Indian Crypto Investors Focus on Platform Security. A growing number of Indian cryptocurrency investors are now prioritizing platform security over quick profits, marking a shift in how digital assets are viewed in one of the world’s fastest-growing crypto markets.

Industry experts note that with rising cases of cybercrime, exchange hacks, and global collapses like FTX, Indian investors are becoming increasingly cautious. Trust, transparency, and compliance are now being weighed more heavily than low fees or fast transactions.

Safety Takes Center Stage

According to market analysts, the behavior of Indian crypto users has evolved significantly in recent years. Previously, investors sought platforms with low transaction costs and high trading speed. Today, concerns over scams and phishing attacks have pushed investors toward platforms offering two-factor authentication, cold storage, and insurance protection.

“Indian investors have matured rapidly,” said a Mumbai-based fintech consultant. “They are no longer impressed only by flashy apps. They want solid proof that their funds are safe.”

Key Security Demands from Investors

Among the most common demands from Indian crypto users are:

- Two-Factor Authentication (2FA) for account access

- Cold wallet storage for safeguarding digital assets offline

- KYC and AML compliance to reduce fraud

- Regular audits and transparency reports

- Insurance protection against hacks

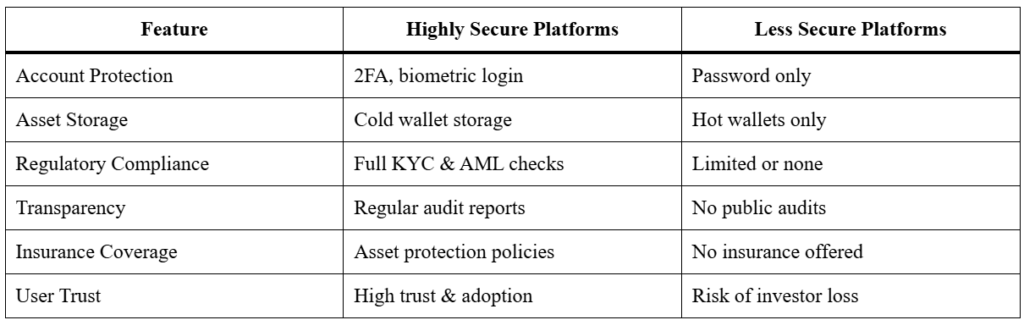

Comparison: Secure vs. Less Secure Platforms

Role of Regulation

While India has yet to finalize a comprehensive crypto framework, discussions around investor protection are increasing. Global models like the European Union’s MiCA regulations and U.S. policies are also influencing local conversations.

Industry insiders suggest that regulatory clarity could further boost investor confidence and encourage more exchanges to adopt robust safeguards.

Investors Warned of Risks

Experts caution that ignoring platform security exposes users to exchange hacks, phishing scams, and fraudulent exit schemes. In recent years, billions of dollars have been lost globally due to such incidents.

“Security should not be treated as optional,” warned a Bengaluru-based blockchain advisor. “For crypto to succeed in India, platforms must prioritize safety above everything else.”

Growing Trust Through Technology

Many Indian exchanges are now investing in blockchain-based transparency tools, allowing users to independently verify proof-of-reserves. Some platforms are also experimenting with AI-driven fraud detection to monitor unusual trading activity and flag suspicious accounts in real time.

Such advancements not only safeguard funds but also help attract institutional investors who demand strict compliance and oversight before entering the market.

Global Lessons Shaping India

The collapse of global giants like FTX and Celsius has made Indian investors more vigilant. Analysts believe that these international failures acted as a wake-up call for domestic users, highlighting the importance of not keeping all assets in one exchange and demanding stronger consumer protection policies.

“Every global failure pushes Indian investors to ask tougher questions,” said an analyst at a Delhi-based research firm. “They want to know whether an exchange has enough liquidity, whether it undergoes audits, and whether it can survive a sudden downturn.”

Outlook

With an estimated 115 million Indians already exploring digital assets, the demand for safer platforms is expected to intensify. Analysts predict that exchanges will increasingly invest in cybersecurity and compliance, while investors will continue to demand proof of transparency.

As India positions itself as a major crypto hub, one thing is clear: the future of crypto adoption in the country will depend on trust and platform security. Know more about Crypto here.

Education and Awareness Fueling Security-First Mindset

Another factor driving the focus on platform security among Indian crypto investors is greater access to education and awareness campaigns. Over the past few years, industry associations, fintech startups, and even independent content creators have played a key role in explaining the risks of unregulated exchanges and unsafe storage practices.

Workshops, webinars, and online guides are teaching investors about the importance of self-custody, multi-signature wallets, and regulatory compliance. This growing knowledge base means new users are less likely to be swayed by platforms that promise unrealistic returns but lack proper safeguards.

In addition, social media communities and crypto forums in India are sharing first-hand stories of frauds, phishing attempts, and platform failures. These real-world accounts make security a relatable issue, encouraging more investors to research thoroughly before committing funds.

Financial institutions have also started issuing advisories about safe digital investing practices, further shaping investor behavior. Combined with global lessons from major exchange collapses, this awareness ensures that security-first investing becomes a long-term cultural shift, not just a passing trend.

As India’s crypto landscape continues to evolve, it’s clear that education and transparency will walk hand in hand with platform security in shaping the future of digital finance.

🔺 Top 3 Gainers (24h Performance)

API3 (API3) – $1.389322 (+60.82%)

UMA (UMA) – $1.521132 (+21.14%)

Origin Protocol (OGN) – $0.070839 (+16.92%)

🔻 Top 3 Losers (24h Performance)

xMoney (UTK) – $0.032149 (−15.95%)

Towns (TOWNS) – $0.027828 (−10.09%)

AS Roma (ASR) – $3.232827 (−10.21%)

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact