Indian Crypto Investors Focus More on Platform Security. The rise of cryptocurrency adoption in India has been phenomenal over the last few years. With millions of investors entering the digital asset market, platform security has become a top priority. Unlike traditional banking systems that offer government-backed protection, cryptocurrency operates on decentralized networks where users bear full responsibility for their funds. This shift has made Indian crypto investors highly aware of the need for secure platforms with strong safeguards against hacking, phishing, and fraud.

In this article, we explore why security is the primary concern, the features investors look for, and how leading platforms stack up against each other.

The Growing Demand for Secure Crypto Platforms

The Indian crypto market has grown rapidly, driven by factors like tech-savvy youth, global crypto trends, and increased awareness of blockchain. However, with growth comes risk. According to industry reports, cyberattacks on crypto exchanges globally have resulted in billions of dollars in losses. These alarming numbers have influenced Indian investors to seek exchanges that offer end-to-end security measures.

The following factors are driving this trend:

- High-profile hacks: Incidents like exchange breaches have shown how vulnerable funds can be on poorly secured platforms.

- Regulatory uncertainty: With regulations still evolving, investors feel the need to choose exchanges that comply with KYC and AML norms for added safety.

- Rise of sophisticated scams: Social engineering attacks, fake apps, and phishing have made security education critical.

What Does Platform Security Mean for Crypto Investors?

For Indian investors, platform security is not just about having a strong password. It involves a multi-layered approach that includes:

- Two-Factor Authentication (2FA): A must-have feature for securing logins and withdrawals.

- Cold Wallet Storage: Platforms that store the majority of funds offline reduce hacking risks.

- Regular Security Audits: Ensures the platform meets global standards.

- Insurance Coverage: Some exchanges offer insurance against hacks, which adds confidence.

- Regulatory Compliance: Adherence to Indian and global AML/KYC norms for transparent operations.

When these elements come together, investors feel more confident about trading and storing their digital assets.

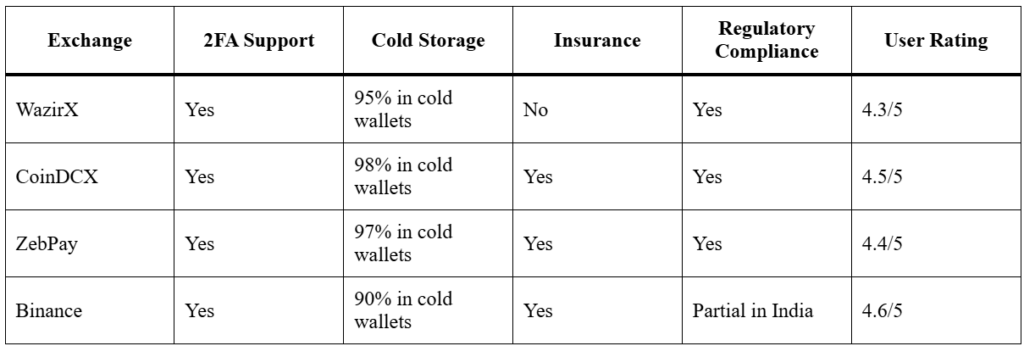

Comparison Table: Top Crypto Platforms and Their Security Features

To help you understand how platforms differ in terms of security, here’s a comparison of some popular crypto exchanges in India.

This table highlights how Indian-focused platforms like CoinDCX and ZebPay emphasize insurance and compliance, making them more attractive for security-conscious investors.

Why Indian Investors Are Extra Cautious

Unlike some Western markets where regulations are clearer, India’s crypto landscape is still evolving. The lack of guaranteed protection by the government means that platform security becomes the only defense line for investors.

In addition, the Reserve Bank of India (RBI) has historically expressed concerns about crypto risks. Though the Supreme Court lifted the banking ban on crypto in 2020, uncertainty persists. This makes Indian investors more likely to choose platforms that proactively implement strong security protocols and comply with all possible regulations.

Steps Indian Investors Can Take for Safer Crypto Investments

Even the most secure platform cannot fully protect users if they ignore basic safety practices. Here are key steps every investor should follow:

- Enable 2FA: Always activate two-factor authentication on your account.

- Avoid Public Wi-Fi: Trading on public networks exposes you to security risks.

- Use Hardware Wallets: For large holdings, store assets in hardware wallets for maximum protection.

- Beware of Phishing: Never click on suspicious links or share private keys.

- Stay Updated: Follow platform security updates and news about potential threats.

By following these steps, investors can add an extra layer of protection beyond what the platform provides.

Impact of Security on Investor Trust

Trust is the foundation of any financial market, and the crypto sector is no different. Indian investors have shown a clear preference for exchanges that not only offer competitive fees and a wide range of tokens but also prioritize security. Platforms that fail to meet these expectations risk losing customers rapidly.

Security also affects adoption. When new investors hear about hacks or scams, they hesitate to enter the market. Conversely, strong security measures and transparent communication can accelerate trust and adoption.

The Future of Platform Security in India

As the Indian crypto market matures, platform security will continue to evolve. Future trends may include:

- AI-driven Fraud Detection: Platforms will use artificial intelligence to detect suspicious activities in real time.

- Biometric Authentication: Beyond passwords and 2FA, biometric logins will become standard.

- Decentralized Exchanges (DEX): Users may increasingly prefer DEX platforms for better control of private keys.

- Regulatory-backed Security Standards: Government regulations may mandate minimum security requirements for all exchanges.

Final Thoughts

The message is clear: Indian crypto investors focus more on platform security than ever before. As digital assets become mainstream, security is no longer optional—it’s a necessity. Whether you’re a new investor or an experienced trader, prioritizing secure platforms and adopting safe practices will ensure your crypto journey remains smooth and profitable.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact