The Bybit Exchange in India Trusted or Risky for Crypto Traders? is one of the most asked questions by Indian investors in 2025. As Indian traders look for advanced crypto platforms beyond domestic exchanges like WazirX or CoinDCX, Bybit Exchange has emerged as a leading global alternative.

But is it legal? Is it profitable? And most importantly, is it safe for Indian users?

Let’s explore how Bybit Exchange fits into the Indian crypto landscape and whether it truly serves the needs of Indian traders.

What Is Bybit Exchange?

Bybit Exchange is a global cryptocurrency trading platform known for its professional-grade tools, fast execution, and extensive derivative markets. Launched in 2018, it’s headquartered in Dubai and serves millions of users worldwide, including a growing user base in India.

While it doesn’t offer direct INR support, Indian traders use Bybit Exchange for its competitive fees, futures trading, staking, and passive income features.

Read All About: Bitmart Exchange

Is Bybit Exchange Legal in India?

As of 2025, Bybit Exchange remains accessible and is not prohibited for users in India. However, it’s also not regulated under Indian crypto laws. That means Indian users can legally access the platform. Still, they must fund their wallets using crypto assets like USDT or BTC, often via P2P transfers or Indian wallets that allow crypto conversion.

There’s no INR deposit or withdrawal support, which keeps Bybit outside the scope of Indian banking systems, allowing it to operate in a grey area legally.

No Direct Ban, But No Regulation Either

Why Indian Traders Are Choosing Bybit Exchange

1. Derivatives and Leverage Trading

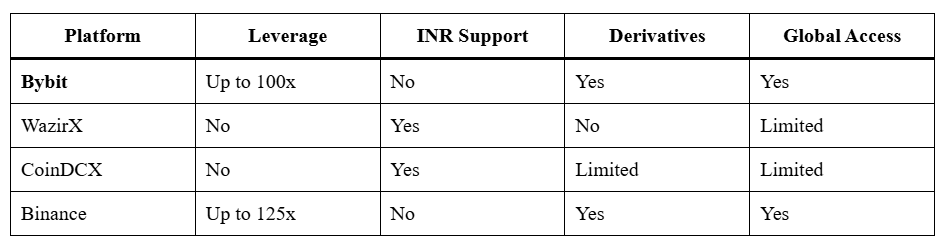

Bybit allows up to 100x leverage on crypto derivatives like BTC/USDT, something Indian exchanges don’t offer due to RBI restrictions. This attracts Indian traders looking for high-risk, high-reward strategies.

2. No KYC for Basic Usage

Indian users can start with limited access without full KYC. However, to withdraw larger amounts or use advanced features, KYC is recommended.

3. Staking and Earn Programs

Through Bybit Earn, Indian users can earn passive income via:

- Fixed savings

- Launchpool staking

- Dual asset investment

4. Advanced Trading Tools

- TradingView charting

- Trailing stop-loss

- Conditional orders

These are rare on Indian platforms but available on Bybit Exchange.

How Indian Users Access Bybit Exchange

Step-by-Step Process:

- You can convert INR to USDT using Indian P2P platforms such as WazirX or Binance P2P marketplaces.

- Transfer USDT to Bybit Wallet.

- Start spot or derivatives trading on Bybit Exchange.

- Withdraw profits back to a local wallet for INR conversion.

Pros and Cons of Using Bybit in India

Pros

- Powerful derivatives and spot market

- Multiple passive income tools

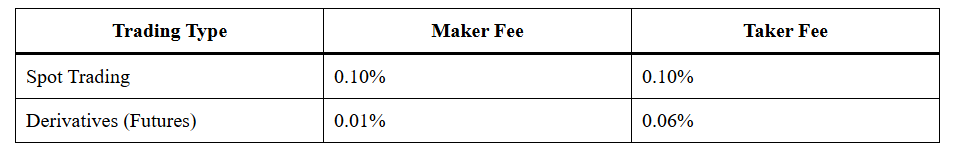

- Low trading fees (as low as 0.01%)

- Mobile app for Android/iOS

- Fast execution (100,000 TPS)

Cons

- No direct INR deposit or withdrawal

- Not regulated under Indian crypto laws

- Leverage trading can result in high risk

- Customer support may not offer India-specific tax guidance

Bybit Fees for Indian Traders

Holding Bybit’s native token (BIT) or participating in promotions may reduce your trading costs further.

Is It Safe to Use Bybit in India?

Yes, from a security standpoint, Bybit Exchange is among the best:

- Multi-layer encryption

- Cold wallet storage

- 2FA and anti-phishing tools

- Real-time risk monitoring

However, Indian users should remember:

- Report capital gains to Indian tax authorities.

- Track crypto assets for compliance with future regulation changes.

- Use P2P platforms carefully for conversions.

Alternatives to Bybit for Indian Traders

While Indian platforms are safe and compliant, Bybit Exchange offers more tools and flexibility for experienced traders.

Tips for Indian Users on Bybit Exchange

- Always use P2P exchanges with high trust ratings.

- Enable 2FA and withdrawal whitelist.

- Monitor the crypto tax situation in India.

- Use Bybit Earn for lower-risk returns.

- Avoid over-leveraging unless you’re a seasoned trader.

Can Indian Users Use Bybit for Passive Income?

Yes. Through Bybit Earn, Indian users can earn on:

- Fixed Savings (e.g., lock up USDT for up to 10% APY)

- Flexible Savings (withdraw anytime)

- Liquidity Mining (earn via DeFi protocols)

It’s a suitable option for Indian HODLers looking to make their crypto work for them without active trading.

Tax & Compliance Checklist for Indian Bybit Users (New)

Trading crypto on a global platform does not exempt Indian residents from local tax rules. Profits from trading or staking on Bybit Exchange may be treated as capital gains or business income, depending on trading frequency and intent. Keep detailed records of trade dates, entry and exit prices, gas or transfer fees, and conversions between USDT and INR for accurate tax disclosure. If you move funds from Bybit Exchange back into an Indian exchange before liquidation to INR, record the rupee value on that conversion date. Consider using crypto tax software that supports CSV imports, and consult a chartered accountant familiar with virtual digital asset guidelines. Staying compliant protects you if regulations tighten.

Final Verdict: Is Bybit Exchange Right for Indian Traders?

Bybit Exchange in India stands out as one of the few global platforms offering:

- Full derivatives suite

- Low fees

- Robust security

- Multiple passive income tools

While it lacks INR support and Indian regulatory backing, it remains accessible, functional, and rewarding, especially for experienced Indian crypto traders.

New users should start slow, avoid leverage initially, and stay updated on legal developments around crypto in India.

Conclusion

In 2025, Bybit Exchange remains one of the most feature-rich and reliable crypto trading platforms accessible in India. Its powerful tools, high liquidity, and diverse income options make it ideal for traders seeking more than just spot trading. Indian users willing to take the extra step to fund wallets via P2P methods can fully unlock the potential of Bybit.

Nevertheless, like all international platforms, it’s essential to prioritize regulatory compliance, exercise caution, and manage risks responsibly. Whether you’re looking to day-trade crypto or grow your portfolio through staking, Bybit Exchange in India is a solid choice if used wisely.

Frequently Asked Questions

Is Bybit Exchange legal to use in India?

Yes, Indian users can legally access and trade on Bybit Exchange. While it is not regulated by Indian authorities, there is currently no law banning the use of global crypto platforms like Bybit. However, it does not support direct INR deposits or withdrawals, so users must use P2P methods to fund their accounts. Always ensure you comply with local tax and reporting requirements.

Can I deposit Indian Rupees (INR) directly into Bybit?

No, Bybit Exchange does not support direct INR deposits or bank transfers in India. Indian users typically convert INR to USDT or BTC through P2P exchanges such as WazirX or Binance P2P, and then transfer the funds to Bybit. This process allows Indian traders to access global crypto markets without direct INR integration.

Do Indian users have to pay tax on profits earned on Bybit?

Yes, profits earned from trading, staking, or investing on Bybit Exchange are subject to taxation in India. The Indian government considers crypto gains as either capital gains or business income, depending on the nature of your activity. A 30% flat tax applies to gains from virtual digital assets, along with a 1% TDS on certain transactions. It is important to keep accurate transaction records and consult a qualified tax advisor.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.