Cold Wallet vs Hot Wallet in India Secure Crypto Option

Cold Wallet vs Hot Wallet in India Secure Crypto Option. As India’s cryptocurrency market gains momentum, safeguarding digital assets has become a top priority for investors. The debate between cold wallets and hot wallets in India revolves around security, accessibility, and usage needs. This guide helps Indian users understand which option is more suitable in their unique financial and regulatory environment.

What Is a Cryptocurrency Wallet?

A cryptocurrency wallet is a tool that stores your private and public keys and enables secure interaction with blockchain networks. In India, as more people invest in digital currencies, choosing the right wallet type, hot or cold, is critical to protect your assets from cyber threats and regulatory shifts.

Read All About: Crypto Wallet

What Is a Hot Wallet?

A hot wallet is a type of crypto wallet that stays connected to the internet, making it easy to access and manage digital assets. It’s commonly used by Indian traders for daily transactions due to its speed and convenience.

Popular forms of hot wallets include exchange wallets like WazirX, CoinDCX, mobile apps, desktop wallets, and browser extensions. These wallets support fast trades, NFT purchases, and interaction with DeFi platforms.

However, because they are always online, hot wallets are more exposed to cyber threats. Users should enable 2FA, use strong passwords, and store only small amounts, keeping larger holdings in secure cold wallets.

Advantages of Hot Wallets in India

- Quick Transactions: Perfect for frequent traders dealing in Bitcoin, Ethereum, or altcoins.

- Supports INR Integration: Many Indian exchanges enable UPI or bank transfers.

- No Extra Cost: Hot wallets are typically free and easy to install.

Disadvantages of Hot Wallets in India

- Security Risks: Vulnerable to online hacks, phishing, and malware.

- Custodial Control: If you use an exchange wallet, your keys are controlled by the platform.

- Regulatory Exposure: Indian exchanges could face restrictions, making funds inaccessible.

What Is a Cold Wallet?

A cold wallet refers to any crypto storage solution that is not connected to the internet. This includes hardware wallets (like Ledger Nano X or Trezor), paper wallets, and air-gapped devices.

You can also convert an old smartphone into an air-gapped cold wallet by installing wallet apps and keeping the phone permanently offline an affordable solution for Indian users who want enhanced security without extra cost.

Advantages of Cold Wallets in India

- Unmatched Security: Immune to online breaches, ransomware, or exchange hacks.

- Best for HODLing: Great for storing crypto long-term without worrying about daily price swings.

- Private Ownership: You have complete control over your keys and funds.

Disadvantages of Cold Wallets in India

- Initial Cost: Quality hardware wallets range between ₹6,000 – ₹12,000.

- Less Convenient: Not ideal for daily transactions or quick trades.

- Availability: May be harder to purchase in India due to import limits or fake products in grey markets.

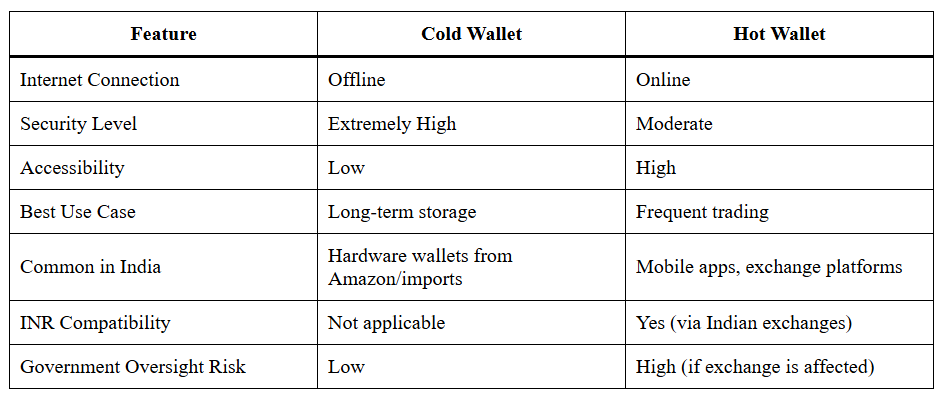

Cold Wallet vs Hot Wallet in India Key Differences

Understanding these differences helps Indian users decide how to safely store and manage crypto under evolving domestic conditions.

Which One Should Indian Users Choose?

Use Hot Wallets If:

- You trade often on Indian exchanges like CoinSwitch, CoinDCX, or WazirX.

- You want instant access to your funds.

- You’re dealing with smaller amounts and value convenience over extreme security.

Use Cold Wallets If:

- You’ve invested large sums (₹1 lakh or more) in crypto assets.

- You’re holding for long-term value appreciation.

- You want complete privacy and ownership over your crypto.

Combined Approach for Indian Investors

Savvy Indian crypto users often combine both wallet types:

- Cold Wallet: Store 80 – 90% of your crypto safely offline.

- Hot Wallet: Keep 10 – 20% online for active trades or DeFi usage.

This blended strategy balances accessibility with high-grade security, which is ideal for navigating India’s often unpredictable crypto regulatory climate.

Tips for Secure Wallet Use in India

Regardless of which type you use, the following tips help you secure your crypto:

- Buy hardware wallets only from official or verified sellers to avoid counterfeit products.

- Avoid public Wi-Fi when accessing hot wallets or exchanges.

- Never share your private key or seed phrase, even with support agents.

- A hot wallet offers instant crypto access online; just remember to use 2FA to keep your assets safe.

- Store seed phrases on paper and lock them in a physical safe.

Backup and Recovery Essentials for Cold Wallets

For Indian users investing in cold wallets, having a secure backup plan is critical. Always write down your Seed Phrase on paper and store it in a waterproof and fireproof location. Avoid saving it digitally (e.g., on cloud storage or mobile phones). Consider creating duplicate backups stored in separate locations to safeguard against disasters. This step can be a lifesaver if your hardware wallet is lost, damaged, or stolen.

Wallet Integration with Indian Tax Tools

As taxation of crypto gains becomes mandatory in India, using wallets that support integration with tax platforms can simplify compliance. Some hot wallets and exchange wallets offer APIs that sync with services like KoinX, helping Indian users generate accurate reports for filing under Section 115BBH. Choosing wallets with exportable transaction histories can reduce audit risks and penalties.

Local Crypto Trends and Wallet Adoption

The Indian crypto community is quickly maturing. As awareness increases, more users are moving toward self-custody and cold wallet adoption, especially amid frequent changes in government policy and RBI caution around digital assets. Having a reliable storage strategy based on wallet type can help Indian investors reduce risk.

Conclusion

Choosing between Cold Wallet vs Hot Wallet in India depends on your investment goals, trading frequency, and desired level of security. Hot wallets offer ease of use and speed, making them ideal for daily users. Cold wallets provide superior protection, ideal for long-term holders and those with larger portfolios. By combining both, Indian users can maximize security without compromising usability, which is crucial in a landscape that’s dynamic and still shaping its regulatory framework.

FAQ’s On Cold Wallet vs Hot Wallet

What is the best choice in India between cold wallet vs hot wallet for beginners?

For beginners in India, a hot wallet is a more practical choice due to ease of use, zero setup cost, and compatibility with Indian exchanges like WazirX and CoinDCX. However, as your portfolio grows, understanding the benefits of cold wallet vs hot wallet becomes essential for long-term security.

Is it legal to use cold wallets in India for storing crypto?

Yes, it is legal to use cold wallets in India. While the government regulates crypto taxation, there are currently no restrictions on using hardware wallets or other forms of offline storage. Comparing cold wallet vs hot wallet in India, cold wallets offer superior safety against cyber threats.

How do Indian investors manage cold wallet vs hot wallet for tax filing?

Indian investors managing both cold wallet vs hot wallet setups must track all transactions for tax filing under Section 115BBH. Hot wallets often integrate with tax tools like KoinX, while cold wallet users should maintain manual records or use apps that support offline imports to stay compliant.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.