USDC Circulation Soars by 700M With Positive Growth Insights

In a significant sign of renewed interest in stablecoins, the circulation of USD Coin (USDC) increased by approximately $700 million in the week ending July 10, as reported by PANews. According to official data from Circle, the issuer of USDC, roughly $3.3 billion in new USDC was issued, while $2.6 billion was redeemed. This net positive flow has pushed USDC’s total supply to approximately $62.7 billion, supported by reserves of around $62.9 billion. This is a strong indicator of growing investor trust and the increasing utility of stablecoins.

USDC: What It Is and Why It Matters

USDC is a regulated, dollar-backed stablecoin that maintains a 1:1 peg with the U.S. dollar. It is widely used across decentralized finance (DeFi) protocols, centralized exchanges, NFT marketplaces, and blockchain payment systems.

What sets USDC apart from other stablecoins is its emphasis on transparency, compliance, and full-reserve backing. Regular attestations and public disclosures reinforce user confidence, especially during volatile periods in the crypto market.

In the week under review, USDC’s sharp increase in circulation is likely driven by growing DeFi activity, rising demand for secure liquidity, and investor preference for transparent and regulated stablecoin options.

Weekly Metrics: Circle’s Breakdown

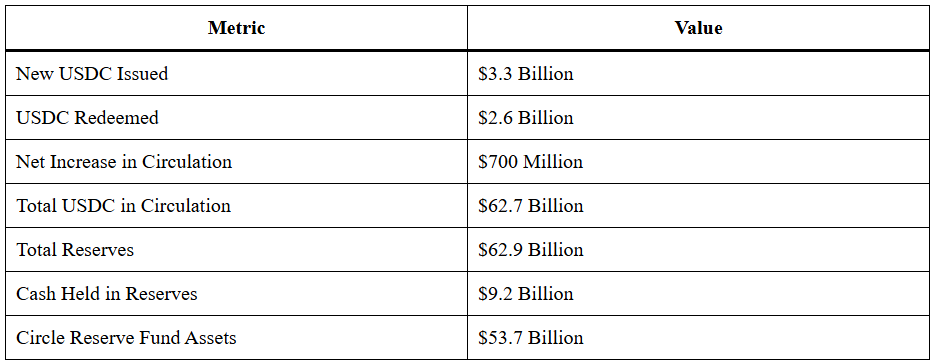

According to Circle’s weekly transparency report:

This breakdown underscores Circle’s commitment to full reserve backing. With over $9.2 billion in cash and $53.7 billion in secure financial instruments, USDC users can rely on near-instant redemption and liquidity access when needed.

Circle: Founding Team and Company Background

Founders and Establishment

Circle was founded in 2013 by Jeremy Allaire (CEO) and Sean Neville. The company was created with a mission to build a more open, global, and inclusive financial system using blockchain technology.

Originally offering consumer-facing financial products, Circle shifted focus toward infrastructure development and launched USDC in September 2018. The stablecoin was developed in partnership with Coinbase under the governance of the Centre Consortium.

Over the years, Circle has grown into one of the most recognized financial technology firms in the blockchain industry. The company advocates for regulatory clarity and trust-driven innovation, making it a key player in shaping the future of digital finance.

Significance of the Surge in Circulation

The $700 million net gain in USDC circulation is more than a weekly statistic. It represents a shift in broader market sentiment and offers several insights:

Market Confidence is Rebounding

Following high-profile collapses in the stablecoin sector, including TerraUSD, investors are showing renewed interest in fully backed and regulated alternatives. USDC’s strong reporting standards make it a preferred choice for many.

DeFi Activity is Accelerating

USDC plays a central role in decentralized finance as a source of liquidity and collateral. Increased issuance typically signals growing adoption across platforms that rely on USDC for lending, trading, and staking.

Investors Seek Stability

During periods of market uncertainty, users often move assets into stablecoins like USDC to preserve value without exiting the crypto ecosystem entirely. This “flight to safety” benefits assets with a proven reserve framework.

Global Regulatory Context and Institutional Relevance

Stablecoins have become a focal point for regulators worldwide. With its compliance-first model, USDC is viewed favorably among policymakers and institutional stakeholders looking to engage with blockchain-based finance.

Circle’s consistent transparency and weekly reserve reporting set a benchmark for the industry. With the majority of its reserves held in short-term U.S. Treasuries through the Circle Reserve Fund, USDC demonstrates a conservative and secure reserve strategy.

Comparison with Other Leading Stablecoins

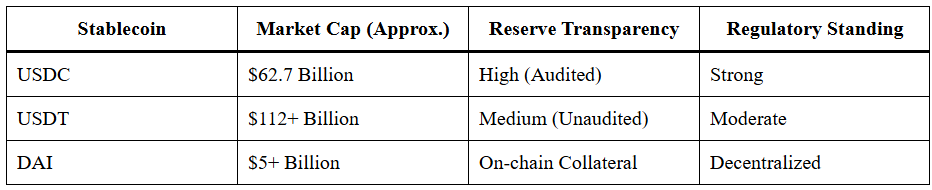

While Tether (USDT) remains the largest stablecoin by market capitalization, USDC’s transparent and regulated structure offers a competitive edge.

USDC’s balance between centralization and accountability makes it particularly attractive to financial institutions and developers building regulatory-compliant applications.

Related Reading

- Stablecoin Explained

- Stablecoin Scam Alert

- Stablecoin Surge Raises Investor Risk Amid Regulation Gaps

Final Thoughts

The $700 million net increase in USDC circulation reflects growing market confidence, institutional adoption, and the demand for transparency in digital finance. Backed by robust reserves and a strong governance model, USDC continues to lead in the stablecoin space.

As regulatory frameworks around digital assets evolve, USDC appears well-positioned to become a foundational asset in both decentralized and traditional financial ecosystems.

🔺 Top 3 Gainers (24h Performance)

1. KNC (Kyber Network) – $0.5377 (+68.31%)

KNC surged following increased adoption of its liquidity protocol across multiple DeFi platforms, reinforcing its position as a core component of decentralized trading ecosystems.

2. XLM (Stellar Lumens) – $0.3978 (+27.29%)

XLM experienced strong upward momentum driven by renewed partnerships in cross-border payments and positive sentiment surrounding its scalable, low-cost transaction infrastructure.

3. IDEX (IDEX) – $0.020 (+17.92%)

IDEX climbed sharply as investors responded to improvements in its hybrid liquidity model, combining centralized speed with decentralized custody to attract new trading volume.

🔻 Top 3 Losers (24h Performance)

1. BANANAS31 (BANANAS31) – $0.014 ( – 470.4%)

BANANAS31 faced a steep decline due to thin trading volume and market skepticism about its long-term utility, triggering profit-taking among early holders.

2. OMNI (OMNI) – $2.96 ( – 32.27%)

OMNI reversed recent gains as momentum cooled and short-term traders capitalized on earlier price surges, contributing to downward pressure.

3. RESOLV (RESOLV) – $0.163 ( – 24.84%)

RESOLV dipped slightly after its integration news wore off and investors awaited further updates on platform utility and user engagement metrics.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.