HODL Strategy Uncovered Beat Volatility and Build Wealth

HODL Strategy Uncovered: Beat Volatility and Build Wealth. HODLing isn’t just a trend; it’s a disciplined investment mindset for true believers in crypto’s future. Discover how patience and smart planning can outperform short-term trading. Master the art of HODLing to navigate market cycles and achieve sustainable financial growth.

What is HODL?

HODL is a widely used term in the cryptocurrency world, originally stemming from a typo in a Bitcoin forum in 2013. The author meant to write “hold,” but instead typed “HODL,” which has since become a backronym for “Hold On for Dear Life.” It refers to an investment strategy where individuals buy and keep their cryptocurrency assets for extended periods, ignoring short-term market volatility. HODLing emphasizes faith in the long-term potential of digital currencies, especially during market corrections or crashes.

The Origin of the HODL Strategy

The HODL strategy originated from within the cryptocurrency community rather than from any formal financial institution or expert. It began in 2013 when a Bitcoin forum user named GameKyuubi made a drunken post titled “I AM HODLING” during a sudden market crash. The misspelling of “hold” quickly gained popularity and evolved into a philosophy among crypto enthusiasts. Today, HODL, short for “Hold On for Dear Life”, symbolizes the practice of holding onto crypto assets through volatility, driven by long-term belief in their future value. This grassroots strategy has since become a cornerstone approach embraced by both retail and institutional investors.

Types of HODL Strategies

There are several variations based on investment preferences and risk tolerance:

1. Passive

Ideal for investors who prefer simplicity. They purchase crypto assets and hold them for years, without frequent checking or rebalancing.

2. Active

This approach involves occasional review of the portfolio and strategic reallocation while maintaining a long-term vision.

3. Staking

Here, users lock their crypto assets on platforms that offer staking rewards. It’s a way to generate passive income while holding assets.

4. Cold Wallet

Using hardware or paper wallets to store assets offline provides increased security and eliminates the risk of online breaches.

Why Do Companies Offer Incentives for HODLing?

Crypto projects and exchanges often encourage HODLing through benefits and bonuses. These incentives are implemented for various reasons:

- Price Stability: Reducing the number of tokens in circulation helps stabilize prices and maintain market integrity.

- Ecosystem Loyalty: Long-term holders are more likely to engage with the project and promote its success.

- Network Strength: In proof-of-stake networks, holding and staking enhances the network’s security and reliability.

- Reduced Selling Pressure: By locking assets, users are less likely to panic sell, which helps protect token value.

How to Qualify for HODL-Based Benefits

To qualify for HODL rewards, investors may need to meet certain requirements:

- Holding tokens in an approved or verified wallet

- Meeting minimum balance thresholds

- Completing KYC verification on participating platforms

- Avoiding any withdrawals or sales during a designated lock-in period

Some companies even use tiered systems to categorize and reward them accordingly.

Key Benefits

HODLing isn’t just about resisting the urge to sell; it’s a strategy with distinct advantages:

Long-Term Capital Growth

Historically, major assets like Bitcoin and Ethereum have demonstrated substantial long-term growth.

Lower Stress Levels

Not being glued to the screen or tracking every market movement reduces emotional pressure and decision fatigue.

Reduced Costs

Fewer trades mean lower fees and less impact from market spreads.

Income Generation

Many platforms offer yield opportunities, letting earn while retaining ownership.

Simplified Management

A long-term approach often means less time spent managing investments.

Risks and Precautions

Despite its benefits, it does involve certain risks that must be considered:

Market Volatility

Crypto prices can fluctuate dramatically and may experience long periods of unrealized losses.

Regulatory Shifts

Laws around digital assets are still evolving, especially in countries like India. These can impact how crypto is held or traded.

Platform Risks

Centralized exchanges may be hacked or go bankrupt, putting funds at risk.

Technological Obsolescence

Some coins may lose relevance or become technically outdated, making them poor long-term assets.

Precautionary Measures:

- Use hardware wallets for long-term storage

- Stay updated on regulatory news

- Diversify your holdings

- Conduct due diligence on any coin or project before HODLing

Where to Find Legit Opportunities

Legitimate HODLing opportunities are essential for safe and rewarding experiences. Look out for:

- Trusted Exchanges: Well-established platforms with clear user protections and transparency.

- Verified DeFi Protocols: Choose only audited and reputed decentralized finance platforms.

- Cold Storage Providers: Companies like Ledger and Trezor offer secure, offline storage options.

- Official Token Programs: Some projects provide native staking or HODL reward programs with terms outlined on their websites.

Best Strategies to Maximize Your HODL Game

To make the most of your HODLing efforts, consider these expert-backed methods:

1. Dollar-Cost Averaging (DCA)

Invest fixed amounts over time instead of lump sums to mitigate volatility.

2. Cold Storage

Remove the risk of exchange hacks by storing crypto in offline wallets.

3. Stake When Applicable

If the asset supports staking, lock it in to earn passive income while holding.

4. Annual Review

Even as a HODLer, check your portfolio annually to ensure your assets remain viable.

5. Ignore Market Hype

Stick to your plan and avoid being influenced by short-term media trends or pump-and-dump cycles.

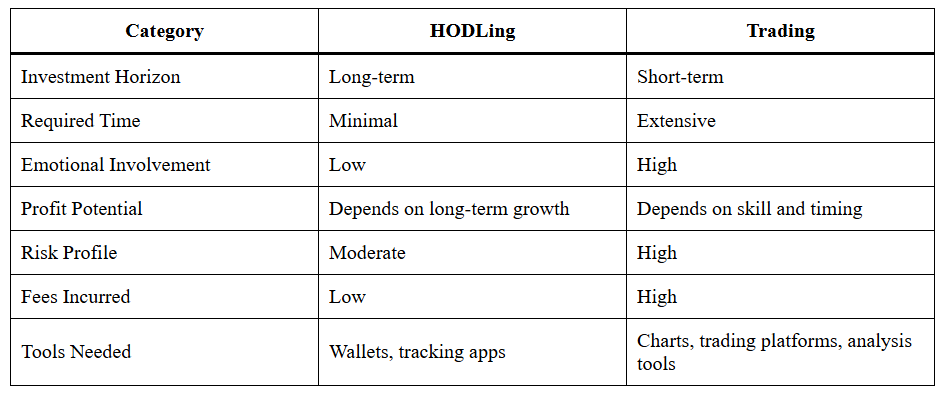

HODL vs Trading: A Side-by-Side Comparison

Tax Implications of HODLing in India

Understanding the tax responsibilities tied to crypto is essential for every HODLer, especially in India:

Capital Gains

Profits from crypto sales are taxed at a flat rate of 30% without deductions for expenses or losses.

Timing of Tax

You are taxed only when you sell, convert, or transfer your crypto, not just for holding it.

Income from Staking

If you earn rewards while HODLing via staking, it is categorized as income and taxed based on your slab rate.

Reporting Obligations

All gains, rewards, and even holding values must be declared during income tax filings under the appropriate categories.

Future Outlook And Strategy

The future of HODLing looks increasingly promising as cryptocurrency adoption grows. With institutional investors entering the space and nations exploring central bank digital currencies, long-term strategies are gaining momentum. In the years to come, we may see:

- More Yield-Generating Products: Combining it with DeFi earnings

- Wider Use of Tokenization: Real estate, stocks, and commodities entering the blockchain ecosystem

- Better Tax Clarity: Governments introducing specific rules and incentives for long-term holders

- Mainstream Portfolio Inclusion: It is becoming a part of traditional financial advice

Conclusion

It is more than a viral term, it represents the disciplined, long-term mindset needed to succeed in the volatile world of cryptocurrency. By focusing on solid fundamentals, secure storage, and strategic timing, investors can weather short-term storms while building long-term value. Whether you’re a beginner or seasoned crypto investor, the strategy offers a path to sustainable financial growth rooted in patience, knowledge, and trust in blockchain technology.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.