When it comes to earning rewards with crypto, Binance Staking is one of the most popular and accessible methods. For both beginners and experts, it offers a simple way to put digital assets to work and generate steady income without active trading. This blog explores everything you need to know about Binance Staking, from its history and founding team to how you can maximize returns securely.

What is Binance Staking?

Binance Staking is a feature offered by the world’s largest cryptocurrency exchange, Binance, that allows users to lock up their tokens to support blockchain networks. In return, participants receive staking rewards, similar to interest in traditional banking.

Unlike mining, which requires expensive equipment and high electricity consumption, staking is eco-friendly and beginner-friendly. With just a few clicks, Binance users can allocate their assets into staking pools and start earning passive income.

Founding Team and Launch of Binance

To understand the strength behind Binance Staking, it’s essential to know about its parent company.

- Founder: Changpeng Zhao (commonly known as CZ), a renowned entrepreneur with prior experience at Blockchain.info and OKCoin.

- Co-founder: Yi He, an influential figure in the crypto industry and former Vice President of OKCoin.

- Launch Year: Binance was officially launched in 2017 and quickly grew to become the largest exchange in terms of trading volume.

This strong foundation and reputation give Binance Staking credibility, attracting millions of users worldwide.

How Binance Staking Works

Binance provides two main types of staking options, designed to cater to different user preferences:

Locked Staking

- Users commit their tokens for a fixed period (7, 30, 60, or 90 days).

- Higher rewards due to longer commitment.

- Ideal for investors who do not need immediate liquidity.

Flexible Staking

- Users can withdraw their tokens at any time.

- Slightly lower rewards compared to locked staking.

- Great for traders who want both passive income and liquidity.

By choosing between flexible and locked options, investors can balance risk, returns, and liquidity according to their strategies.

Why Choose Binance Staking?

Here are the top reasons why millions of users prefer Binance Staking over other platforms:

- User-Friendly Interface: No technical knowledge is required.

- Diverse Coin Support: Staking available for over 100 tokens, including ETH, ADA, BNB, and DOT.

- Trusted Platform: Backed by Binance’s strong reputation and global compliance efforts.

- Competitive Rewards: Higher yields than many other exchanges.

- Security First: Binance employs cold wallets, advanced encryption, and a SAFU fund for user protection.

Benefits of Binance Staking

- Passive Income Stream

By participating in Binance Staking, investors earn rewards automatically, making it a reliable passive income strategy. - Low Entry Barrier

Unlike mining or trading, staking requires no expensive hardware or high skills. Beginners can start with minimal investment. - Portfolio Diversification

Users can stake different coins simultaneously, reducing risk and boosting overall returns. - Eco-Friendly Model

Staking consumes far less energy than mining, aligning with sustainable crypto practices.

Risks to Consider

While Binance Staking offers attractive benefits, it is not risk-free:

- Market Volatility: Crypto prices can drop, reducing the fiat value of staking rewards.

- Lock-in Period Risks: In locked staking, funds are inaccessible until maturity.

- Platform Risks: Although Binance is highly secure, no platform is immune to cyber threats.

Understanding these risks helps investors make informed decisions before committing assets.

How to Stake and Earn on Binance

Getting started with Binance Staking is straightforward. Here’s a step-by-step process:

- Create and Verify a Binance Account

- Sign up on Binance and complete identity verification (KYC) for security and access to full features.

- Deposit or Purchase Tokens

- Transfer crypto from an external wallet or buy directly on Binance using fiat.

- Navigate to the Earn Section

- On the Binance dashboard, go to “Earn” → “Staking.”

- Select a Token to Stake

- Browse available staking options with their APYs (Annual Percentage Yields).

- Popular choices include BNB, ETH, ADA, and DOT.

- Choose Flexible or Locked Duration

- Decide between flexible staking (withdraw anytime) or locked staking (fixed days for higher rewards).

- Confirm Staking

- Review the details, confirm the amount, and stake your tokens.

- Start Earning Rewards

- Rewards are automatically credited to your account daily or periodically depending on the token.

Example: If you stake BNB for 30 days with a 6% APY, you’ll earn proportional rewards based on your staked amount and duration.

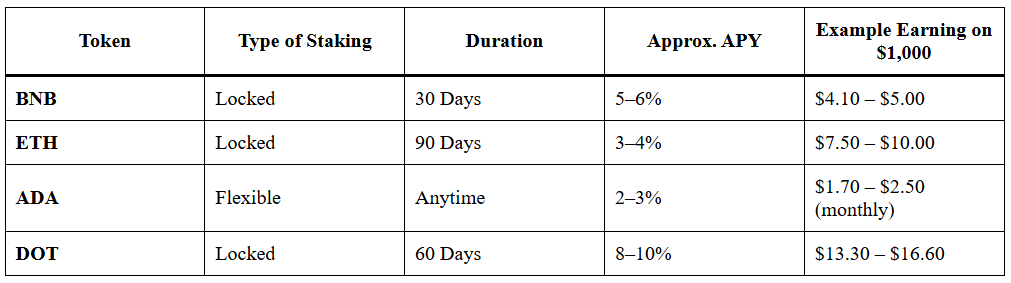

Earning Structure of Binance Staking

The rewards in Binance Staking vary depending on the token, lock-up period, and market demand. Here’s a simplified earning structure example:

Note: Returns are estimates based on APY ranges and may fluctuate depending on network rewards and Binance policies.

This earning structure helps investors understand how much they can realistically earn through Binance Staking, making it a clear “earn with crypto” opportunity.

Strategies to Maximize Rewards

To get the best out of Binance Staking, consider these strategies:

- Mix Flexible and Locked Options: Combine both for liquidity and high returns.

- Stake Strong Projects: Prioritize well-established tokens like BNB and ETH.

- Reinvest Rewards: Compound your staking rewards for exponential growth.

- Stay Updated: Follow Binance announcements for new staking opportunities.

Final Thoughts

Binance Staking has redefined passive income opportunities for crypto investors. With flexible and locked options, strong security measures, and a reputation backed by the industry’s largest exchange, it offers both beginners and experts a reliable way to grow their digital wealth.

For anyone looking to build an “Earn With Crypto” strategy, Binance Staking stands as one of the most effective and accessible methods available today.

Frequently Asked Questions

What is Binance Staking and how does it work?

Binance Staking allows users to lock up their crypto assets on the Binance platform and earn passive income in the form of staking rewards. The process involves delegating your coins to support blockchain network operations, and in return, you receive rewards directly credited to your Binance account.

What is the minimum amount required for Binance Staking?

The minimum amount depends on the cryptocurrency. For example, staking BNB usually requires just 0.1 BNB, while other tokens may have different thresholds. Binance provides the minimum staking requirement for each supported asset.

Is Binance Staking safe and secure?

Yes, Binance uses advanced security protocols, insurance funds, and strict regulatory compliance to ensure user safety. However, risks like market volatility and project-specific risks still apply. Always do your own research before staking.

How much can I earn with Binance Staking?

Earnings vary by token, duration, and staking type. On average, flexible staking offers 5–10% APY, while locked staking can provide 15–25% APY depending on the crypto. Binance displays the potential APY before you stake.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.