Cryptocurrencies have become one of the hottest investment options across the globe. With millions of people buying Bitcoin, Ethereum, and other digital assets, governments worldwide are now focusing on how to regulate this fast-growing space. One of the most significant aspects of regulation is taxation. In India, the government introduced a clear taxation framework in the Union Budget 2022. However, like any other financial asset, cryptocurrencies are not free from government regulations, especially when it comes to taxation. To help investors stay compliant and avoid confusion, this article will walk you through Crypto Tax Secrets 2025 Easy Guide to Save Smart. From international tax rules to India’s unique structure, you’ll find everything you need in one place.

Understanding Crypto Taxation Basics

Before diving into country-specific rules, it’s important to understand what Crypto Tax actually means. Governments classify cryptocurrency differently: some treat it as property, others as capital assets, and a few as commodities. In each case, taxation is applied whenever a taxable event occurs. Understanding crypto tax has become crucial for both beginners and seasoned investors, especially in 2025, as regulations continue to evolve rapidly, and failing to comply with tax laws can lead to penalties, audits, and legal complications. Crypto tax refers to the taxation applied to transactions involving cryptocurrencies. This typically includes taxes on capital gains realized when digital assets are sold, traded, or used to purchase goods and services, as well as income tax when cryptocurrencies are received as income (e.g., through mining, staking, airdrops, or as payment for work). Essentially, crypto tax turns various crypto-related actions into taxable events, similar to how traditional assets are treated under tax laws. With proper planning and awareness, one can optimize returns while staying tax-compliant.

Under Crypto Tax Secrets 2025 Easy Guide to Save Smart, the most common taxable events include:

- Selling cryptocurrency for Fiat currency.

- Exchanging one cryptocurrency for another.

- Using crypto to pay for goods or services.

- Mining or staking rewards received as income.

- Airdrops and gifts of digital assets.

The purpose of crypto taxation is not just revenue generation. Governments also aim to ensure transparency in digital financial flows and discourage illegal activities such as money laundering.

Why is the crypto tax imposed?

- To Treat Crypto Like Other Assets

- Governments consider cryptocurrency as a virtual digital asset (VDA), similar to stocks, bonds, or real estate.

- Since profits from these assets are taxed, crypto gains also fall under taxation to ensure fairness.

- Governments consider cryptocurrency as a virtual digital asset (VDA), similar to stocks, bonds, or real estate.

- Revenue Generation for the Government

- With the growing popularity of Bitcoin, Ethereum, and other tokens, massive amounts of money flow into crypto markets.

- Taxing crypto transactions provides governments with a new source of revenue to fund public welfare, infrastructure, and national development.

- With the growing popularity of Bitcoin, Ethereum, and other tokens, massive amounts of money flow into crypto markets.

- Curbing Money Laundering & Illegal Activities

- Cryptocurrencies, due to their decentralized nature, can be misused for black money circulation, terror funding, or illegal trade.

- Imposing taxes along with strict reporting requirements creates a transparent financial trail that discourages misuse.

- Cryptocurrencies, due to their decentralized nature, can be misused for black money circulation, terror funding, or illegal trade.

- Regulating a High-Risk Market

- Crypto markets are volatile and speculative, leading to massive profits or losses.

- By imposing taxes, governments establish control and accountability, reducing risks of fraud and financial instability.

- Crypto markets are volatile and speculative, leading to massive profits or losses.

- Aligning with Global Financial Standards

- Many countries like the USA, UK, Australia, and Japan already tax cryptocurrencies.

- India and other nations impose crypto tax to align with international financial laws and maintain credibility in global trade.

- Many countries like the USA, UK, Australia, and Japan already tax cryptocurrencies.

In short, Crypto tax is imposed to ensure fairness in taxation, prevent illegal activities, generate revenue, regulate risks, and align with global standards.

International Taxes on Crypto

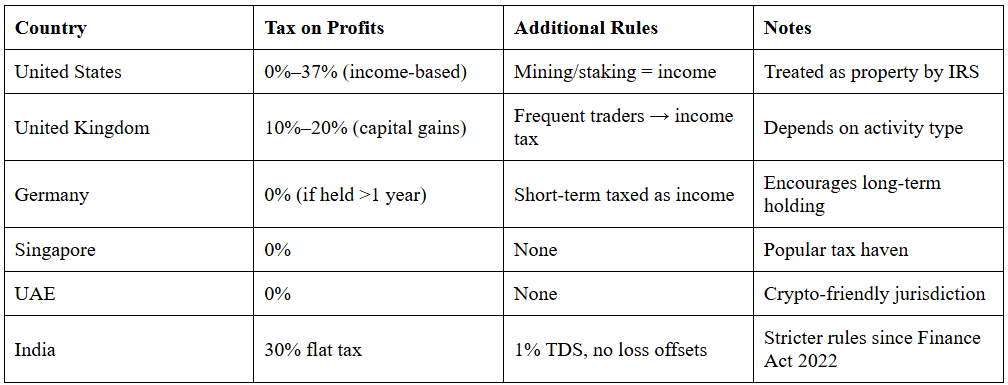

Different countries have adopted different approaches to crypto taxation. Let’s examine some of the key jurisdictions under Crypto Tax Secrets 2025 Easy Guide to Save Smart:

- United States: The IRS treats crypto as property. Depending on income brackets the short-term capital gains are taxed as ordinary income (10%–37%), while long-term gains are taxed at 0%, 15%, or 20%. Mining and staking are treated as income.

- United Kingdom: HMRC requires investors to pay capital gains tax on disposals. Frequent traders may be treated as income earners, paying standard income tax rates.

- Germany: A favorable system.Gains from crypto held for over a year are exempt from tax.Short-term disposals attract regular income tax.

- Singapore & UAE: Both nations have emerged as crypto tax havens. They levy 0% tax on crypto gains, making them highly attractive for global investors.

Comparison Table: Global Crypto Tax Rules vs India (2025)

This comparison in Crypto Tax Secrets 2025 Easy Guide to Save Smart highlights how India stands out as one of the strictest jurisdictions.

India’s Crypto Tax Rules (2025)

India’s taxation framework for crypto was introduced in the Finance Act, 2022, and remains unchanged in 2025. Under Crypto Tax Secrets 2025 Easy Guide to Save Smart, the rules are:

- As per Section 115BBH, every gain from crypto trading is taxed at a uniform rate of 30%.

- Section 194S mandates a 1% tax deducted at source on cryptocurrency transactions above the set limit.

- No deductions allowed except cost of acquisition.

- Under current tax rules, crypto losses cannot be offset either against other virtual digital assets or against non-crypto income.

- Schedule VDA reporting mandatory from FY 2025–26.

This framework has been criticized for being too harsh on retail investors, especially when compared with global norms.

Pros and Cons of Crypto Taxation

Pros

- Provides legitimacy to crypto as an asset class.

- Creates revenue streams for governments.

- Protects investors from fraud and scams through monitoring.

Cons

- High taxation may discourage participation.

- No provisions for loss adjustment discourage risk-taking.

- India’s strict regulations could lead investors to explore foreign exchanges.

Through Crypto Tax Secrets 2025 Easy Guide to Save Smart, investors can clearly see that while regulation brings structure, it also creates hurdles in adoption.

Returns After Investment – Practical Examples

Example 1 – Investor in the US

- Buys Bitcoin at $10,000.

- Sells at $15,000 → Profit = $5,000.

- If long-term → taxed at 15% = $750.

- Net return = $4,250 after applying Crypto Tax Secrets 2025 Easy Guide to Save Smart.

Example 2 – Investor in India

- Buys Bitcoin at ₹1,00,000.

- Sells at ₹1,50,000 → Profit = ₹50,000.

- 30% tax = ₹15,000.

- Net return = ₹35,000 (plus 1% TDS already deducted).

Clearly, Crypto Tax Secrets 2025 Easy Guide to Save Smart shows India’s investors are hit harder compared to many global markets.

Indian Government Access & Laws

The Indian government enforces its rules strictly:

- Section 115BBH imposes 30% tax.

- Section 194S mandates 1% TDS.

- Reporting crypto in ITR is mandatory.

- Non-disclosure can attract heavy penalties, including imprisonment.

- RBI continues to monitor exchanges and digital flows.

Under Crypto Tax Secrets 2025 Easy Guide to Save Smart, compliance is non-negotiable for Indian investors.

National & International Outcomes

Nationally, crypto tax helps India monitor financial transactions and build government revenue. However, it is a risk discouraging innovation and pushing startups abroad.

Internationally, Crypto Tax Secrets 2025 Easy Guide to Save Smart reveals that countries with lighter tax regimes attract more talent and investments, while stricter nations see lower participation. There’s also an increasing push for a uniform global tax framework.

Conclusion

Cryptocurrency taxation is now unavoidable. Some countries encourage adoption with lower taxes while India has taken a stricter path.The key to successful investing lies in being informed. Crypto Tax Secrets 2025 Easy Guide to Save Smart empowers you with the knowledge of global and Indian rules, the pros and cons, and real-life returns. By staying compliant and planning wisely, investors can navigate the challenges of crypto taxation while still benefiting from the opportunities that digital assets present.

I’m an enthusiastic content writer passionate about crypto and digital finance. I love creating clear, engaging, and easy-to-understand content that helps readers learn, explore, and grow in the world of crypto and side income.