Powerful Crypto Card Guide for Smarter Payments. The world of digital assets is evolving rapidly, and one of the biggest innovations for everyday users is the crypto card. Just like traditional debit or credit cards, a crypto card allows you to spend money in physical stores, online shops, and ATMs. The difference is that instead of being tied only to fiat currencies like INR, USD, or EUR, This connects directly to your cryptocurrency holdings.

For travelers, digital nomads, and modern investors, crypto cards have become essential tools to bridge the gap between blockchain assets and real-world payments. This guide explores how this work, their benefits, risks, and the best platforms available today.

What is a Crypto Card?

This is a payment card issued by financial institutions or crypto exchanges that lets you spend cryptocurrencies like Bitcoin, Ethereum, or stablecoins. When you swipe or tap a this, the backend system instantly converts your digital assets into local fiat currency, so merchants can accept payments without worrying about crypto volatility.

There are two main types:

- Crypto Debit Cards – Linked directly to your wallet, they allow you to spend what you already own.

- Crypto Credit Cards – Work like traditional credit cards but reward spending with cashback in crypto.

Why Use a Crypto Card?

Using this comes with multiple advantages that go beyond just spending digital assets:

- 🌍 Global Access – Spend cryptocurrencies anywhere credit cards are accepted.

- 💳 Rewards & Cashback – Many crypto cards offer up to 8% cashback in crypto.

- 🔒 Security – Protected by blockchain transparency and card provider’s fraud systems.

- 📈 Portfolio Utility – Allows you to use crypto holdings without liquidating them on exchanges.

- ✈️ Travel Benefits – Some cards offer lounge access, lower forex fees, and worldwide usability.

How Does a Crypto Card Work?

When you use this, here’s what happens in the background:

- You tap, swipe, or enter your card for payment.

- The card provider converts your chosen crypto (BTC, ETH, USDT, etc.) into the local fiat currency.

- The merchant receives the fiat amount, just like any regular card transaction.

- You get charged in crypto, and in some cases, you earn cashback in digital assets.

This seamless conversion is why crypto cards are gaining global adoption.

Top 5 Powerful Crypto Cards to Consider

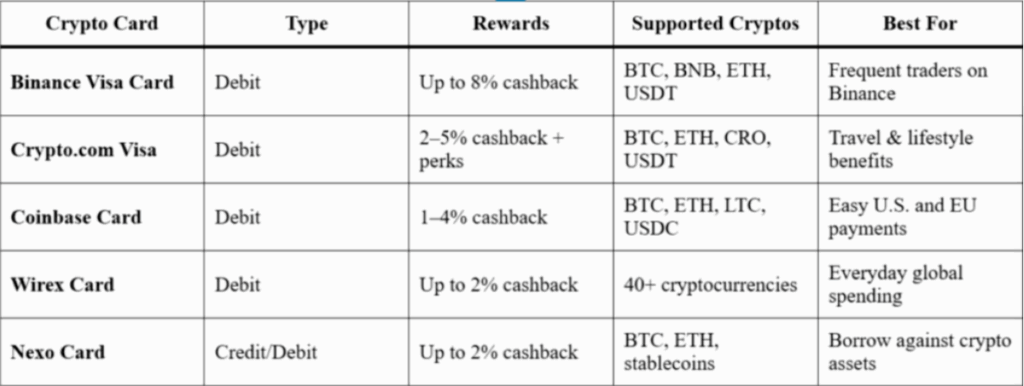

Below is a comparison table of the best crypto cards available in 2025:

This comparison helps you choose the right crypto card depending on whether you want high cashback, multi-asset support, or global usability.

Benefits of Using a Crypto Card in India

For Indian users, This offers unique benefits despite the regulatory hurdles:

- 🔄 Convert crypto instantly into INR for online or offline purchases.

- 💼 Manage both crypto and fiat through one card.

- 📊 Track spending and rewards in mobile apps.

- ✈️ Useful for international travel where INR is not widely accepted.

However, users must stay aware of India’s tax rules (30% tax on gains and 1% TDS on crypto transfers).

Risks and Challenges of Crypto Cards

While crypto cards bring convenience, there are challenges:

- Regulatory Uncertainty – Rules for crypto usage vary by country.

- Volatility – Value of crypto may drop before conversion.

- Fees – Some crypto cards charge issuance or withdrawal fees.

- Limited Acceptance – In regions with strict crypto bans, usage may be restricted.

Mitigating these risks requires choosing reliable platforms and keeping only a manageable amount of crypto on your card wallet.

How to Choose the Best Crypto Card

When picking a crypto card, consider:

- Supported Coins – Does it support the crypto you hold most?

- Rewards – Cashback, staking perks, or travel benefits?

- Fees – Issuance, transaction, and ATM withdrawal charges.

- Availability – Not all crypto cards are available in India.

- Ease of Use – Mobile app integration and customer support matter.

Future of Crypto Cards

The demand for crypto cards is set to rise as more people adopt blockchain-based finance. Global payment giants like Visa and Mastercard are already collaborating with crypto exchanges to expand offerings. As regulations become clearer, especially in India, crypto cards could become as common as UPI or net banking for digital transactions.

Conclusion

A crypto card is more than just a financial tool it’s a bridge between digital assets and real-world payments. Whether you are a frequent traveler, an investor looking to maximize rewards, or simply someone who wants to use Bitcoin for coffee, a crypto card makes it possible.

By comparing top platforms and understanding risks, you can choose the best crypto card for your lifestyle and spending habits. With the rise of digital payments, crypto cards are not just the future they’re already here.

Final Thoughts

As adoption grows, This will reshape how we think about money. From daily shopping to international travel, they provide flexibility, rewards, and security that traditional banking can’t always match. If you haven’t explored one yet, now is the perfect time to consider this for smarter payments.

FAQs

Q1. How do digital payment cards connected to crypto wallets work?

These cards link directly to your digital wallet, converting assets into local currency at the point of sale, making transactions seamless and instant.

Q2. Are blockchain-powered payment cards accepted worldwide?

Yes, most of these cards are accepted anywhere traditional debit or credit cards are, especially when they are backed by networks like Visa or Mastercard.

Q3. What are the main benefits of using blockchain-based cards?

The benefits include lower fees, faster international payments, strong security through encryption, and the ability to spend assets globally.

Q4. How can I ensure safe transactions with digital asset payment cards?

Choose providers with strong security features such as two-factor authentication, real-time alerts, and regulated partnerships with trusted banks.

Q5. Do these payment solutions offer rewards or cashback?

Yes, many providers offer cashback, rewards in digital assets, or even loyalty points, making them attractive alternatives to regular banking cards.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact