Crypto Mining Exposed: Hidden Risks & Big Rewards

Crypto mining is the foundation of many Blockchain networks, ensuring transactions are validated and new coins are introduced into circulation. This complex process has evolved over time, shifting from individual hobbyists to industrial-scale operations. But what exactly is crypto mining, and how can you benefit or lose from it?

What Is Crypto Mining?

Crypto mining is the process by which transactions on a blockchain are validated and added to the distributed ledger. It involves solving complex mathematical puzzles using computing power, typically rewarded with new cryptocurrency coins and transaction fees.

In proof-of-work (PoW) systems like Bitcoin, miners compete to be the first to solve the puzzle. The winner gets to add a new block to the blockchain and is rewarded in cryptocurrency. The system incentivizes participants to secure the network.

Crypto mining also ensures decentralization, as no central authority controls the blockchain. This autonomy makes it both attractive and disruptive in traditional finance sectors. From Bitcoin to altcoins, mining plays a vital role in how these digital currencies are issued and validated.

Types of Crypto Mining

Understanding the various types of crypto mining helps determine the most efficient strategy for your goals and resources.

1. CPU Mining

- Utilizes regular computer processors.

- Cost-effective but slow and inefficient for modern cryptocurrencies.

2. GPU Mining

- Uses graphics processing units.

- More powerful than CPUs; suitable for mining Ethereum and similar coins.

3. ASIC Mining

- Application-Specific Integrated Circuits are custom-built for mining.

- Extremely fast but expensive and limited to specific coins.

4. Cloud Mining

- Rent mining power from remote data centers.

- Requires no hardware maintenance but comes with potential risks.

5. Mobile Mining

- Conducted via apps on smartphones.

- Very limited returns; often not worth the effort.

Why Companies Offer Crypto Mining Services

Many companies offer crypto mining to individuals who lack the infrastructure or expertise to mine on their own. These services allow clients to rent equipment, use cloud computing, or buy shares in mining farms. The reasons include:

- Scalability – Companies can mine at a larger scale for better efficiency.

- Profit-sharing – Revenue is shared between the company and customers.

- Market demand – Growing interest in crypto mining fuels demand for turn-key solutions.

Companies also gain by leveraging bulk energy contracts, reducing operational costs. This allows for competitive pricing models for users and higher overall profitability.

How to Qualify for Mining Participation

While anyone can technically start mining, certain prerequisites must be met:

- Hardware Access – Must have suitable mining rigs (ASIC, GPU, or CPU).

- Software Setup – Need compatible mining software and digital wallet.

- Stable Internet Connection – Essential for 24/7 mining operations.

- Sufficient Power Supply – Mining requires high electricity usage.

- Knowledge of Pools or Solo Mining – Choose the right path based on your risk appetite.

Understanding the network difficulty and coin profitability also helps in making informed decisions.

Benefits of Crypto Mining

Crypto mining can be highly profitable and empowering when approached strategically.

- Passive Income – Earn regular rewards for validating transactions.

- Network Security Contribution – Help secure decentralized systems.

- Asset Appreciation – Potential for mined coins to increase in value.

- Self-Custody – Full control over earned cryptocurrencies.

It also builds technical knowledge and increases familiarity with blockchain ecosystems.

Risks and Precautions

Crypto mining isn’t without its dangers. Awareness and planning are key.

- High Initial Investment – Hardware and electricity costs can be steep.

- Volatile Returns – Crypto prices fluctuate, affecting profitability.

- Regulatory Uncertainty – Laws vary by country and can change.

- Scams in Cloud Mining – Beware of fraudulent service providers.

- Environmental Impact – Especially with PoW systems like Bitcoin.

Precautions:

- Always research the mining pool or service.

- Use reliable hardware and update software regularly.

- Monitor profitability calculators before investing.

Avoid suspicious platforms offering guaranteed returns with no transparency.

Where to Find Legit Crypto Mining Opportunities

Finding trustworthy crypto mining options can be challenging. Here’s what to look for:

- Transparent Pricing Models

- Reputation and Reviews

- Real-Time Dashboard Access

- Registered Legal Entity

- Long-Term Market Presence

Stick to platforms with solid track records and avoid get-rich-quick schemes.

Read All About: Free Crypto Mining Apps In India

Best Strategies to Maximize Crypto Mining

Success in crypto mining requires smart planning and continuous optimization.

Strategies:

- Join Mining Pools – Improve your odds of steady payouts.

- Switch Coins Regularly – Use auto-switching tools to follow the most profitable coins.

- Optimize Electricity Usage – Mine in areas with cheaper energy.

- Regular Maintenance – Prevent downtime by ensuring hardware efficiency.

- Tax Optimization – Understand deductions and reporting requirements.

You should also track mining difficulty levels, electricity costs, and upcoming halving events to stay profitable from Whattomine.

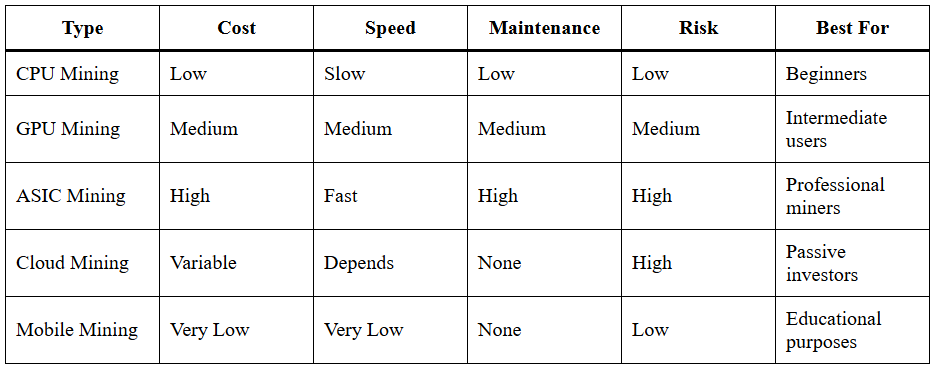

Difference Between Mining Types

Here’s a side-by-side comparison to highlight differences:

Tax Implications of Crypto Mining

Crypto mining is treated as income in many jurisdictions and is taxable. Here’s what you should know:

- Taxable Income – Mined crypto is often taxed at the market value on the day received.

- Capital Gains – If the mined crypto is held and later sold, capital gains tax applies.

- Business Deductions – Miners may deduct costs like electricity and hardware if registered as a business.

Always consult a tax professional to ensure compliance. (IRS)

Future Outlook of Crypto Mining

The future of cryptocurrencies mining is evolving rapidly, especially with:

- Green Mining Initiatives – Focus on reducing energy consumption.

- Proof-of-Stake Adoption – Ethereum has already transitioned to PoS, reducing the demand for traditional mining.

- Technological Advances – ASICs and software becoming more efficient.

- Stricter Regulations – Governments are enforcing energy caps and implementing licensing requirements.

Sustainability, regulation, and innovation will define the next chapter of crypto mining.

Conclusion

Crypto mining remains a compelling avenue for earning digital assets and contributing to decentralized networks. With the right hardware, strategic approach, and awareness of risks and taxes, both individuals and businesses can participate profitably. As the ecosystem evolves, miners must stay agile to adapt to changing technologies and legal landscapes. Whether you’re a beginner or an experienced miner, continuous learning and vigilance are your best assets.

Frequently Asked Questions

Is crypto mining still profitable in 2025?

Yes, cryptocurrencies mining can still be profitable in 2025, but it depends on several factors like the type of coin being mined, electricity costs, hardware efficiency, mining difficulty, and market prices. Using ASIC miners and joining mining pools can improve profit margins.

Is crypto mining legal in India

The legality of crypto mining varies by country. In India, crypto mining is not explicitly illegal, but it is unregulated. However, high electricity consumption and unclear taxation may pose challenges. Always check local laws and energy policies before starting.

What is the best cryptocurrency to mine right now?

The best cryptocurrency to mine depends on current market conditions, mining difficulty, and your hardware. As of now, coins like Bitcoin (via ASIC), Litecoin, Kaspa, and Ethereum Classic are among the most mined. Use profitability calculators to find real-time options.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.