BlackRock Bitcoin, Ether ETFs Secure $1B Amid CME Gap. In a landmark moment for the cryptocurrency market, BlackRock Bitcoin, Ether ETFs Secure $1B Amid CME Gap, highlighting a surge of institutional adoption in digital assets. This development comes as Bitcoin (BTC) price action moves to fill the Chicago Mercantile Exchange (CME) gap, a technical phenomenon closely followed by traders worldwide.

Institutional investments have long been viewed as a crucial bridge for mainstream crypto adoption, and BlackRock the world’s largest asset manager has become the latest heavyweight to validate that trend. But why is this inflow so significant, and what does it mean for Bitcoin, Ethereum, and the broader crypto ecosystem? Let’s dive in.

The Significance of BlackRock’s Entry

BlackRock has built its reputation managing over $9 trillion in assets, making its moves a barometer for global financial trends. When BlackRock introduced Bitcoin and Ether Exchange-Traded Funds (ETFs), the goal was simple: make digital asset exposure more accessible to institutional investors.

The fact that BlackRock Bitcoin, Ether ETFs Secure $1B Amid CME Gap so quickly speaks volumes about investor appetite. These funds allow traditional financial players pension funds, insurance firms, and wealth managers to gain crypto exposure without directly holding volatile digital coins.

This reduces perceived risk while still providing upside potential. Importantly, ETFs also benefit from regulatory approval, further legitimizing crypto within the global financial system.

What Is the CME Gap and Why Does It Matter?

The CME gap refers to price differences that occur when the Chicago Mercantile Exchange closes for the weekend, and Bitcoin continues trading on crypto exchanges globally. When the CME reopens, the price often “fills the gap,” meaning BTC gravitates back to the level where the gap occurred.

With the latest market move, BlackRock Bitcoin, Ether ETFs Secure $1B Amid CME Gap precisely as BTC’s price action neared one of these significant gaps. Traders interpret these gaps as magnetic zones, and historically, Bitcoin has shown a strong tendency to revisit them.

Thus, BlackRock’s ETF inflows aligning with this technical event created a perfect storm of both institutional momentum and technical confirmation.

Why $1B in ETF Inflows Is a Game-Changer

In traditional finance, a billion-dollar milestone acts as a strong vote of confidence. When BlackRock Bitcoin, Ether ETFs Secure $1B Amid CME Gap, it signaled three critical outcomes:

- Institutional Endorsement: Major players are no longer on the sidelines. They’re investing real money.

- Liquidity Boost: ETFs create deeper markets, helping reduce volatility.

- Investor Confidence: A surge in inflows suggests that institutional portfolios increasingly consider crypto a serious asset class.

It’s not just about numbers; it’s about perception. For years, skeptics dismissed Bitcoin and Ethereum as speculative bubbles. Now, with ETFs drawing billion-dollar inflows, that narrative is rapidly changing.

Bitcoin vs. Ethereum – Which Benefited More?

Both Bitcoin and Ethereum stand to gain from BlackRock’s ETF offerings. Bitcoin remains the dominant player in terms of store-of-value narrative, while Ethereum appeals due to its smart contract ecosystem.

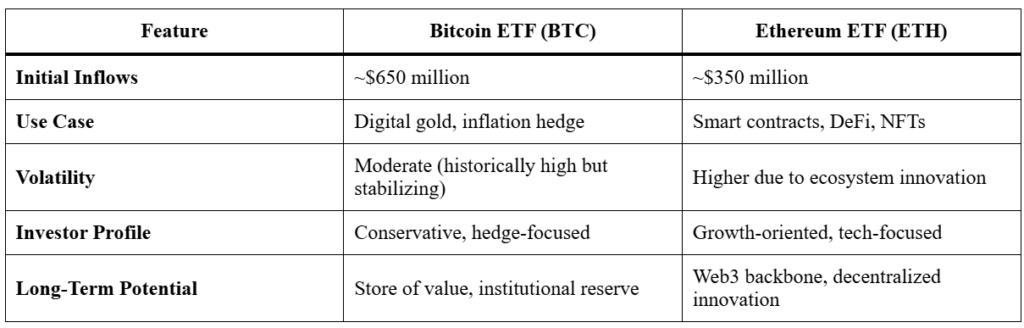

Here’s a quick comparison table to highlight the differences in ETF performance and potential:

As shown, Bitcoin ETFs gathered more inflows initially, but Ethereum ETFs are attracting growth-focused investors betting on blockchain’s broader use cases.

Institutional Adoption and Market Ripple Effects

The fact that BlackRock Bitcoin, Ether ETFs Secure $1B Amid CME Gap doesn’t just affect BlackRock investors. It influences:

- Market Psychology: Retail traders see this as validation of long-term bullishness.

- Liquidity Pools: Increased ETF demand drives liquidity, reducing price manipulation risks.

- Regulatory Pressure: Success may push regulators to fast-track additional crypto-based investment products.

This ripple effect can strengthen the entire crypto ecosystem, pushing more traditional players to follow suit.

Risks and Caution Points

Despite the optimism, it’s essential to consider risks. Even though BlackRock Bitcoin, Ether ETFs Secure $1B Amid CME Gap, volatility remains high in crypto markets.

- Regulatory Shifts: Sudden government crackdowns could alter ETF access.

- Market Cycles: BTC is still cyclical, often tied to halving events.

- Correlation Risks: If global markets face liquidity crunches, crypto ETFs may not be immune.

Investors must balance the hype with caution, ensuring that diversification remains a priority.

Future Outlook: Where Do We Go From Here?

The billion-dollar ETF milestone suggests we’ve entered a new phase of crypto adoption. If BlackRock Bitcoin, Ether ETFs Secure $1B Amid CME Gap in such a short period, what happens when inflows reach $10B or more?

- Mainstream Integration: Expect ETFs to appear in retirement funds, mutual funds, and corporate treasuries.

- Technological Growth: Ethereum’s use cases in DeFi and NFTs may explode with institutional liquidity.

- BTC as a Reserve Asset: With more ETFs, Bitcoin could solidify its “digital gold” status.

The trend is clear: institutional money is here to stay, and ETFs are the bridge driving adoption.

Conclusion

The news that BlackRock Bitcoin, Ether ETFs Secure $1B Amid CME Gap underscores a pivotal shift in the financial landscape. Bitcoin’s technical price action and Ethereum’s innovation-driven appeal, combined with BlackRock’s global influence, are reshaping the future of investing.

As CME gaps continue to capture trader attention and institutional money flows in through ETFs, we are witnessing the convergence of traditional finance and decentralized assets like never before.

For investors, the message is clear: the crypto revolution is no longer just retail-driven it’s becoming a cornerstone of institutional portfolios worldwide.

🔺 Top 3 Gainers (24h Performance)

- Measurable Data Token (MDT) – $0.032089 (+42.20%)

- Alpine F1 Team Fan Token (ALPINE) – $1.647247 (+22.44%)

- IDEX (IDEX) – $0.028829 (+15.13%)

🔻 Top 3 Losers (24h Performance)

- SKALE (SKL) – $0.04094 (−17.67%)

- Berachain (BERA) – $2.021976 (−10.06%)

- Gitcoin (GTC) – $0.357628 (−9.74%)

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact