Understanding the DApps Foundation

Unpacking Decentralization: An In-Depth Explanation

DApps Deep Dive. Decentralization means that instead of one person or group being in charge, power is shared across many people in a network, making things more open and fair. It reduces the risk of censorship, promotes transparency, and removes intermediaries. In a decentralized system, no one person or group is fully in charge, control is shared among many.

What is Decentralization

At its core, decentralization means transferring control and decision-making from a centralized entity (like a government, bank, or tech platform) to a distributed network of independent participants. In the blockchain world, decentralization is achieved through peer-to-peer (P2P) protocols, consensus mechanisms (like Proof of Work or Proof of Stake), and transparent public ledgers.

Unlike centralized systems, where one authority governs infrastructure and rules, decentralized systems rely on community consensus and open participation. Everything that happens, like transactions or changes, is out in the open, so anyone can check it, making it very hard to cheat the system.

Key Features of Decentralization

- Distributed Control:

No single entity can unilaterally alter the rules or data. Authority is spread across nodes (computers) on the network. If one part of the network stops working or tries to cheat, the rest keeps running smoothly without being affected. - Transparency:

Everything that happens, like sending or receiving crypto, is saved forever on a public blockchain that anyone can see. This ensures that no action is hidden or manipulated without consensus. This level of openness builds trust among users who don’t even know each other. - Redundancy and Fault Tolerance:

Because data is duplicated across multiple nodes, there’s no single point of failure. Even if part of the network goes offline, operations can continue uninterrupted. This makes systems resilient and durable. - Neutrality and Censorship Resistance:

Anyone can access the network without permission. No one’s in charge who can block you, freeze your money, or delete your activity. This is crucial for people in regions with oppressive regimes or restricted internet.

Why Decentralization Matters

Decentralization is a foundational principle in blockchain, cryptocurrency, and Web3 ecosystems. It enables freedom of access, encourages innovation, and fosters equitable participation.

- Empowers Individuals:

Users retain full ownership of their digital assets, identity, and data. This removes reliance on corporations that often exploit user data for profit. - Removes Intermediaries:

Decentralized systems like DeFi eliminate banks, brokers, and payment processors. This means faster payments, lower fees, and more people, especially the unbanked, can join the financial world. - Increases Security:

Decentralized networks are harder to attack. An attacker would need to compromise more than 51% of the network to alter transaction history, a nearly impossible task in major blockchains like Bitcoin or Ethereum.

Real-World Examples of Decentralization

- Bitcoin (BTC):

No single person controls the Bitcoin network. It operates via a decentralized consensus where miners validate transactions and secure the chain. - Ethereum (ETH):

Ethereum enables decentralized applications (DApps) to run without downtime or interference. Its smart contract functionality allows anyone to create autonomous, censorship-resistant applications. - Filecoin / IPFS:

These decentralized storage networks allow users to store and share files across a distributed set of nodes, instead of relying on Amazon Web Services or Google Cloud. - Helium Network:

A decentralized wireless network where individuals contribute bandwidth through their hotspots in return for tokens, removing telecom monopolies.

Different Forms of Decentralization

Decentralization is not binary, it’s a spectrum. Different layers can be decentralized independently:

- Architectural Decentralization:

How many nodes exist and how they are distributed across geographies. - Political Decentralization:

How many entities control the infrastructure (validators, Miners, etc.). - Logical Decentralization:

Whether the system behaves as a single whole or as multiple independent subsystems (e.g., sharding).

Understanding these layers helps assess how “decentralized” a blockchain or DApp truly is.

Challenges in Decentralization

While decentralization offers many benefits, it also introduces complexities:

- Coordination is Harder:

Without central authority, upgrades, governance decisions, and dispute resolution must be done via consensus. This slows decision-making. - Performance Trade-Offs:

Decentralized systems tend to be slower than centralized ones. Confirming transactions through global consensus takes time and resources. - User Responsibility:

In this system, users keep full control of their passwords and money. They’re in charge of keeping everything safe. If keys are lost, funds cannot be recovered, and there is no “forgot password” option.

The Future of Decentralization

With the rise of Web3, decentralized identity, and Decentralized Finance (DeFi), decentralization is becoming more than a philosophy, it’s becoming a digital necessity. Future systems aim to balance decentralization with usability and scalability, enabling billions to participate without needing deep technical knowledge.

Emerging technologies like Layer 2 solutions, modular blockchains, and zero-knowledge proofs are helping networks become more decentralized without compromising speed or security.

DApps – A Comprehensive Introduction

Decentralized Applications, or DApps, are software programs that run on a blockchain network instead of centralized servers. They function just like traditional apps, allowing users to interact, transact, and perform tasks, but without relying on a company or authority to manage their operations. The main idea behind DApps is to eliminate the need for trust in a central authority by replacing it with trust in code and the blockchain network.

Key Characteristics of DApps

- Built on Blockchain Technology

DApps are built using blockchain platforms like Ethereum, Solana, Avalanche, or BNB Chain. These blockchains store the app’s data and smart contract logic in a decentralized manner, ensuring that no single party has control over the app. - Open Source & Community Driven

Many DApps are open-source, which means anyone can see how they work and even help improve them. This promotes transparency, trust, and community collaboration. Anyone can verify how the app works or even contribute to its development. - Smart Contracts as the Engine

Every DApp runs on something called a smart contract, it’s a piece of code that carries out the app’s rules automatically. These contracts automatically process transactions or actions when pre-defined rules are met. - No Central Ownership

There is no central party or company controlling the app. Instead, users collectively own and govern the DApp using tokens, voting rights, or DAOs (Decentralized Autonomous Organizations). - Token Economics

Many DApps use tokens (like ETH or platform-specific tokens) as fuel to run operations. Tokens may also be used to incentivize users, govern the platform, or pay for services within the app.

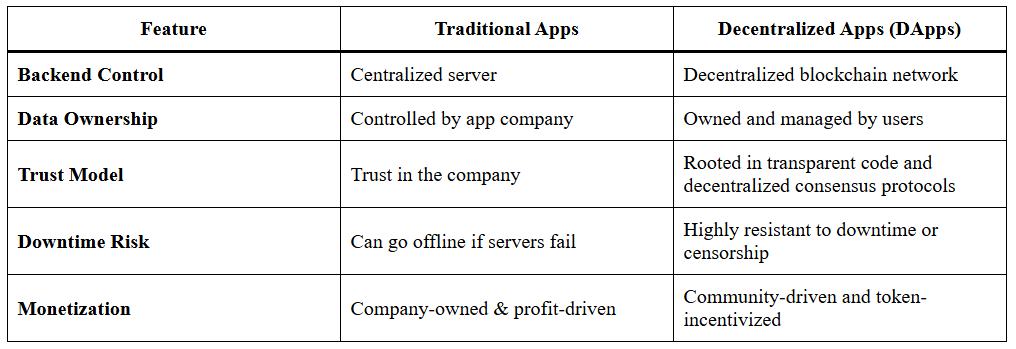

How DApps Differ from Traditional Apps

Examples of Real-World DApps

- Uniswap (DeFi): A decentralized exchange that allows users to swap cryptocurrencies without a central intermediary.

- OpenSea (NFTs): A marketplace for buying and selling NFTs, where ownership is verified via blockchain.

- Lens Protocol (Social Media): It’s like social media, but decentralized. Users keep control of their posts, profiles, and followers.

- Audius (Music Streaming): A blockchain-based music streaming app that pays artists directly without middlemen.

Advantages of Using DApps

- Censorship Resistance:

No central server means governments or corporations can’t shut the app down or censor user actions. - User Sovereignty:

Users control their accounts, assets, and identities, not the platform. - Global Accessibility:

Anyone with an internet connection and a crypto wallet can access DApps, no matter their location or background. - Transparency & Trust:

The open-source and on-chain nature of DApps makes their operations verifiable by anyone.

Challenges of DApps

DApps are exciting and new, but they still have problems, like being hard to use or not many people using them yet:

- Poor User Experience:

Many DApps require wallet setup, gas fees, and crypto knowledge, which can overwhelm beginners. - Network Congestion & High Fees:

Popular networks like Ethereum sometimes suffer from slow speeds and high transaction costs. - Smart Contract Bugs:

Bugs or loopholes in smart contracts can lead to hacks or loss of funds, highlighting the need for security audits. - Regulatory Uncertainty:

The lack of clear legal frameworks around DApps makes it challenging to adopt them in some countries or industries.

Under the Hood: The Inner Workings of DApps

To understand how DApps truly function, we need to go beyond the surface and explore what makes them work—both technically and structurally. Unlike traditional applications that run on centralized infrastructure, DApps (Decentralized Applications) are powered by blockchain networks, smart contracts, and distributed systems. Their backend logic is transparent, autonomous, and often community-governed.

The Architecture of a DApp

DApps typically consist of two major components:

Frontend (User Interface)

This is similar to traditional apps, it’s the part users interact with. It can be built using conventional web development technologies like HTML, CSS, and JavaScript. However, unlike traditional apps where the frontend communicates with centralized servers, a DApp’s frontend interacts with a blockchain network through smart contracts.

Backend (Smart Contracts)

A smart contract is a digital agreement that runs on a blockchain and carries out instructions on its own when certain things happen. They define the core logic of the application, handling transactions, managing tokens, storing data, and enforcing rules. Once deployed, these contracts operate autonomously and cannot be altered without consensus.

For example, in a DApp like Uniswap, smart contracts handle everything from liquidity pooling to token swapping, without a single human gatekeeper.

Blockchain Integration

DApps are deployed on blockchain platforms such as Ethereum, Solana, BNB Chain, or Polygon. Each user action, like sending a token or interacting with a contract, triggers a blockchain transaction. These transactions are validated by nodes, grouped into blocks, and permanently recorded on the blockchain ledger.

This distributed structure ensures data immutability, security, and trustlessness, the cornerstones of decentralization.

Wallets and User Identity

DApps do not use traditional username-password systems. Instead, they rely on cryptographic wallets (e.g., MetaMask, Trust Wallet) for user authentication and transactions.

When a user connects a wallet to a DApp:

- Their public address acts as their identity.

- Signing a transaction proves ownership.

- No sensitive user data is stored on centralized servers.

This wallet-based system improves privacy and reduces attack vectors.

Read All About: Crypto Wallets (Cold Vs Hot Wallets)

Tokens and Incentives

Many DApps integrate cryptographic tokens to enable in-app utility and incentivize participation. These tokens might serve as:

- Payment methods (e.g., for transactions or services)

- Governance tools (e.g., voting in DAOs)

- Reward systems (e.g., yield farming, staking)

Users can earn tokens just by helping out, like adding funds to a pool or voting on project updates. This creates a self-sustaining economy around the DApp.

Data Storage

Blockchains are not efficient for storing large amounts of data. So, many DApps use hybrid storage models:

- On-chain: Critical data (balances, smart contract logic)

- Off-chain: Media, files, and logs (via IPFS, Arweave, or Filecoin)

This model balances transparency with scalability and cost-efficiency.

Governance and Upgrades

Since smart contracts are immutable by design, upgrades and changes require predefined governance mechanisms, usually via DAOs (Decentralized Autonomous Organizations). Token holders may vote on proposals to update contract logic, add features, or change protocol parameters.

This shifts control from developers to the community, reinforcing the DApp’s decentralized nature.

Understanding Opportunities and Limitations of DApps

DApps change the game by letting people use apps without relying on big companies, they’re a whole new way to build and use digital tools. While they unlock powerful opportunities, they also come with distinct challenges that must be understood, especially by newcomers to Web3 and blockchain.

Opportunities of DApps

Decentralized Control and Ownership

One of the most significant advantages of DApps is the elimination of central authorities. Instead of relying on a single company or administrator, DApps are governed by smart contracts and, in many cases, by the community through DAOs (Decentralized Autonomous Organizations). This gives users more transparency, freedom, and control over how the application operates.

Censorship Resistance

DApps are extremely difficult to take down or censor. Since they run on blockchain networks distributed across thousands of nodes, no single entity can block access. This makes them ideal for use cases in finance, communication, and publishing, especially in regions with restrictive governments or institutions.

Programmable Money and Token Integration

DApps enable seamless integration of cryptocurrency and digital assets. This allows for innovative features like micro-payments, staking, peer-to-peer lending, in-game economies, and user rewards, all without third-party intermediaries.

Enhanced Security and Transparency

Because smart contracts are open-source and transactions are recorded on public ledgers, DApps offer greater auditability. Anyone can verify how a DApp works, how funds are handled, and how decisions are made, creating a more trustless and secure ecosystem.

Limitations of DApps

1. User Experience Complexity

Interacting with DApps can be intimidating for beginners. Users must understand blockchain wallets, Gas Fees, private keys, and often deal with clunky interfaces. This learning curve is a major hurdle for mass adoption.

2. Scalability and Speed

Blockchains like Ethereum often face congestion and high fees when DApp usage spikes. These scalability issues affect performance and make DApps less viable for large-scale real-time applications.

3. Irreversible Bugs and Security Flaws

Once deployed, smart contracts are difficult to change. A bug or vulnerability in the code can lead to loss of funds or exploit attacks, as seen in several high-profile DeFi hacks. Ensuring contract security requires deep technical expertise and thorough auditing.

4. Legal and Regulatory Uncertainty

Because DApps challenge existing business models and legal systems, they often operate in grey areas. Issues around KYC, taxation, compliance, and data privacy are still evolving, which can impact development and user trust.

Deep Dive into Smart Contracts

Smart Contracts: An In-Depth Overview

Think of Smart Contracts as digital rules written in code that run on a blockchain and carry out actions on their own when conditions are met. They automatically enforce rules and execute actions once predefined conditions are met, without needing intermediaries like banks, lawyers, or platforms.

The idea of smart contracts was first proposed by Nick Szabo in the 1990s, but it wasn’t until Ethereum launched in 2015 that they became real and usable. Ethereum allowed developers to write and deploy programmable logic on the blockchain, triggering a revolution in decentralized applications (DApps).

Key Characteristics

- Immutable: After it’s launched, a smart contract can’t be changed, unless it was written to allow updates.

- Autonomous: Executes actions (like transferring tokens) automatically when conditions are met.

- Transparent: Anyone can inspect the code and track execution on the blockchain.

Smart contracts form the backbone of DeFi, NFTs, DAOs, and DApps. From lending protocols like Aave to NFT Marketplaces like OpenSea, every interaction is governed by code, not trust.

Writing & Deploying Smart Contracts

Programming Languages

To build smart contracts, developers use special coding languages made just for blockchains:

- Solidity (for Ethereum, Polygon, BNB Chain)

- Vyper (an alternative to Solidity)

- Rust (used for Solana, Near, and Polkadot)

- Move (for Aptos and Sui)

These languages define how the contract behaves, what inputs it accepts, and what outputs it produces.

Development Process

- Writing Code: Developers use IDEs like Remix (for Solidity) or Hardhat/Truffle frameworks.

- Testing: Critical for ensuring there are no logic or security flaws. Testnets like Goerli, Mumbai, or Sepolia are used.

- Compiling: Code is converted into bytecode that the blockchain understands.

- Deployment: The bytecode is sent to the blockchain via a wallet (e.g., MetaMask) using gas fees.

Once deployed, the smart contract lives on-chain and is publicly accessible. Changes or upgrades typically require deploying a new version and migrating data/state.

Safeguarding Smart Contracts: A Focus on Security

Because smart contracts control huge amounts of money, hackers often try to break into them. Since code errors are irreversible once deployed, security is a critical concern.

Common Threats

- Reentrancy Attacks: Exploiting recursive calls to drain funds (e.g., The DAO hack in 2016).

- Integer Overflows/Underflows: Arithmetic bugs that allow incorrect calculations.

- Front-running: Manipulating transaction order to benefit from smart contract logic.

Best Practices:

- Code Audits: Conducting independent reviews from security experts (e.g., Certik, Trail of Bits).

- Using Standard Libraries: Like OpenZeppelin for trusted implementations of tokens and access controls.

- Fail-Safes & Checks: Adding require/assert statements to prevent unintended behavior.

- Bug Bounty Programs: Encouraging white-hat hackers to report bugs responsibly.

Security in smart contracts is not optional, it’s mandatory for user safety, platform trust, and long-term viability.

The Dynamics of Smart Contract Composability

Composability means smart contracts can interact and integrate with each other, like “money Legos.” Developers can stack functionalities and build on existing protocols instead of starting from scratch.

Types of Composability

- Synchronous: Contracts interact within a single transaction (e.g., calling multiple functions in one go).

- Asynchronous: Contracts communicate across different blocks, often using messaging layers like bridges.

Benefits

- Innovation: Developers can combine elements from lending, swaps, and NFTs to create new DApps.

- Interoperability: One protocol can enhance another (e.g., Yearn Finance using Curve and Aave).

- Efficiency: Saves development time and cost by reusing reliable modules.

Challenges

- Security Risk Propagation: If one component is vulnerable, the entire chain is at risk.

- Version Compatibility: Changes in one contract can break interactions with others.

Despite its complexity, composability has fueled the rapid innovation of Web3. It allows the ecosystem to evolve in a modular, collaborative, and highly scalable way.

Exploring DAOs: Decentralized Autonomous Organizations

DAOs (Decentralized Autonomous Organizations) represent a fundamental shift in how people collaborate, govern, and make collective decisions, without centralized control. Powered by smart contracts and guided by community consensus, DAOs are building the future of transparent and inclusive digital governance.

DAOs Unveiled: A Comprehensive Overview

A DAO is an organization governed by code, not by traditional management structures. It relies on Smart Contracts to enforce rules and Tokens to distribute voting power. Everyone involved gets a say, and the decision-making process is open and can’t be messed with.

Unlike traditional organizations that rely on a board of directors or CEOs, DAOs are community-driven. Every major action, whether spending treasury funds or changing protocol rules, requires the approval of token holders through a vote.

DAOs aim to eliminate central authority, reduce corruption, and enable borderless collaboration. If you have the internet and a crypto wallet, you can be part of the system, no special permission needed.

The Inner Workings of DAOs: Mechanisms & Voting

At the core of every DAO lies a set of smart contracts and a governance token. These elements ensure automated enforcement and fair participation.

Key Mechanisms:

- Treasury: DAOs often manage a pool of funds (in crypto), used for grants, development, or community rewards.

- Governance Token: When you have a governance token, you help decide how the project runs and what changes happen next.

- Proposals: Any member (or group) can suggest changes, like hiring contributors, funding projects, or making protocol upgrades.

- Voting: After a proposal is shared, people with tokens can vote on whether it should happen or not. The outcome depends on rules like quorum, majority, or stake-based voting.

Voting may occur on-chain (executed by smart contracts) or off-chain (tracked through platforms like Snapshot and executed manually). This system ensures transparent decision-making, but also raises concerns about voter apathy and token whales dominating outcomes.

Building Blocks: Steps to Create a DAO

To start a DAO, you need both the tech part, like smart contracts, and the people part, where the community decides how things will work. Here’s a simplified breakdown:

1. Define Purpose and Vision

Decide what your DAO aims to achieve, fund open-source projects, manage a DeFi protocol, run a gaming guild, or govern a social club.

2. Design Governance Structure

You’ll need to choose how voting power works—does each token count as one vote, or do you use a system like quadratic voting to make things fairer?, Decide how many votes a proposal needs to pass, and who controls the money once it’s approved.

3. Develop Smart Contracts

Deploy smart contracts to handle proposals, treasury, voting, and membership. If you’re just starting out, tools like Aragon, DAOstack, or Juicebox help you build a DAO without needing deep technical skills.

4. Distribute Governance Tokens

Tokens can be distributed through airdrops, sales, staking, or contribution rewards. These tokens empower the community to participate in decisions.

5. Launch and Grow Community

Create communication channels (Discord, Telegram), documentation, and onboarding guides. A strong, engaged community is critical to DAO success.

DAO Use Cases & Limitations

Popular DAO Use Cases:

- Protocol Governance: Uniswap and Compound use DAOs to manage upgrades and control treasury funds.

- Investment Collectives: DAOs like MetaCartel Ventures pool funds and vote on startup investments.

- NFT Collectives: Flamingo DAO manages a collective NFT portfolio with member-voted purchases.

- Social & Creator DAOs: Friends With Benefits (FWB) is a social DAO for creatives, governed by token holders.

Limitations and Challenges:

- Low Voter Participation: Many token holders don’t vote, leaving decisions to a small minority.

- Centralization Risk: Token distribution can be skewed, allowing whales to dominate governance.

- Legal Uncertainty: DAOs operate globally but face unclear legal status in many jurisdictions.

- Smart Contract Vulnerabilities: Just like with DApps, bugs or exploits can compromise DAO functions and funds.

Conclusion

DApps, smart contracts, and DAOs are redefining how we build, use, and govern digital systems. Decentralization offers transparency, control, and trustless interaction, but also brings technical and legal challenges. DApps empower users with open access and self-sovereignty, while smart contracts automate actions without intermediaries. DAOs take it further, enabling community-driven decision-making. Together, they form the foundation of Web3, a more open, secure, and participatory internet. Understanding these components is key to navigating and contributing to the future of decentralized technology.