Crypto Funds Inflows Surge $3.7B Amid Bitcoin Record Rally

Crypto Funds Inflows Surge $3.7B Amid Bitcoin Record Rally. The cryptocurrency market witnessed a dramatic resurgence this week as crypto investment funds recorded $3.7 billion in net inflows, pushing the total assets under management (AUM) to a staggering $211 billion. This significant uptick in institutional capital comes on the back of Bitcoin hitting new all-time highs, fueling investor optimism and market momentum.

Institutional Confidence Surges

The record-breaking inflows underscore a renewed wave of institutional confidence in the long-term potential of crypto assets. According to multiple fund managers, this week’s numbers mark the largest inflow since the beginning of 2021, a year that saw a historic bull run led by Bitcoin and Ethereum.

Such a spike indicates that professional investors are increasingly treating crypto as a viable asset class and are no longer sitting on the sidelines. With regulatory frameworks maturing in various regions and spot Bitcoin ETFs gaining traction globally, the risk-reward ratio appears to be tilting in favor of long-term crypto investment.

Bitcoin Leads the Pack with Historic Gains

Bitcoin alone accounted for over $2.5 billion of the weekly inflows, driven by increased demand from institutional funds and retail investors alike. The leading cryptocurrency soared past its previous all-time high, crossing $72,000, as it became clear that traditional finance players are entering the space at full steam.

Read All About: Bitcoin (BTC): The Digital gold

Key Factors Behind Bitcoin’s Rally:

- Institutional ETF approvals in the U.S. and Europe

- Macroeconomic uncertainty pushing investors towards non-sovereign assets

- Halving narrative fueling long-term bullish sentiment

- Growing demand for digital store-of-value alternatives

Bitcoin’s dominance in the market is once again on full display, with its share of total crypto AUM rising to over 67%, up from 60% just two weeks ago.

Ethereum and Altcoins See Renewed Interest

While Bitcoin stole the spotlight, Ethereum also benefited, drawing in more than $600 million in weekly inflows, marking its strongest performance in months. The impending transition to full Proof-of-Stake and updates to its staking model have reignited interest among institutions.

Meanwhile, Solana, Polygon, and Avalanche also recorded positive inflows, albeit more modestly. The trend suggests a broadening interest in layer-1 solutions, particularly those focused on scalability, low fees, and enterprise adoption.

Assets Under Management Reach $211 Billion

The spike in inflows has propelled the global crypto AUM to $211 billion, a level not seen since late 2021. This figure reflects the growing maturity of the crypto market and its ability to attract institutional capital on par with traditional asset classes.

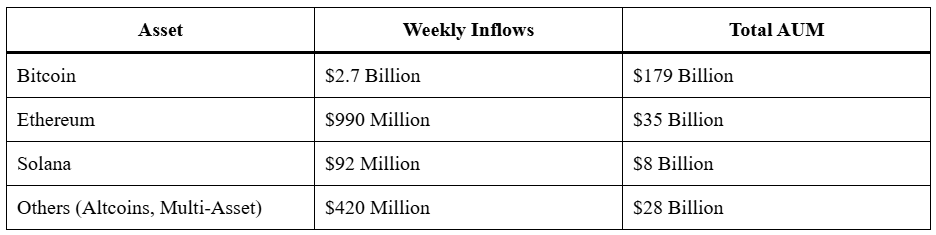

Breakdown of Current AUM by Asset:

This distribution highlights a growing diversification trend among institutional players, who are no longer solely focused on Bitcoin but are also exploring the broader ecosystem.

What This Means for the Crypto Sector

The record inflows and rising AUM are not just numbers, they signal a strong shift in perception among traditional financial institutions. Crypto is no longer being treated as a fringe investment but is increasingly seen as a core part of diversified portfolios.

This inflow wave could potentially:

- Accelerate the adoption of blockchain technology in mainstream finance

- Drive regulatory clarity as demand for oversight grows

- Fuel market development and liquidity for newer altcoins and DeFi projects

Analyst Insights and Market Forecast

Industry analysts believe this is only the beginning of a new growth cycle. With increasing clarity from regulators and the global macroeconomic environment remaining uncertain, digital assets offer a compelling hedge.

“Institutions are finally acting on years of research and due diligence. What we’re seeing now is long-term money entering the space with conviction,” said a senior strategist at a leading crypto investment firm.

Check Out Market Live Update on CoinMarketCap

Regulatory Tailwinds Supporting Growth

Part of the reason behind the current surge is the improved regulatory landscape, particularly in the United States and European Union. Spot Bitcoin ETFs have been approved in several jurisdictions, giving institutions a regulated and liquid gateway into the crypto market.

Additionally, India’s stance on crypto taxation and recognition of digital assets as virtual digital property is encouraging domestic institutions to explore compliant entry points into the market.

Conclusion

The $3.7 billion surge in weekly inflows into crypto funds and the record-breaking total AUM of $211 billion reflect deepening institutional confidence and growing mainstream adoption. With Bitcoin leading the charge and altcoins gaining momentum, the market appears to be entering a new phase of maturity and strategic allocation.

As regulatory frameworks improve and traditional financial systems continue to recognize crypto’s potential, we are likely witnessing the foundation of a long-term bull cycle, fueled not just by hype, but by real capital.

🔺 Top 3 Gainers (24h Performance)

1. THE (THE) – $0.39 (+27.49%)

THE rallied sharply as speculative trading and increased on-chain activity surged following community-led burn proposals and social media hype.

2. BANANA (BANANA) – $23.26 (+18.91%)

BANANA saw a notable price increase driven by renewed interest from NFT collaborations and meme coin momentum, capturing attention across retail investor circles.

3. FIS (FIS) – $0.1165 (+14.59%)

FIS gained strength on the back of ecosystem expansion news and updates to its staking rewards program, which improved its appeal among DeFi users.

🔻 Top 3 Losers (24h Performance)

1. USUAL (USUAL) – $0.0928 ( -12.95%)

USUAL faced a steep pullback after a speculative peak, with short-term traders taking profits and declining trading volume cooling previous momentum.

2. SYRUP (SYRUP) – $0.4448 (-10.86%)

SYRUP declined due to market uncertainty around its roadmap execution and a drop in engagement across its DeFi liquidity pools.

3. VIC (VIC) – $0.2850 (−9.58%)

VIC saw losses as investors shifted capital to trending assets, while delays in governance voting and roadmap updates led to fading community enthusiasm.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.