Have you ever wondered how these savvy crypto traders in India consistently make profits throughout price swings, even when the market is down? Long and short positions in crypto trading in India are a speculative approach that many sophisticated traders utilize to optimize this price volatility and generate bigger earnings.

This strategic approach helps traders speculate price movements and make significant profits, irrespective of whether the crypto asset value appreciates or depreciates.

Long and Short Positions: Your Gateway to Profitable Crypto Trading in India: This article breaks down the concepts of long and short positions in crypto trading in India and empowers you to make informed decisions and execute profitable trades in the growing crypto market.

What is Position Trading in Crypto?

Before we get into the long and short positions in crypto, let’s first break down the concept of position trading.

Position trading in crypto is a strategy that allows traders to capitalize on market trends and shifts and make informed decisions. It indicates the price movement of the crypto and whether it will go up or down. Based on this information, investors chose the trading strategy.

Crypto traders consider long-term perspectives for weeks, months, or years, instead of short-term or instant trading, like in day trading. They hold on to their position, review investments, and make strategic profits over time.

Long and Short Positions: Your Gateway to Profitable Crypto Trading in India

So, how to trade long and short crypto? Let’s explore the basics of long and short positions first, and what they mean in crypto.

Long Position

A crypto long position means buying crypto, expecting its price to appreciate or rise in the future. It is one of the most common and basic trading strategies, especially when the crypto market is bullish.

Note: A crypto bullish market in India signifies an upward momentum when the crypto prices are rising or are expected to rise. It reflects an optimistic sentiment among traders who try to utilize the strong price climb and realize profits.

This approach is quite straightforward, as the traders are confident about the price appreciation and try to make the most of the situation.

How to Trade Long in Crypto?

Traders who “go long” bet on the price rise. The market is positive, and traders expect to sell their crypto assets at a higher price to make significant profits.

Key characteristics:

- Traders hold on to this position for an extended time, which can range from a few weeks or years.

- Long trading is a good option for optimistic traders. They have perseverance and believe in the long-term potential of their chosen crypto asset.

- This is a common practice of traders who rely on the bullish market trend.

- Traders “buy low” or enter the market when the asset price declines and “sell high,” or exit or sell the asset when the price appreciates.

- Novice traders prefer long position trading as it is less risky.

Tips for long position traders:

- To succeed, choose the right time to enter or exit the market.

- Technical analysis, like studying historical market data, understanding Moving Averages, RSI (Relative Strength Index), support/resistance levels, market signals, etc., is crucial.

- Beyond technical analysis, it is also important to consider the potential of the crypto project and frequently follow updates on social media handles.

- An increase in the trading volume indicates buyers’ interest. Conversely, a low volume highlights weak momentum and can impact the profitability.

Short Position

A short position, often called “shorting,” is more complicated than a long position. Unlike crypto long trading, traders try to capitalize on the falling market prices. In crypto trading in India, this strategy is typical of bear markets, which allows traders to offset potential losses rather than just holding on to the assets.

Note: A bear market in crypto refers to a strong market downturn when there is a significant decline in prices over a short period. There is an overall negative sentiment in the market. The traders are pessimistic and are referred to as “bears.”

How to Trade Short in Crypto?

Traders try “short-selling” to profit from falling prices. Let’s take an example: A trader who understands the bearish signals and has also anticipated the probability of the falling prices of Bitcoin in the coming days. He will then borrow the required amount of Bitcoin he wants to trade from a third party or a lending platform like an exchange, and sell it immediately at the current price. As anticipated, the Bitcoin price falls within a few days, and he buys back the borrowed amount of Bitcoin at a lower price and returns it to the lending platform. The price difference here is his profit.

Key characteristics:

- Unlike long positions, shorting involves a shorter duration, typically for a few days or weeks.

- This strategy is common during bearish markets when traders try to utilize the falling prices and make profits. It provides a hedge against potential losses.

- It is a common strategy for seasoned traders who understand the market and utilize the bearish trend.

- Traders “sell high,” meaning sell the crypto at a high price, and “buy low,” meaning buy back the crypto at a lower price and make profits.

- It is a riskier trading strategy than crypto long trading.

Tips for short position traders:

- This requires considerable knowledge of the market, strategic analysis, and price movements.

- Rely heavily on technical analysis tools to understand charts, candlesticks, trends, and bearish patterns.

- A high selling volume may indicate a price decline and a good opportunity to buy the crypto.

Long and Short Positions: Pros and Cons for Successful Crypto Trading in India

Both crypto long and short positions have their share of pros and cons. Crypto trading in India provides traders with the choice and flexibility to utilize these two trading strategies to balance risks and maximize profits.

Crypto Long Position: Pros

- It is less risky as the market is favourable and bullish, and traders can earn profits by selling at a higher price.

- The maximum loss incurred is the initial amount invested. This is preferred by new traders or those who want to trade safely and are averse to risks.

- Long trading is a safe, easy-to-grasp, and straightforward concept for beginners venturing into crypto trading.

- No borrowing from a third party or lending platform is required. Use your crypto assets and start trading.

- Good strategy for long-term trading. Earn simply by holding assets for an extended time.

Crypto Long Position: Cons

- This strategy works well only during bullish market trends. If prices stay low for too long, it diminishes the opportunities as traders must wait until the market revives.

- Holding assets for a long time locks the funds and the earning opportunities.

- The crypto market is volatile. Sudden price crashes may impact the profits.

- Holding assets for a long time needs patience. Some traders may give in to panic-selling or FOMO (Fear of Missing Out) and sell assets too early due to fear or anxiety.

Crypto Short Position: Pros

- Offers an opportunity to earn profits during bearish trends when the prices fall.

- Provides flexibility to traders to diversify investments without waiting or depending solely on upward market trends.

- It cushions traders against a negative market sentiment and provides a hedge to offset losses.

- Shorting is a path to quick gains from sudden and small price drops.

Crypto Short Position: Cons

- Traders can incur unlimited losses. If the prices continue to rise indefinitely, traders must still buy back the asset at a much higher price.

- Borrowing involves paying interest rates and fees to the lender, which can be expensive.

- It is a complex and high-risk investment. It is not suited for beginners, who may find it challenging and mentally exhausting.

Crypto Long Vs. Short: Know the Difference Before Trading

While crypto trading in India, harnessing the long and short positions depends on your trading goals, risk profile, aspirations, and investment style.

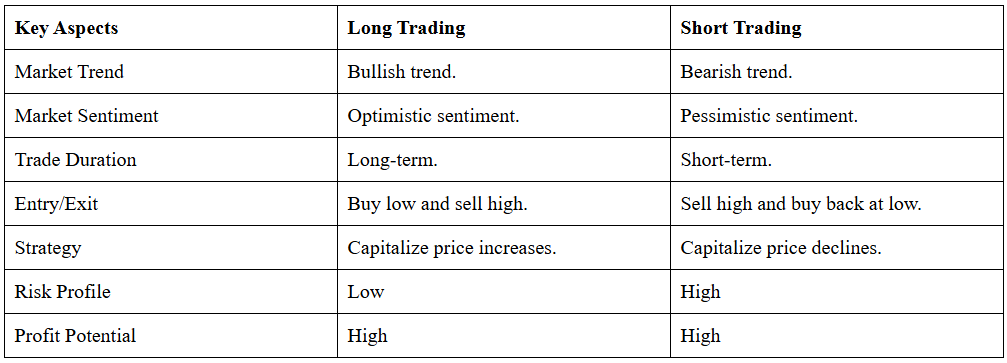

The table below is a comparative analysis between crypto long and short positions:

Closing Thoughts

Both long and short positions have profit potential and offer unique opportunities for crypto trading in India, but for lucrative earnings, you must understand the market trends, price shifts, and your risk tolerance. Many seasoned Indian traders combine long and short positions to create a balanced crypto trading strategy to maximize profits and protect assets against potential losses during different market conditions. The key is to acknowledge the changing market sentiments, employ the best trading strategy that handles risks prudently, and lead to success.

Taniya is a Content Writer with over 6 years of experience in the industry, specializing in Web3, crypto, Blockchain, Tokenization, and Decentralized Finance. She is passionate about creating compelling and well-researched narratives, navigating readers through the emerging trends and dynamic world of Web3 and Decentralized Finance.