Powerful Guide: Is Cryptocurrency Safe for You? With the rising popularity of digital assets, one question echoes in almost every investor’s mind: cryptocurrency is safe or not? While millions are attracted to the promise of high returns and decentralized finance, others remain skeptical due to security risks, regulatory challenges, and market volatility.

This guide dives deep into the safety of cryptocurrencies, exploring both opportunities and risks. Whether you are a beginner or an experienced investor, understanding whether cryptocurrency is safe will help you make informed financial decisions.

What Makes People Ask if Cryptocurrency Is Safe?

The question of whether cryptocurrency is safe arises because of three main factors:

- Volatility – Prices can fluctuate by double-digit percentages within hours.

- Security Risks – Hacks, phishing, and exchange failures raise concerns.

- Regulatory Uncertainty – Governments around the world treat cryptocurrencies differently.

Despite these challenges, millions continue to invest because they believe cryptocurrency is safe when handled with proper precautions.

How Cryptocurrency Security Works

To evaluate whether cryptocurrency is safe, we need to understand the security mechanisms:

- Blockchain Technology: Transactions are recorded on a decentralized, immutable ledger.

- Cryptographic Protection: Strong encryption safeguards data and transactions.

- Peer-to-Peer Network: Eliminates reliance on central institutions.

- Wallets & Private Keys: Investors control their funds through secure keys.

These factors demonstrate why many experts believe cryptocurrency is safe at a technical level. However, risks emerge from human error, poor storage, or unreliable exchanges.

Risks That Make People Doubt If Cryptocurrency Is Safe

Even with advanced technology, no system is entirely risk-free. Let’s explore common issues that influence whether cryptocurrency is safe:

- Exchange Hacks – History has seen major breaches like Mt. Gox, leading to billions in losses.

- Phishing Scams – Fake websites trick users into revealing private keys.

- Loss of Private Keys – If keys are lost, funds are irretrievable.

- Regulation & Bans – Uncertain laws in some countries make people wonder if cryptocurrency is safe in the long run.

- Market Manipulation – Pump-and-dump schemes affect investor trust.

Why Some Believe Cryptocurrency Is Safe

Despite the risks, many investors strongly believe cryptocurrency is safe because:

- Blockchain transactions are almost impossible to alter.

- Decentralization reduces single points of failure.

- Institutional adoption increases trust.

- Improved wallets and cold storage make funds more secure.

The balance between risks and protections is what makes people debate whether cryptocurrency is safe today.

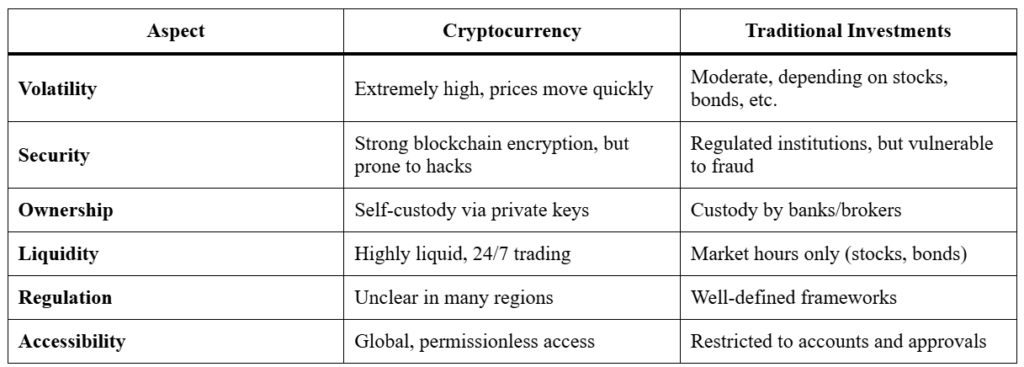

Comparison: Cryptocurrency Safety vs. Traditional Investments

To better understand if cryptocurrency is safe, let’s compare it to other asset classes:Powerful Guide: Is Cryptocurrency Safe for You?

This shows that asking if cryptocurrency is safe depends on comparing it to what you value: independence and high reward potential, or regulated stability.

Best Practices to Ensure Cryptocurrency Is Safe

If you are still wondering whether cryptocurrency is safe, here are steps you can take to minimize risks:

- Use Reputable Exchanges – Stick to platforms with strong security measures.

- Enable Two-Factor Authentication – Add extra protection for accounts.

- Store in Cold Wallets – Offline wallets are the safest for long-term holding.

- Avoid Sharing Private Keys – Treat them like your bank PIN.

- Diversify Investments – Don’t put all money into one asset.

- Stay Updated – Follow market news and regulations.

Following these practices ensures that cryptocurrency is safe for most investors.

The Role of Regulation in Deciding If Cryptocurrency Is Safe

Global regulators are actively working on frameworks. In the US, the SEC monitors crypto assets, while in Europe, the MiCA regulation aims to establish rules. In India, policymakers are reviewing taxation and compliance rules.

When regulators step in, some investors feel cryptocurrency is safe because it adds legitimacy, while others worry it reduces decentralization. Either way, regulation will play a crucial role in answering the question: is cryptocurrency safe?

Future Outlook: Will Cryptocurrency Be Safer?

The future of whether cryptocurrency is safe depends on:

- Improved Technology – Better wallets, stronger encryption.

- Institutional Adoption – Banks and funds adding credibility.

- Clear Regulations – Governments providing investor protections.

- Education – As users learn, scams will reduce.

Over time, most experts believe that cryptocurrency is safe will be a more common conclusion as systems mature.

Conclusion

So, is cryptocurrency safe? The answer lies in understanding both the opportunities and risks. On one hand, blockchain technology and decentralized finance provide strong protection, accessibility, and high growth potential. On the other hand, volatility, scams, and uncertain regulations raise valid concerns.

For investors, the real safety comes from using secure practices, staying informed, and diversifying assets. When these steps are taken, most experts agree that cryptocurrency is safe enough to consider as part of a balanced portfolio.

In the end, the decision depends on your risk tolerance and investment goals. By combining knowledge with caution, you can confidently decide whether cryptocurrency is safe for your financial journey.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact