India Faces Crypto Scrutiny While China Stalls Tech JVs. In today’s rapidly shifting global economy, two major themes are shaping discussions in Asia: India’s scrutiny of cryptocurrencies and China’s hesitancy to move forward with joint ventures (JVs) in the Indian technology sector. Together, these developments highlight how finance, regulation, and geopolitics are tightly intertwined.

India, which has long been cautious about the rise of cryptocurrencies, is intensifying its regulatory stance. At the same time, China’s delay in approving or progressing tech-based joint ventures in India reflects a growing geopolitical disconnect between two of the world’s largest economies. This article explores both issues in detail, examines their broader implications, and provides a comparative view of how businesses and investors are adapting.

India’s Growing Scrutiny of Cryptocurrencies

Over the past few years, India has positioned itself as one of the most important markets for digital assets. Millions of Indians trade cryptocurrencies daily, and local exchanges have reported record-breaking volumes during market upswings. However, regulatory scrutiny has intensified.

The Indian government and regulators are raising questions about:

- Taxation: The tax department now requires detailed reporting of crypto transactions, with a flat 30% tax on gains and 1% TDS (Tax Deducted at Source) on trades.

- Illicit Use: Concerns about money laundering, terror financing, and capital flight remain central to the government’s stance.

- Consumer Protection: Regulators want to ensure investors are shielded from scams and market volatility.

The Reserve Bank of India (RBI) has been vocal about its reservations, warning that unchecked adoption of crypto could destabilize financial systems. While not outright banning digital assets, India’s “regulate through taxation and reporting” approach has significantly changed how traders and investors participate in the market.

China Stalls Tech Joint Ventures with India

On the other side of the story lies China, which has traditionally been a strong player in India’s technology and manufacturing space. However, since 2020, the pace of Chinese investments and JVs in India has slowed dramatically.

Key reasons include:

- Geopolitical Tensions: Border disputes and strained diplomatic relations have created uncertainty.

- National Security Concerns: India has tightened its Foreign Direct Investment (FDI) policies, requiring government approval for investments from countries that share a border with India — directly impacting China.

- Technology Security: India has banned several Chinese apps, citing data privacy risks, further straining trust.

This slowdown has major implications for India’s start-up ecosystem, as Chinese investors were previously among the top funders in fintech, e-commerce, and gaming ventures.

Why These Two Stories Intersect

At first glance, India’s crypto scrutiny and China’s hesitation in JVs may seem unrelated. Yet, both reflect a common theme: economic sovereignty and digital independence.

- India wants tighter control over its financial ecosystem, ensuring that digital assets don’t undermine monetary stability.

- At the same time, it is wary of foreign influence in critical technology infrastructure, particularly from China.

These policies are about protecting national interests in an era where data and digital assets are as powerful as traditional capital.

Impact on Businesses and Investors

For Indian Crypto Investors

Regulations mean less freedom but more transparency. While heavy taxation may discourage speculative traders, long-term investors see this as a step toward eventual legitimacy.

For Startups and Tech Firms

The slowdown in Chinese investments has created a gap in funding. Indian companies are now seeking capital from alternative sources such as the US, Japan, and the Middle East.

For Global Investors

Both developments signal India’s intent to create a self-reliant digital ecosystem. However, the restrictive policies may deter those seeking fast returns.

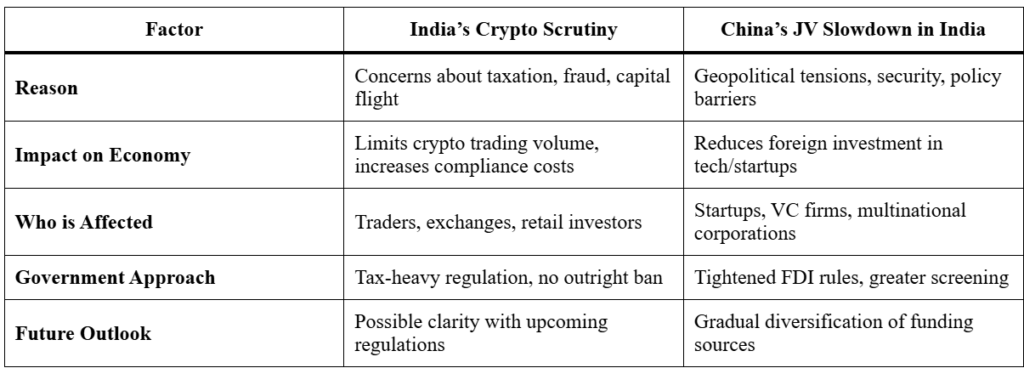

Comparison Table: India’s Crypto Scrutiny vs. China’s JV Slowdown

Future Outlook: What Lies Ahead?

For Crypto in India

While regulations seem strict, they may pave the way for eventual legalization under a structured framework. Analysts believe India may introduce clearer rules, potentially classifying crypto as an asset class rather than a currency. This could attract institutional players once legal clarity is achieved.

For Tech Investments with China

India is unlikely to completely shut the door on Chinese investment, but diversification is the new mantra. Startups are increasingly turning to US and Middle Eastern venture capital funds, reducing dependency on Chinese investors.

Global Implications

India’s dual stance reflects a broader global trend where nations are prioritizing digital sovereignty. Both the crypto regulations and JV restrictions align with global shifts toward tighter control over financial flows and data privacy.

Conclusion

The twin headlines — India Faces Crypto Scrutiny While China Stalls Tech JVs — represent more than just policy updates; they reflect a shift in how India approaches digital finance and international partnerships.

On one hand, stricter rules around crypto highlight the government’s push for greater oversight, investor protection, and tax revenue. On the other, the cooling of China-India tech collaborations underscores the importance of safeguarding national interests in an era of geopolitical uncertainty.

For businesses, startups, and investors, these developments serve as a reminder: the digital economy is no longer just about innovation, but also about sovereignty and security. Navigating this new environment requires flexibility, compliance, and a keen eye on both local and global policy trends. Know more on Crypto here.

🔺 Top 3 Gainers (24h Performance)

- xMoney (UTK) – $0.038887 (+29.20%)

- Acala Token (ACA) – $0.032312 (+10.60%)

- API3 (API3) – $0.8378 (+7.99%)

🔻 Top 3 Losers (24h Performance)

- Cyber (CYBER) – $2.424479 (−14.97%)

- AS Roma (ASR) – $3.833852 (−14.62%)

- SKALE (SKL) – $0.033324 (−12.64%)

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact