Cryptocurrencies are changing the way the world views money. From disrupting financial systems to creating investment opportunities, the crypto revolution is here, and growing fast. If you’re new to this space, understanding crypto fundamentals is the first step toward confidently navigating the digital economy.

Let’s break it down step by step, so you can gain the foundation needed to dive deeper into the crypto universe.

What Are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies secured by cryptography. Unlike traditional fiat currencies issued by governments, cryptocurrencies operate on Blockchain technology, which is a decentralized ledger distributed across many computers (nodes).

Key Characteristics:

- Decentralization: No central authority controls it.

- Immutability: Transactions, once verified, cannot be altered.

- Transparency: Every transaction is immutably recorded on a transparent, public ledger for all to verify.

- Security: Strong cryptographic algorithms protect the network.

Cryptos like Bitcoin, Ethereum, and Litecoin are examples, each designed with specific use cases in mind, from digital payments to smart contracts and decentralized apps.

Introduction to Bitcoin

Launched in 2009 by the mysterious figure (or group) known as Satoshi Nakamoto, Bitcoin (BTC) stands as the world’s first and most recognized cryptocurrency. It was envisioned as peer-to-peer electronic cash, allowing people to send and receive money without intermediaries like banks.

Key Facts about Bitcoin:

- Supply Limit: Capped at a maximum of 21 million coins, Bitcoin has a fixed supply that ensures no more BTC will ever be created.

- Blockchain: Records every BTC transaction permanently.

- Mining: New bitcoins are introduced into circulation through a process called Mining.

- Volatility: Bitcoin prices fluctuate based on supply, demand, and market sentiment.

Bitcoin laid the foundation for the thousands of cryptocurrencies that followed and remains the benchmark of the crypto world.

Understanding Different Types of Cryptocurrencies

Over time, developers have introduced various cryptocurrencies with unique purposes. Let’s classify them into key categories:

Coins

These are native to their own blockchain.

- Bitcoin (BTC): Digital gold.

- Ethereum (ETH): Smart contracts and dApps.

- Litecoin (LTC): Faster payments.

Tokens

Built on existing blockchains like Ethereum.

- Utility Tokens: Used for accessing products/services (e.g., BAT, GRT).

- Security Tokens: Digital representations of real-world assets such as stocks, real estate, or bonds, offering investors a blockchain-based form of traditional securities.

- Governance Tokens: Allow holders to vote on project decisions (e.g., UNI, AAVE).

Read all About: Tokens

Stablecoins

Stablecoins, like USDT and USDC, are tied to fiat currencies to maintain a steady value and minimize price fluctuations. Pegged to fiat currencies to reduce volatility (e.g., USDT, USDC).

Read All about: Stablecoin

Meme Coins

Community-driven coins, often with little intrinsic value but massive popularity (e.g., DOGE, SHIB).

Each type plays a role in the broader crypto ecosystem—from payment systems to investing, gaming, and finance.

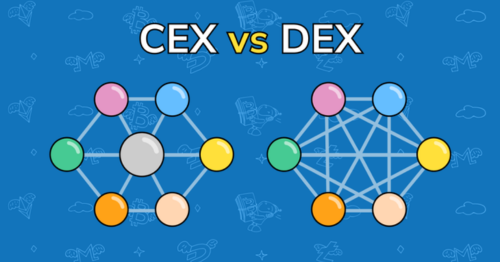

4. Centralized vs Decentralized Exchanges (CEX vs DEX)

Buying, selling, and trading cryptocurrencies happen on platforms called exchanges. These come in two main forms:

Centralized Exchanges (CEX):

These are managed by companies that facilitate transactions and hold user funds temporarily.

- Examples: Binance, Coinbase, Kraken

- Pros: High liquidity, easy to use, customer support

- Cons: Risk of hacks, limited control over your assets

Decentralized Exchanges (DEX):

These allow peer-to-peer crypto trading without a central authority.

- Examples: Uniswap, PancakeSwap, SushiSwap

- Pros: More privacy, self-custody of funds

- Cons: Lower liquidity, higher learning curve

Whether you use a CEX or DEX depends on your experience level, trust in platforms, and trading needs.

How to Use Crypto Wallets

“A crypto wallet securely holds your private keys, giving you access to and control over your digital assets. Think of it as your digital bank account, but with more control and responsibility.

Types of Crypto Wallets:

Hot Wallets (Internet-connected)

- Examples: MetaMask, Trust Wallet, Coinbase Wallet

- Pros: Easy to access and use for daily transactions

- Cons: More vulnerable to online threats

Cold Wallets (Offline storage)

- Examples: Ledger Nano, Trezor

- Pros: Extremely secure for long-term holding

- Cons: Less convenient for quick access

Key Wallet Concepts:

- Public Key: Like your bank account number, used to receive funds.

- Private Key: Like your ATM PIN, used to send funds. Never share it!

- Seed Phrase: A recovery phrase for restoring your wallet. Store it offline and securely.

To start, download a trusted wallet, back up your seed phrase, and always double-check addresses before making transactions.

Read all About: Crypto Wallets

Final Thoughts: Begin Your Crypto Journey with Confidence

Learning crypto fundamentals is the first essential step in your Web3 journey. With knowledge about cryptocurrencies, Bitcoin, token types, exchanges, and wallets, you now have the building blocks to explore this evolving financial frontier.

Whether you’re investing, trading, or simply curious about the tech, the key is staying informed and cautious. The crypto space offers vast potential, but also requires responsibility and due diligence.

Frequently Asked Questions

Is cryptocurrency legal in India?

Yes, cryptocurrency trading is legal in India, but it’s not considered legal tender. The government is working on regulations for taxation and security.

Can I lose my crypto if I forget my wallet password?

If you lose your private key or seed phrase, you could permanently lose access to your crypto. Always back up your seed phrase in a safe, offline location.

Do I need a bank account to use cryptocurrency?

No, you can use crypto without a traditional bank account, especially with decentralized wallets and exchanges. However, to buy crypto with fiat, you’ll need one.

What is the minimum amount I can invest in crypto?

Many exchanges allow investments as low as ₹100 or $10, depending on the platform.

Are crypto transactions anonymous?

They are pseudonymous, not directly linked to your identity but visible on public blockchains. With some effort, transactions can sometimes be traced.