Crypto Loan platforms are revolutionizing financial access in India, allowing users to borrow funds by pledging digital assets like Bitcoin, Ethereum, or stablecoins without selling them.

In this blog, we review the Top 5 India Apps/Platforms that offer secure, regulated, and easy-to-access Crypto Loan services. Whether you’re a crypto HODLer looking to unlock liquidity or a researcher exploring the DeFi ecosystem in India, these platforms cater to a wide range of financial needs.

What Is a Crypto Loan?

A Crypto Loan is a type of secured loan where you deposit your cryptocurrencies as collateral in exchange for cash or stablecoins. Unlike traditional loans, crypto loans are fast, don’t require credit checks, and allow you to retain your crypto investment while accessing liquidity.

This model benefits both lenders (who earn interest) and borrowers (who maintain exposure to their crypto assets).

Why Crypto Loans Are Gaining Popularity in India

India’s tech-savvy youth and growing crypto community are increasingly using crypto loan platforms for:

- Avoiding capital gains tax triggered by selling crypto

- Quick access to funds for trading or emergency expenses

- Unlocking liquidity while holding long-term crypto positions

- Participation in high-yield farming or trading strategies

Additionally, platforms operating in India are enhancing compliance, KYC, and asset protection features, making crypto loans more secure and regulated than ever before.

Top 5 India Apps/Platforms for Crypto Loan Services

Let’s dive into the best platforms making crypto loan services accessible for Indian users.

1. CoinDCX

Overview: CoinDCX, one of India’s most trusted crypto exchanges, now offers crypto loans through its DCXlend platform.

- Loan Options: Bitcoin, Ethereum, USDT-backed loans

- Collateral Accepted: Multiple crypto assets

- Features: No credit check, flexible tenure, 24/7 support

Why It Stands Out: CoinDCX ensures institutional-grade security and deep liquidity, offering some of the best LTV (Loan-to-Value) ratios in the Indian market.

Launched: 2018

Founders: Neeraj Khandelwal and Sumit Gupta

2. ZebPay Lending

Overview: ZebPay’s lending platform allows users to earn interest or borrow against their crypto assets.

- Loan Options: BTC, ETH, USDT

- Collateral Accepted: BTC and ETH

- Features: Daily interest rates, flexible lock-in

Why It Stands Out: With a simple UI and strict security measures, ZebPay is ideal for new crypto users in India.

Launched: 2014

Founders: Saurabh Agrawal, Sandeep Goenka, and Mahin Gupta

3. Vauld (Currently In Operational Transition)

Overview: Though operations are under restructuring, Vauld was once a leading loan provider in India.

- Loan Options: Stablecoin loans at competitive interest rates

- Collateral Accepted: BTC, ETH, XRP, and others

- Features: Instant disbursal, up to 66% LTV

Why It Stands Out: Vauld was known for extremely low fees and high security, though users should check latest updates before engaging.

Launched: 2018

Founders: Darshan Bathija and Sanju Kurian

4. Unocoin Lending

Overview: One of the earliest Indian crypto platforms, Unocoin now offers crypto loan services for BTC holders.

- Loan Options: INR against BTC collateral

- Collateral Accepted: Bitcoin only

- Features: Instant approval, real-time wallet integration

Why It Stands Out: It is tailor-made for Indian users looking for simple, rupee-based crypto loan access.

Launched: 2013

Founders: Sathvik Vishwanath and Harish BV

5. LendFi

Overview: A rising Web3-native app targeting Indian users with decentralized crypto loan services.

- Loan Options: Stablecoins and fiat

- Collateral Accepted: ETH, BNB, MATIC

- Features: DeFi integration, no intermediaries, lower interest

Why It Stands Out: LendFi’s unique DeFi-backed architecture provides higher transparency and lower rates by removing middlemen.

Launched: 2021

Founders: Web3 DAO-backed (No central founders)

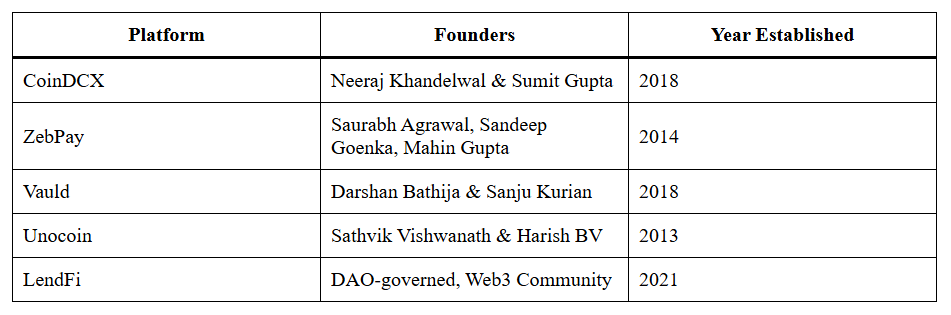

Founders & Establishment Year Snapshot

Key Benefits of Using a Crypto Loan in India

Here’s why more Indians are turning to loan apps:

- No credit history required

- Quick disbursement and approval

- Retain crypto upside while getting liquidity

- Minimal paperwork and instant digital process

- Access funds without selling crypto in a bearish market

These benefits make loans an attractive financial instrument, especially for crypto investors who want to keep their holdings intact.

Is It Safe to Use Crypto Loan Platforms?

Yes, but with caution. Here are a few must-check points:

- Platform Security: Look for multi-signature wallets, 2FA, and cold storage.

- Regulatory Compliance: Platforms should follow RBI and SEBI-aligned practices.

- Transparent LTV Ratios: Understand the liquidation threshold.

- Terms of Service: Read fine print on interest, margin calls, and penalties.

Conclusion

The growth of crypto loan platforms in India is transforming the way individuals and businesses access capital. Whether you’re a trader seeking extra margin, a long-term HODLer needing liquidity, or someone interested in passive income via lending, these top 5 India apps offer secure, flexible, and rewarding options.

However, always do your research, compare LTV ratios, check fees, and read user reviews before pledging your crypto.

Frequentlhy Asked Questions

What is a crypto loan and how does it work?

A crypto loan is a secured loan where you pledge your cryptocurrency (like Bitcoin or Ethereum) as collateral to borrow cash or stablecoins, without selling your crypto holdings.

Is taking a crypto loan legal in India?

Yes, taking a crypto loan is legal in India. While cryptocurrencies are not recognized as legal tender, there are no laws prohibiting the use of crypto-backed financial services, provided platforms follow KYC and compliance norms.

Which is the best crypto loan app in India?

Top-rated crypto loan platforms in India include CoinDCX, ZebPay, Unocoin, and emerging DeFi apps like LendFi. Each app differs in interest rates, supported coins, and loan terms, so it’s best to compare based on your needs.

Can I get an INR loan using my crypto in India?

Yes. Some Indian platforms, like Unocoin, offer loans in INR against Bitcoin. Other platforms may offer stablecoins, which can then be converted to INR through exchanges.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.