Top 5 Arbitrage Trading Crypto Apps

Arbitrage Trading: Best Apps for Low-Risk Crypto Profits has become a trending topic in the crypto world as more investors seek consistent gains with minimal risk. With hundreds of crypto platforms available today, identifying the best tools for arbitrage is essential for success. This guide reviews the top 5 crypto apps that help users execute arbitrage strategies effectively and securely.

What is Arbitrage Trading?

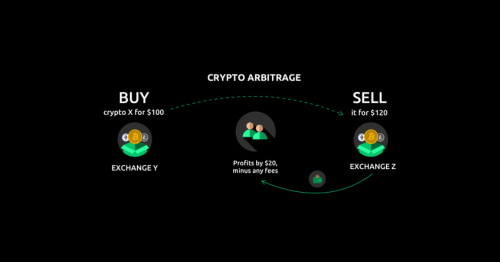

Arbitrage trading is a market-neutral strategy where traders exploit price differences of the same asset across different platforms. In crypto, where prices fluctuate rapidly across exchanges, arbitrage trading can generate steady profits. It involves buying a cryptocurrency at a lower price on one platform and simultaneously selling it at a higher price on another.

This approach doesn’t depend on long-term price movement, making it a powerful option for risk-averse traders. It also works well with automated tools and bots available on modern crypto apps.

Read All About: Crypto Trading Guide That Works for Every Trader

Why Crypto Apps Matter for Arbitrage Trading

Success in arbitrage trading relies on speed, accuracy, and execution. That’s where dedicated crypto apps come in. The best apps offer:

- Real-time price tracking across multiple exchanges

- Integrated wallets for faster fund transfers

- Customizable trading bots

- Alerts for price gaps and arbitrage opportunities

- Transparent fee structures and fast withdrawals

Let’s explore the top 5 crypto apps tailored for arbitrage trading.

Top 5 Apps For Arbitrage Trading

1. Coinigy

Coinigy is a well-established platform that allows users to track prices across 45+ exchanges. It integrates seamlessly with API keys, letting traders monitor and trade directly from the dashboard.

Key Features:

- Multi-exchange dashboard

- Arbitrage scanning tool

- Fast order execution

- API and bot integration

- Advanced charting tools

Best For: Traders seeking full control over multiple exchange accounts in one place.

2. Bitsgap

Bitsgap is widely used for its automated arbitrage trading bots. The app allows traders to connect to various exchanges and execute cross-platform trades quickly.

Key Features:

- Cloud-based arbitrage bots

- Built-in arbitrage scanner

- Portfolio management

- Demo trading environment

- Real-time alerts and analytics

Best For: Users who prefer automation and cloud-based execution.

3. ArbiSmart

ArbiSmart is a regulated platform that automates arbitrage trading while handling risk through its algorithmic engine. It simplifies the user experience by doing all calculations and transactions on behalf of the user.

Key Features:

- Fully automated arbitrage engine

- EU-licensed and regulated

- Transparent risk metrics

- Fiat and crypto deposits supported

- Passive income model

Best For: Passive investors looking for automated, regulated arbitrage trading.

4. Pionex

Pionex offers 16+ built-in trading bots, including arbitrage strategies. Its low trading fees and easy-to-use interface make it beginner-friendly.

Key Features:

- Arbitrage and grid bots

- Built-in exchange functionality

- Mobile and desktop access

- Competitive fee structure

- Manual and automated trading options

Best For: Beginners and casual traders exploring arbitrage trading.

5. KoinKnight

KoinKnight is a niche arbitrage scanner specifically designed for Indian traders. It highlights real-time arbitrage opportunities between local and global exchanges.

Key Features:

- INR and crypto price gap alerts

- User-friendly dashboard

- Quick wallet integration

- Data on trading volumes and spreads

Best For: Indian users focusing on local and international price gaps.

How to Start Arbitrage Trading with These Apps

To begin using these apps for arbitrage trading:

- Register and verify accounts on multiple exchanges

- Connect your exchange accounts to your chosen crypto app via API keys

- Fund your accounts across selected platforms

- Set alerts or enable bots based on your risk preferences

- Monitor performance and withdraw profits consistently

Always test bots in demo environments before going live, especially when dealing with volatile markets.

Benefits of Using Apps for Arbitrage Trading

Arbitrage trading using dedicated crypto apps offers several advantages:

- Automation: Most apps support bots that execute trades instantly

- Speed: Quick price detection and fund transfer options

- Security: Reputable apps use encrypted APIs and offer withdrawal controls

- Cross-platform execution: Supports trades across multiple exchanges simultaneously

- Real-time insights: Accurate data for better decisions

Risks and How to Mitigate Them

Even with top apps, arbitrage trading carries certain risks:

- Price slippage during high volatility

- High transaction or withdrawal fees

- Slow order execution if the exchange is overloaded

- APIs disconnecting unexpectedly

- Market manipulation or fake liquidity

Mitigation Tips:

- Use exchanges with high liquidity

- Set transaction limits to control slippage

- Opt for apps with proven uptime and support

- Avoid unfamiliar exchanges with low user ratings

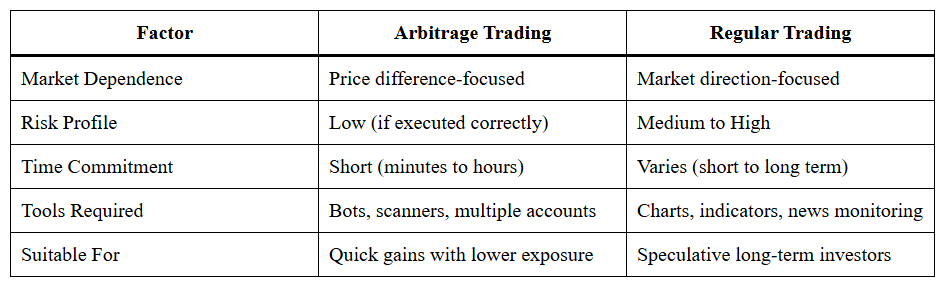

Arbitrage Trading vs Regular Crypto Trading

Tax Implications of Arbitrage Trading

Tax treatment of arbitrage trading depends on your local laws. Generally:

- Profits are taxable as short-term capital gains

- Every transaction must be recorded for audit compliance

- Trading bots do not affect tax liability

- Tax forms vary based on frequency and volume of trades

Traders should maintain detailed records and consult a tax advisor to avoid compliance issues.

Future of Arbitrage Trading Apps

As crypto markets mature, arbitrage trading is becoming more sophisticated:

- AI-powered bots are improving trade accuracy

- Cross-chain arbitrage is growing with DeFi

- More institutional investors are entering the space

- Tighter regulations are increasing transparency

- Real-time blockchain data is making apps smarter and faster

The best crypto apps will continue evolving to keep up with these advancements.

Conclusion

It remains one of the most effective low-risk strategies in the crypto space, and using the right crypto app can make a significant difference in outcomes. The top 5 crypto apps, Coinigy, Bitsgap, ArbiSmart, Pionex, and KoinKnight, each offer unique features tailored for different trader needs. Whether you’re looking for automation, simplicity, regulation, or local exchange arbitrage, these apps provide the tools to succeed in your strategy.

Start small, monitor results, and scale up with confidence using the app that best fits your trading style.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.