Crypto Token Explained: Smart Benefits & Key Risks

Crypto Token Explained: Smart Benefits & Key Risks. Cryptocurrencies have rapidly evolved, and one of the most talked-about digital assets is the crypto token. Whether you’re a beginner or an investor looking to deepen your understanding, this guide offers a comprehensive overview of crypto tokens, their types, uses, and much more.

What is a Crypto Token?

A crypto token is a type of digital asset created on an existing blockchain, such as Ethereum, Binance Smart Chain, or Solana. Unlike coins (e.g., Bitcoin or Ether) that operate on their native blockchains, tokens rely on pre-existing Blockchains for their infrastructure and operations.

Crypto tokens can represent various utilities, from granting access to decentralized apps (DApps) and smart contracts to representing ownership of physical assets or even voting rights in decentralized autonomous organizations (DAOs).

Role of Smart Contracts in Crypto Token Ecosystems

Smart contracts play a foundational role in the creation, management, and execution of crypto tokens. These self-executing codes run on blockchain networks and automate agreements without the need for intermediaries. In token ecosystems, smart contracts govern everything from token distribution and transfers to staking rules and governance voting. Their immutability ensures trust, transparency, and efficiency, which are essential for decentralized finance (DeFi) and other blockchain-based applications.

Types of Crypto Tokens

Understanding the different types of crypto tokens is essential for investors and enthusiasts. Here’s a breakdown:

1. Utility Tokens

These are the most common tokens that provide access to a product or service within a blockchain ecosystem. Example: Basic Attention Token (BAT).

2. Security Tokens

These represent ownership in an asset or a company and are regulated by financial authorities. They are akin to traditional securities.

3. Governance Tokens

These allow holders to vote on proposed changes in a decentralized network. Example: UNI token for Uniswap.

4. Stablecoins

These tokens are pegged to stable assets like the US Dollar to minimize volatility. Example: USDC, USDT.

5. Non-Fungible Tokens (NFTs)

NFTs represent unique items or assets, including art, music, or in-game items.

Why Do Companies Offer Crypto Tokens?

Companies offer tokens for a variety of strategic and operational reasons:

- Fundraising: Many startups use Initial Coin Offerings (ICOs) to raise capital.

- Incentivization: Tokens are used to reward users and developers within an ecosystem.

- Ecosystem Growth: Tokens attract users and developers, increasing platform adoption.

- Decentralization: Tokens empower users to participate in governance and influence the direction of projects.

Real-World Use Cases of Crypto Tokens

Beyond speculation, crypto tokens are being integrated into real-world solutions across industries. In gaming, tokens reward players and facilitate asset ownership. In supply chain management, tokens help track goods in a tamper-proof manner. Healthcare platforms use tokens for securing patient records, while real estate firms are beginning to tokenize property ownership to simplify transactions. These real-world use cases demonstrate the expanding utility of crypto tokens far beyond digital currencies.

How to Qualify for Crypto Tokens

Acquiring crypto tokens often requires the following:

- KYC Verification: Platforms may require identity verification.

- Wallet Setup: You need a compatible crypto wallet like MetaMask or Trust Wallet.

- Exchange Registration: Users must sign up on crypto exchanges that list the token.

- Participation in Airdrops or ICOs: Some tokens are distributed for free or during early project phases.

- Staking Participation: Certain tokens are earned through staking crypto in DeFi protocols.

Benefits of Crypto Tokens

Investing or participating in crypto tokens can provide multiple advantages:

- High Liquidity: Tokens can be traded on multiple exchanges worldwide.

- Decentralized Access: No central authority governs token usage.

- Diversified Investment Options: Tokens span industries like gaming, DeFi, healthcare, and more.

- Low Entry Barriers: Users can start investing with minimal capital.

- Passive Income: Many tokens allow for staking and earning rewards.

Risks & Precautions

Like all investments, tokens come with certain risks:

- Market Volatility: Token prices are often highly volatile.

- Regulatory Challenges: Some tokens may face future legal restrictions.

- Fraud & Scams: Fake projects or rug pulls are prevalent.

- Technical Risks: Smart contract bugs can result in token loss.

- Lack of Transparency: Not all tokens provide full information or disclosures.

Precautions to Take:

- Always research thoroughly (DYOR).

- Verify project authenticity via whitepapers and community feedback.

- Use reputable wallets and exchanges.

- Avoid sharing seed phrases or private keys.

Where to Find Legit Crypto Tokens

Identifying trustworthy tokens is crucial. Here’s where to look:

- Major Exchanges: Platforms like Coinbase, Binance, and Kraken list vetted tokens.

- Aggregator Sites: CoinMarketCap and CoinGecko offer detailed information and tracking tools.

- Official Project Websites: Direct sources offer whitepapers, roadmaps, and team credentials.

- DeFi Platforms: Trustworthy decentralized apps often introduce legitimate tokens.

Best Strategies to Maximize Token Value

To get the most out of your token investments:

- Staking: Lock your tokens in platforms that offer interest or yield.

- Yield Farming: Earn tokens by providing liquidity in DeFi pools.

- Holding for Governance: Retain governance tokens to participate in project decisions.

- Buy the Dip: Accumulate tokens during price corrections.

- Portfolio Diversification: Invest across various token types to reduce risk.

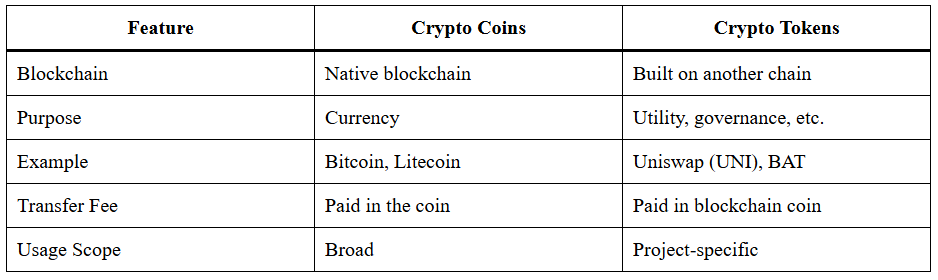

Difference Between Crypto Coins and Crypto Tokens

Here’s a quick comparison to help distinguish between the two:

Tax Implications of Crypto Tokens

The Tokens are subject to taxation in many jurisdictions. Key points include:

- Capital Gains Tax: Profits from token trading are often taxed.

- Income Tax: Tokens earned from staking, airdrops, or yield farming may be taxed as income.

- GST/VAT: In some regions, transactional taxes may apply.

Important Note: Always consult a certified tax professional to ensure compliance with local regulations.

Read All About: Income Tax Department Of India

Future Outlook for Crypto Tokens

The crypto token ecosystem continues to evolve at a fast pace. Here’s what the future might hold:

- Mass Adoption: As more industries integrate blockchain, token usage will grow.

- Regulatory Clarity: Government frameworks will help stabilize and legitimize the market.

- Tokenization of Assets: Real-world assets like real estate and art will increasingly be tokenized.

- Cross-Chain Interoperability: Future tokens will be easily transferrable across multiple blockchains.

- AI Integration: Smart tokens will incorporate AI to automate decision-making processes.

Conclusion

Crypto tokens have revolutionized the way we perceive and interact with digital assets. From enabling decentralized governance to powering innovative financial ecosystems, they play a crucial role in the broader blockchain narrative. However, with benefits come risks, making it vital to research, plan, and act strategically. Whether you’re a seasoned investor or just getting started, understanding tokens can open doors to immense opportunities in the evolving digital economy.

FAQ’s

What is the difference between a crypto coin and a crypto token?

A crypto coin operates on its own native blockchain (like Bitcoin on the Bitcoin blockchain), while a crypto token is built on an existing blockchain (like Uniswap on Ethereum). Coins primarily serve as currency, whereas tokens can represent utility, assets, or voting rights within specific platforms.

How do I buy a crypto token?

To buy a crypto token, first set up a crypto wallet compatible with the token’s blockchain (e.g., MetaMask for Ethereum tokens). Then, register on a trusted exchange that lists the token, deposit funds, and place a buy order. Always verify token contract addresses to avoid scams.

Are crypto tokens legal in India?

Crypto tokens are not banned in India, but they are currently unregulated. The government allows crypto trading and investing under certain tax guidelines, such as a 30% tax on profits and 1% TDS on transactions. It’s essential to stay updated with changing regulatory policies.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.