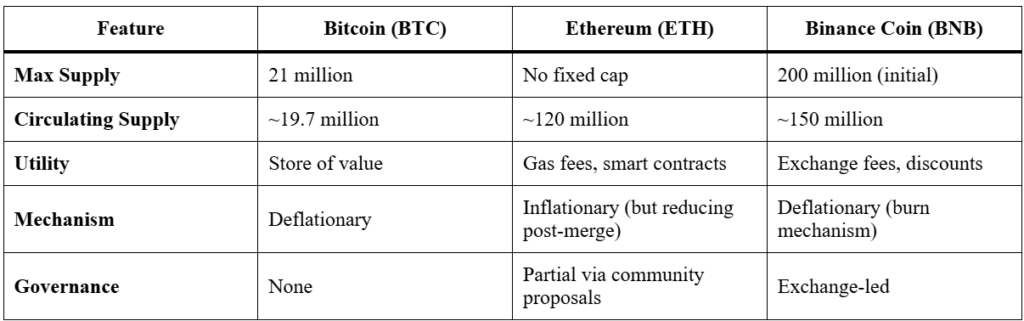

To see Tokenomics Meaning in practice, let’s look at some well-known projects:

- Bitcoin (BTC): Has a fixed maximum supply of 21 million coins, which makes it deflationary. Its value is driven by scarcity.

- Ethereum (ETH): Focuses on utility. ETH is required to pay gas fees and participate in smart contracts.

- Binance Coin (BNB): Implements regular token burning to reduce supply and increase value over time.

Each of these examples highlights different aspects of Tokenomics Meaning—scarcity, utility, and value appreciation mechanisms.

Comparison Table: Tokenomics Across Popular Cryptos

This comparison shows how different projects apply Tokenomics Meaning uniquely to achieve their goals.

Challenges in Tokenomics

While the concept is powerful, there are challenges in designing sustainable tokenomics:

- Over-Supply: Too many tokens can dilute value.

- Poor Utility: Tokens with no clear use cases often fail.

- Whale Concentration: If a few wallets control most tokens, it creates risks.

- Lack of Transparency: Investors may lose trust if tokenomics details aren’t shared.

Recognizing these pitfalls makes it easier to understand why Tokenomics Meaning is central to evaluating new crypto projects.

The Future of Tokenomics

As blockchain adoption grows, the importance of well-structured tokenomics will only increase. We’re likely to see:

- More deflationary models to ensure long-term value.

- Hybrid utilities combining governance, staking, and payments.

- Greater transparency, with detailed tokenomics published before launch.

- Regulation ensuring fair distribution and preventing manipulation.

The future will revolve around projects that carefully design their economies, reinforcing why Tokenomics Meaning is one of the most important ideas in crypto today.

Conclusion

Whether you are an investor, developer, or simply a curious learner, understanding Tokenomics Meaning is essential to navigating the crypto ecosystem. It reveals how tokens are created, distributed, and maintained, helping you evaluate the long-term potential of a project.

Projects with solid tokenomics often survive bear markets, attract loyal communities, and build sustainable ecosystems. On the other hand, weak or misleading tokenomics can doom even the most hyped ventures.

By paying close attention to Tokenomics Meaning, you can make smarter, safer, and more rewarding decisions in the world of cryptocurrency.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact