DeFi Revolution Unlocking Big Gains & Avoiding Pitfalls

DeFi Revolution: Unlocking Big Gains & Avoiding Pitfalls. DeFi Revolution: Unlocking Big Gains & Avoiding Pitfalls highlights the incredible opportunities and critical challenges of decentralized finance. In this edition of “Project Deep Dives,” we explore how DeFi is reshaping global finance, who it benefits, how it works, and what to watch out for.

What is DeFi?

DeFi, or decentralized finance, refers to a blockchain-based financial ecosystem that eliminates the need for traditional intermediaries such as banks, brokers, or payment processors. It enables peer-to-peer transactions, lending, borrowing, and other financial services through Smart Contracts, offering users greater transparency, control, and accessibility. Through smart contracts and decentralized apps (dApps), users can borrow, lend, trade, earn interest, and access other financial instruments, all without relying on traditional institutions.

The key value proposition of DeFi lies in its permissionless nature, full transparency, and programmability. Anyone with an internet connection can access Decentralized Finance platforms without relying on centralized authorities, while smart contracts ensure open, automated, and customizable financial interactions across the blockchain.. Anyone with an internet connection can participate, making financial services more accessible than ever before.

Types of DeFi Applications

Decentralized Finance is not a single tool or product; it’s a broad ecosystem. Here are the major types:

1. Lending & Borrowing Platforms

Protocols such as Aave and Compound allow users to lend their cryptocurrencies to earn interest or use their digital assets as collateral to borrow funds. These decentralized platforms operate through smart contracts, enabling secure, automated, and efficient peer-to-peer lending without the need for traditional financial intermediaries.

2. Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) like Uniswap and Curve enable peer-to-peer token trading directly on the blockchain, removing the need for centralized oversight. These platforms use automated liquidity pools and smart contracts to facilitate fast, secure, and transparent transactions between users.

3. Stablecoins

Stablecoins such as DAI and USDC are cryptocurrencies specifically engineered to maintain a steady value, often pegged to the U.S. dollar. Widely used in DeFi transactions, they provide a reliable medium of exchange and store of value, helping users navigate the volatility typically associated with crypto markets.

4. Yield Farming & Liquidity Mining

Users provide liquidity to earn rewards, often paid in protocol-native tokens.

5. Synthetic Assets

Projects like Synthetix enable users to trade digital versions of real-world assets like stocks and commodities.

6. Insurance & Risk Protection

DeFi insurance platforms provide decentralized coverage solutions that protect users against risks such as smart contract vulnerabilities, protocol failures, and extreme market volatility. By leveraging blockchain transparency and community-driven models, these platforms offer an added layer of security for participants in the Decentralized Finance ecosystem.

Why Do Companies Offer DeFi Products?

DeFi isn’t just for individual users. Companies are building and offering Decentralized Finance tools for several reasons:

- Lower Infrastructure Costs: By automating processes through smart contracts, Decentralized Finance platforms significantly reduce reliance on traditional staffing and complex infrastructure, leading to streamlined operations and lower overhead expenses.

- Faster Product Innovation: Open-source frameworks allow rapid development.

- Market Differentiation: Offering DeFi tools attracts a tech-forward user base.

- Global Reach: DeFi has no borders, companies can serve users worldwide.

- Revenue Generation: Protocol fees, token economics, and user volume drive income.

How to Qualify for DeFi Services

The beauty of DeFi is that there are virtually no qualifications. All you need is:

- A crypto wallet like MetaMask or Trust Wallet lets users securely store, manage, and interact with their digital assets. It also provides access to dApps and DeFi services while keeping full control over private keys. These wallets also serve as gateways to the Decentralized Finance ecosystem, enabling seamless access to decentralized applications (dApps), token swaps, and blockchain-based services.

- Access to the internet is essential for participating in the Decentralized Finance ecosystem, as all transactions, smart contracts, and interactions with decentralized applications (dApps) occur online through blockchain networks.

- Some cryptocurrencies, such as ETH or USDC, are essential for interacting with DeFi platforms. ETH is often used to pay transaction fees on the Ethereum network, while stablecoins like USDC provide a consistent value for trading, lending, and earning yields within decentralized finance applications.

- A basic Understanding of Blockchain interfaces is important for navigating Decentralized Finance platforms effectively. Familiarity with tools like crypto wallets, Smart Contract interactions, and transaction confirmations helps users manage their assets securely and make informed decisions within the decentralized ecosystem.

There are no credit scores, income requirements, or approvals. Most DeFi apps are completely open to everyone, though KYC requirements may appear in certain regulated versions.

Benefits of DeFi

Why are millions using Decentralized Finance? The benefits are hard to ignore:

- User Control: You own and control your assets — no custodians involved.

- Transparency: Transactions are visible and verifiable on public blockchains.

- Higher Returns: Compared to banks, DeFi can offer significantly better yields.

- Global Accessibility: Anyone with a smartphone and internet can participate.

- Composability: Apps can build on each other to create better financial systems.

Risks & Precautions

While the rewards can be impressive, the pitfalls are real. Key risks include:

- Smart Contract Exploits: Bugs in code can be exploited by hackers.

- Volatility: Crypto prices fluctuate rapidly, affecting investment values.

- Rug Pulls: Some developers abandon projects after collecting user funds.

- Impermanent Loss: Liquidity providers may lose value during price swings.

- Regulatory Uncertainty: Decentralized Finance faces challenges as laws in many countries are still evolving.

Precautions:

- Use audited platforms

- Diversify across protocols

- Stay informed through community updates

- Don’t invest more than you can afford to lose

Where to Find Legit DeFi Projects

Finding legitimate DeFi tools requires research and skepticism. Look for:

- Third-party security audits

- Transparent documentation and whitepapers

- Open-source code on GitHub

- Strong, active communities on forums and social media

- High Total Value Locked (TVL) as a trust metric

Avoid anonymous teams and overly aggressive returns without explanation.

Best Strategies to Maximize DeFi

Success in Decentralized Finance isn’t luck — it’s about applying smart strategies:

- Start small and scale gradually

- Diversify investments across categories (DEXs, lending, etc.)

- Reinvest your earnings to compound returns

- Monitor gas fees and use Layer 2 networks to save costs

- Follow protocol governance to vote or adjust positions early

Staying educated and disciplined is your biggest edge.

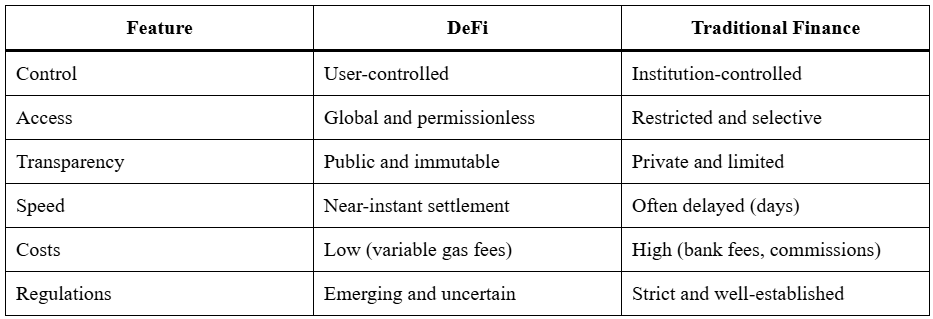

Difference Between DeFi and Traditional Finance

Tax Implications of DeFi

Taxation in DeFi can be complex, but here are the basics:

- Capital Gains: Triggered when selling or swapping tokens.

- Income Tax: Applies to staking rewards, farming income, and airdrops.

- Record Keeping: You must track each transaction’s value and timing.

- Tax Reporting: Jurisdictions vary, but DeFi earnings are increasingly under scrutiny.

Consulting with a tax professional and using tracking tools can help you stay compliant.

Future Outlook of DeFi

DeFi is still in its early stages, but its growth is exponential. Here’s what to expect:

- Integration with Traditional Finance: Banks may adopt Decentralized Finance protocols.

- Clearer Regulations: Legal certainty may attract institutional investors.

- Mass Adoption: Better interfaces will bring millions more users.

- Cross-Chain Compatibility: Interoperability between blockchains will become seamless.

- New Products: Insurance, identity, credit scoring — all going decentralized.

The DeFi revolution is just getting started.

Conclusion

Decentralized Finance opens the door to financial freedom, efficiency, and innovation, but it’s not without risk. From earning passive income to accessing loans without a bank, the potential of decentralized finance is massive. Still, caution and strategy are essential. By understanding how Decentralized Finance works, using legit platforms, managing risk, and planning for taxes, users can unlock the full potential of this groundbreaking ecosystem.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.