As the Indian crypto landscape continues to evolve, Crypto Farming is emerging as one of the most talked-about ways to generate passive income. But is it the goldmine it claims to be or a hidden risk in disguise? Let us break it down and help you make informed decisions.

What is Crypto Farming?

Crypto Farming, also called yield farming, is the process of earning interest or rewards by locking up cryptocurrency in decentralized finance (DeFi) protocols. In return, users get incentives in the form of more crypto tokens.

It is similar to how banks pay you interest on fixed deposits, but the returns here can be significantly higher. You lend, stake, or provide liquidity, and your crypto starts generating income without being actively traded.

How Does Crypto Farming Work?

There are several ways to engage in Crypto Farming, each with its own risk-reward dynamics:

1. Liquidity Mining

You provide a pair of tokens, such as ETH and USDT, to a decentralized exchange (DEX) like Uniswap or QuickSwap. In return, you earn a portion of the trading fees and sometimes governance tokens.

2. Staking

Some blockchain protocols allow users to stake coins like MATIC, SOL, or ADA. You earn rewards for helping to validate blockchain transactions. It is considered one of the more stable forms of farming.

3. Lending Platforms

Platforms like Aave or Compound enable users to lend tokens to others in a decentralized fashion. In return, lenders earn interest, often paid in the platform’s native tokens.

4. Vault Strategies (Auto-Compounding)

Platforms such as Yearn Finance or Beefy Finance allow users to automatically reinvest earned rewards. This compounding strategy can significantly boost returns over time without requiring manual intervention.

Crypto Farming in India: The Rise of Passive Income Opportunities

India has witnessed an explosion of crypto adoption over the past few years. With over 20 million Indian investors participating in the market, interest in Crypto Farming is rising. Many are turning to DeFi protocols to diversify income sources beyond traditional stocks and real estate.

However, India’s regulatory landscape remains uncertain. While crypto is not banned, it is heavily taxed. A 30 percent tax on crypto gains and a 1 percent TDS on every transaction have made Indian investors more cautious. Despite these hurdles, crypto farming is being actively explored for its high-yield potential.

Platforms such as CoinDCX, KoinX, and WazirX are becoming popular choices for beginners, especially those looking for farming options with INR deposits and easier KYC processes.

Key Benefits of Crypto Farming

- High Returns: Some pools offer APYs well above 100 percent, particularly in volatile or newly launched protocols.

- Passive Income: Once you deposit funds, your tokens begin earning without constant monitoring.

- Decentralized Access: No intermediaries or paperwork, and funds remain under your control.

- Flexible Exit Options: Many platforms allow users to withdraw funds at any time, offering liquidity unlike fixed deposits.

Risks and Challenges of Crypto Farming

- Impermanent Loss: This occurs when the value of deposited tokens changes in comparison to when they were first deposited, reducing overall returns.

- Smart Contract Vulnerabilities: Bugs or exploits in the platform’s code can lead to a complete loss of funds.

- Rug Pulls: In unaudited or newer protocols, malicious developers can drain the liquidity and disappear.

- Regulatory Uncertainty in India: With unclear government regulations, policy reversals or stricter rules can impact farming activities overnight.

Founding Team and Establishment Timeline of DeFi Farming

Crypto Farming as a concept does not have a single founder but evolved from innovations in decentralized finance. Below are some of the notable platforms and developers responsible for pioneering this field:

Compound Finance

- Founder: Robert Leshner

- Established: 2017

- Credited for introducing incentive-driven lending and borrowing models in DeFi.

Yearn Finance

- Founder: Andre Cronje

- Launched: February 2020

- Known for automating yield strategies and vault-based farming, it quickly became a DeFi staple.

Uniswap

- Founder: Hayden Adams

- Launched: November 2018

- A trailblazer in liquidity mining and automated market maker (AMM) protocols, facilitating the growth of farming opportunities.

These platforms laid the foundation for what has now become a multi-billion-dollar ecosystem that spans across blockchains like Ethereum, Binance Smart Chain, and Polygon.

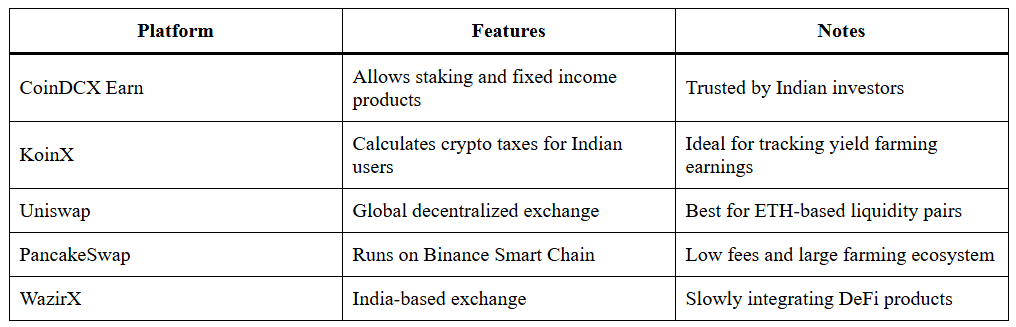

Best Platforms for Crypto Farming in India

These platforms are well-suited for Indian investors, offering the right balance between security, ease of use, and local compliance. However, it is always advisable to perform due diligence before committing funds.

How to Get Started with Crypto Farming in India

- Choose a Platform: Start with reputable exchanges or DeFi protocols.

- Create a Wallet: Use MetaMask or Trust Wallet to connect with DeFi platforms.

- Buy Tokens: Purchase crypto like USDT, ETH, or MATIC from an Indian exchange.

- Connect and Deposit: Link your wallet to the DeFi protocol and deposit your funds.

- Monitor Returns: Use dashboards or trackers to follow your yields and adjust strategies.

It is crucial to understand Smart Contract interactions and gas fees, especially on Ethereum. Consider using Polygon or BSC-based farms to reduce transaction costs.

Final Thoughts: Is Crypto Farming Worth It in India?

Crypto Farming offers a compelling way for Indian investors to grow their wealth without constant market speculation. While returns can be high, so are the risks. With the current tax regime, legal ambiguity, and technical barriers, farming may not be ideal for every investor.

However, for those who take the time to understand the platforms, risks, and protocols, Crypto Farming can serve as a valuable tool in a diversified crypto portfolio. As the Indian regulatory framework matures, farming could become even more mainstream and structured.

For now, it remains a powerful yet underutilized opportunity for disciplined investors willing to do their homework.

Frequently Asked Questions

Is crypto farming legal in India?

Yes, crypto farming is not illegal in India. However, it operates in a regulatory grey area. While the Indian government has not banned crypto farming, income from it is subject to taxation under current crypto laws. Investors must report earnings and pay a 30% tax on gains and 1% TDS on transactions.

Which is the best platform for crypto farming in India?

Popular platforms among Indian users include CoinDCX Earn, KoinX, and WazirX for simpler farming and staking options. For more advanced DeFi farming, users often prefer Uniswap, PancakeSwap, and Yearn Finance connected via MetaMask or Trust Wallet.

Is crypto farming profitable in 2025?

Yes, crypto farming can be profitable in 2025, especially for those who understand DeFi protocols, manage risk, and use stablecoins to reduce volatility. However, profitability depends on factors like APY, impermanent loss, market trends, and transaction fees.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.