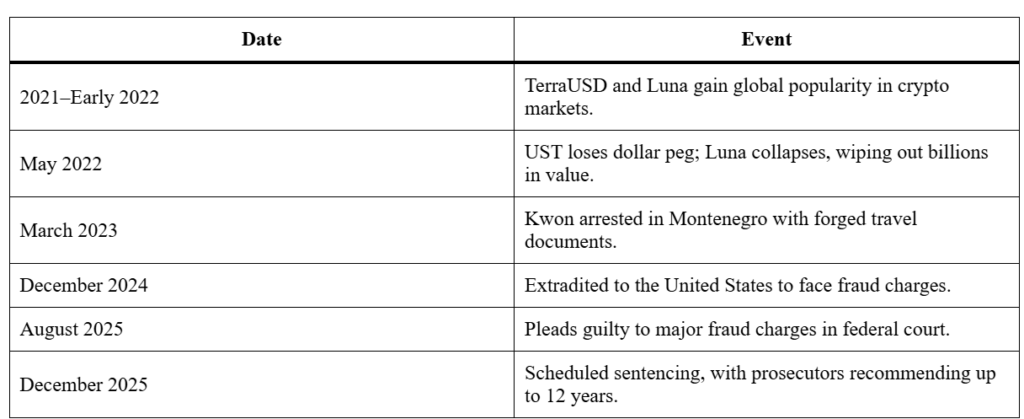

Do Kwon, Crypto Mogul, Admits to Major Fraud Charges. The global cryptocurrency community was shaken this week as Do Kwon, the high-profile co-founder of Terraform Labs, formally admitted guilt to major fraud charges in a United States federal court. Once celebrated as a visionary blockchain entrepreneur, Kwon’s fall from grace has now become one of the most significant scandals in the history of digital finance.

The Guilty Plea That Stunned the Industry

After years of legal battles, extradition disputes, and mounting evidence, Kwon’s courtroom confession marked a decisive turning point. In his plea agreement, the former “cryptocurrency king” acknowledged orchestrating a scheme that misled investors about the stability and safety of his flagship digital asset ecosystem, which included the TerraUSD (UST) stablecoin and its sister token, Luna.

By admitting to multiple fraud-related charges, Kwon now faces the possibility of a lengthy prison sentence. Although sentencing guidelines could allow for up to 25 years behind bars, his deal with prosecutors suggests the term may be closer to 12 years if all conditions are met.

How TerraUSD Went From Hero to Zero

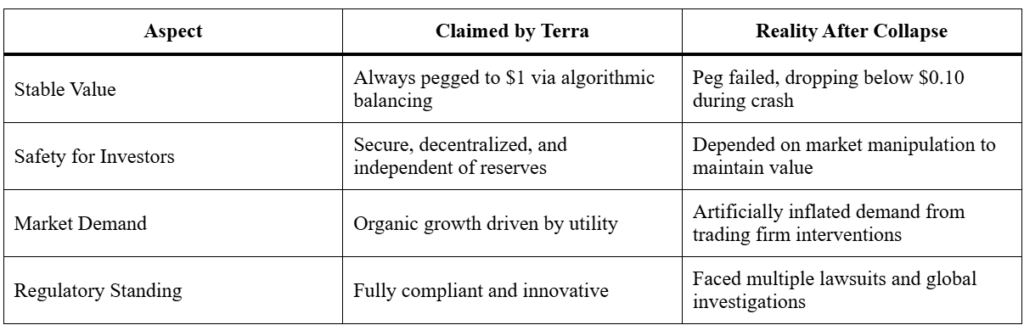

At the heart of this legal disaster is the collapse of UST, an algorithmic stablecoin designed to maintain a fixed value of one U.S. dollar. Unlike traditional stablecoins backed by reserves, UST relied on a self-adjusting supply-and-demand mechanism linked to the Luna token.

Initially hailed as an innovation in decentralized finance, UST gained massive popularity in 2021 and early 2022, attracting billions in investments. Kwon confidently promoted it as a more efficient and decentralized alternative to traditional payment systems.

However, in May 2022, the peg began to unravel. Instead of holding steady at $1, UST’s value spiraled downward within days, dragging Luna into a freefall. Investors watched helplessly as more than $40 billion in market value evaporated—an event that rippled across the entire cryptocurrency sector, causing further bankruptcies and liquidity crises.

Prosecutors’ Case Against Kwon

According to U.S. federal prosecutors, the real story behind UST’s “stability” was far less organic than Kwon claimed. Court documents reveal that a third-party trading firm was secretly involved in propping up the stablecoin’s value, creating a false sense of market confidence.

Authorities allege that this deception encouraged more investors to buy into the Terra ecosystem under the belief it was self-sustaining. The truth, however, was that the system’s success depended on deliberate manipulation rather than purely algorithmic forces.

In the plea deal, Kwon agreed to forfeit millions of dollars in assets, including shares of Terraform Labs and various cryptocurrency holdings, to help repay those affected.

Timeline of Key Events

The Global Ripple Effect

The downfall of Do Kwon has left deep scars on the cryptocurrency industry. For many retail investors, the Terra collapse was not just a financial loss but a betrayal of trust. The project had been marketed as a breakthrough in financial technology, promising stability in a volatile market. Instead, it became a cautionary tale about the dangers of hype, overconfidence, and lack of transparency in blockchain projects.

Regulators around the world have since tightened their oversight of stablecoins and decentralized finance products. Countries that previously took a hands-off approach to crypto innovation are now demanding stricter compliance measures, independent audits, and investor protection protocols.

Lessons for the Crypto Community

The Kwon saga offers several critical takeaways for anyone involved in the cryptocurrency ecosystem:

- Transparency is Non-Negotiable – Projects must provide verifiable proof of their claims, especially when they deal with stability mechanisms and investor funds.

- Algorithmic Risk is Real – Automated systems can fail catastrophically without adequate safeguards or reserves.

- Regulation Can Protect Investors – While many in the crypto space resist government intervention, the Terra incident highlights the necessity of oversight to prevent systemic failures.

- Hype Isn’t a Business Model – Long-term success in blockchain technology requires sustainable economics, not just market enthusiasm.

Terra’s Promises vs. Reality

What’s Next for Do Kwon?

While the guilty plea brings some closure to this chapter, the story is far from over. Kwon’s sentencing in December 2025 will be closely watched, not only for the length of prison time but also for how restitution to victims will be handled.

Additionally, Terraform Labs faces ongoing litigation from investors and regulators, and there is speculation that more executives could be implicated in related fraud investigations.

For Kwon personally, his legacy—once tied to innovation—will now forever be overshadowed by one of the largest frauds in financial history.

Final Thoughts

Do Kwon’s rise and fall mirrors the boom-and-bust cycles that have defined the cryptocurrency era. His ambition to reinvent money with an algorithmic stablecoin may have started as a bold experiment, but the lack of transparency, combined with market manipulation, transformed it into a financial disaster.

For the crypto industry, this case is more than a legal drama it is a wake-up call. Innovation without accountability can destroy not only fortunes but also faith in the very systems meant to empower people. Whether the community learns from this tragedy will determine if blockchain technology can truly fulfill its promise of a fairer, more decentralized financial future

🔺 Top 3 Gainers (24h Performance)

- Cyber (CYBER) – $2.815509 — +47.33%

- SKALE (SKL) – $0.026842 — +29.88%

- Hifi Finance (HIFI) – $0.099702 — +18.75%

🔻 Top 3 Losers (24h Performance)

- Alpine F1 (ALPINE) – $1.182252 — -22.28%

- Spark (SPK) – $0.088943 — -15.84%

- AS Roma (ASR) – $6.166935 — -9.40%

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact