Crypto Industry Feedback Sought on Tax, TDS Rules. The Indian government has recently announced that Crypto Industry Feedback Sought on Tax, TDS Rules will shape the next wave of regulatory decisions. Since the introduction of a 30% tax on virtual digital assets (VDAs) and a 1% Tax Deducted at Source (TDS) on crypto trades, the domestic digital asset ecosystem has witnessed major disruptions. Investors have shifted trading activities to offshore platforms, while startups have struggled to maintain growth momentum.

By opening a feedback channel with the industry, India signals its willingness to balance tax compliance, investor protection, and innovation. This article explores why feedback is being sought, the challenges of the current system, comparisons with global policies, and potential future scenarios.

Why Feedback on Crypto Tax Policy Matters

The move to invite feedback highlights a recognition that current tax rules may not fully align with the realities of the crypto ecosystem.

- High TDS burden – A 1% TDS on every transaction discourages frequent trading, leading to liquidity issues in domestic exchanges.

- Shift to offshore exchanges – To avoid high taxes, many Indian traders now use international platforms, reducing government revenue.

- Impact on innovation – Startups and blockchain developers in India are facing an investor exodus.

- Need for clarity – Ambiguities in defining crypto assets versus utility tokens cause compliance confusion.

By gathering insights directly from stakeholders, policymakers can potentially simplify regulations, reduce tax friction, and encourage responsible growth.

Current Tax and TDS Rules in India

To understand why Crypto Industry Feedback Sought on Tax, TDS Rules, it is essential to revisit the framework currently in place.

- Flat 30% Tax: Profits from selling crypto assets are taxed at 30%, with no deductions allowed for expenses except acquisition cost.

- 1% TDS: Exchanges must deduct 1% TDS on each crypto trade, regardless of profitability.

- No Carry-Forward of Losses: Losses cannot be offset against profits, increasing investor risk.

- International Transfers: Offshore transfers are closely monitored, with restrictions creating friction for global participation.

These policies, while intended to strengthen oversight, have unintentionally reduced domestic trading volume by over 70% in some estimates.

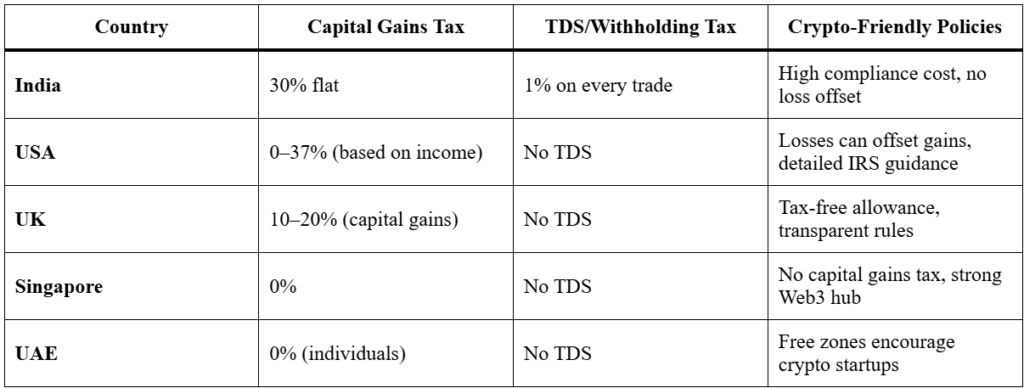

Global Comparison of Crypto Tax Policies

India is not the only country experimenting with crypto taxation. Many governments are adjusting rules to strike a balance.

Here’s a comparison table highlighting how India’s policies stack against other nations:

This comparison shows that India’s flat high tax and TDS rules make it less competitive than other markets.

Challenges Faced by Indian Crypto Industry

With Crypto Industry Feedback Sought on Tax, TDS Rules, the focus is on solving existing pain points. Key challenges include:

- Liquidity Drain – The 1% TDS makes high-frequency trading unsustainable.

- Brain Drain – Developers and entrepreneurs are moving to Dubai, Singapore, and other friendly jurisdictions.

- Revenue Loss – Instead of collecting more taxes, strict policies have reduced the overall taxable base.

- Unclear Classifications – Some tokens function as securities, others as utilities, but rules treat all as the same.

- Investor Hesitation – New retail investors shy away from crypto due to unclear taxation and risk of penalties.

Why Offshore Shift Is a Concern

The offshore migration of Indian crypto users is a direct result of current tax rules. Traders prefer platforms outside India that do not impose TDS and have lower compliance burdens. This creates two major problems:

- Revenue Leakage: Government loses potential tax income as trading happens outside regulated Indian exchanges.

- Data Risks: Offshore trading reduces visibility into transactions, making it harder to track fraud or money laundering.

Inviting industry feedback is an attempt to reverse this offshore trend and bring activity back to regulated platforms.

What Industry Is Proposing

Industry leaders, exchanges, and investors have submitted several recommendations, including:

- Reduce TDS from 1% to 0.01% or 0.05% to encourage liquidity.

- Allow loss offsetting, similar to equities and mutual funds.

- Differentiate asset classes within crypto for fairer taxation.

- Simplify reporting requirements to avoid compliance fatigue.

- Incentivize innovation by offering tax breaks for blockchain startups.

These measures could make India a competitive Web3 hub while still ensuring tax compliance.

Potential Benefits of Policy Revision

If the government acts on feedback, India can unlock multiple benefits:

- Boost to Domestic Exchanges – More liquidity and trading activity.

- Higher Tax Revenue – Lower rates but larger base.

- Startup Growth – More blockchain innovation and job creation.

- Investor Confidence – Clarity will attract both retail and institutional investors.

- Global Competitiveness – India can position itself alongside Singapore and Dubai as a crypto-friendly market.

Conclusion

The announcement that Crypto Industry Feedback Sought on Tax, TDS Rules reflects India’s willingness to recalibrate its crypto policy. While the existing system has created barriers to growth, feedback-driven reforms could restore balance between compliance and innovation.

By reducing TDS, allowing loss offsets, and simplifying tax frameworks, India can retain talent, boost domestic exchanges, and increase tax revenues without stifling innovation.

The coming months will be crucial in determining whether India can transition from being a restrictive crypto market to a thriving global hub for digital assets. Know Latest Crypto news here.

🔺 Top 3 Gainers (24h Performance)

- API3 (API3) – $1.374176 (+63.28%)

API3 recorded a strong surge, leading today’s gainers with an impressive 63.28% increase, attracting attention from traders seeking momentum plays. - UMA (UMA) – $1.484521 (+18.84%)

UMA saw solid upward movement, gaining 18.84% in the last 24 hours, reflecting renewed investor confidence. - Origin Protocol (OGN) – $0.070515 (+16.62%)

OGN posted steady gains, rising 16.62%, supported by active trading volumes and market sentiment.

🔻 Top 3 Losers (24h Performance)

- xMoney (UTK) – $0.032073 (-13.20%)

UTK led the losers with a sharp decline of 13.20%, signaling caution among short-term investors. - AS Roma Fan Token (ASR) – $3.260895 (-10.00%)

ASR faced downward pressure, sliding 10% as sports-related tokens experienced selling activity. - Towns (TOWNS) – $0.02784 (-9.53%)

TOWNS slipped 9.53%, closing among the top three losers as investor sentiment weakened.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact