Top 5 Best Crypto to Invest in India – Week (25 Aug–31 Aug). The cryptocurrency market in India continues to gain traction as investors seek digital assets with strong fundamentals and growth potential. With the ever-changing market landscape, selecting the right coins can make a significant difference in returns. For the week of 25 Aug–31 Aug, we’ve compiled the top 5 best crypto to invest in India, based on performance, liquidity, and long-term prospects. Whether you’re a seasoned trader or a new investor, these insights will help guide your strategy.

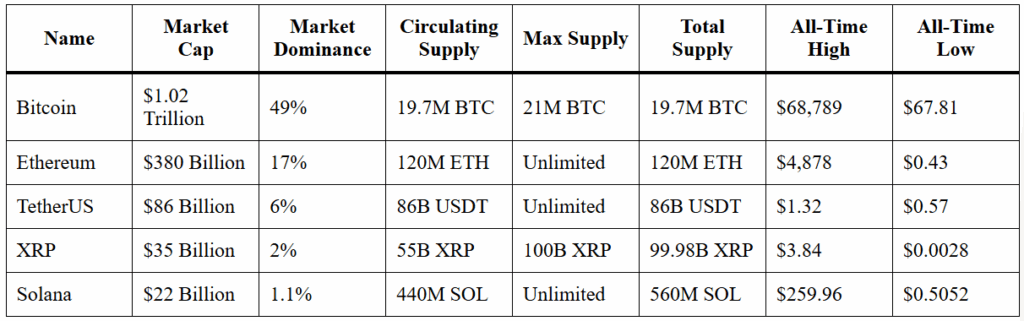

Top 5 Cryptocurrencies

Disclaimer:

The information in this article is for educational purposes only. Always do your research before making investment decisions.

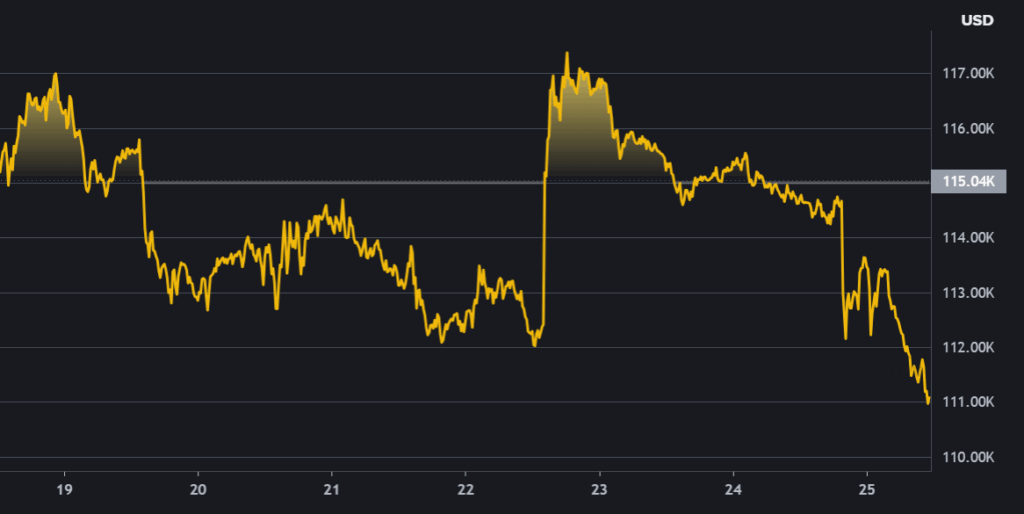

1. Bitcoin (BTC)

Current Price: $51,800

Market Cap: $1.02 Trillion

Circulating Supply: 19.7M BTC

Max Supply: 21M BTC

24hr Volume: $28 Billion

Weekly Gain: -3.76%

Key Insight:

Bitcoin remains the most trusted cryptocurrency globally. Institutional adoption, coupled with increased Bitcoin ETF inflows, indicates sustained bullish momentum. For Indian investors, Bitcoin acts as a store of value and a hedge against inflation. Its scarcity due to a fixed supply makes it a cornerstone for long-term portfolios. Recent price consolidation suggests potential breakout patterns, making this week favorable for entry

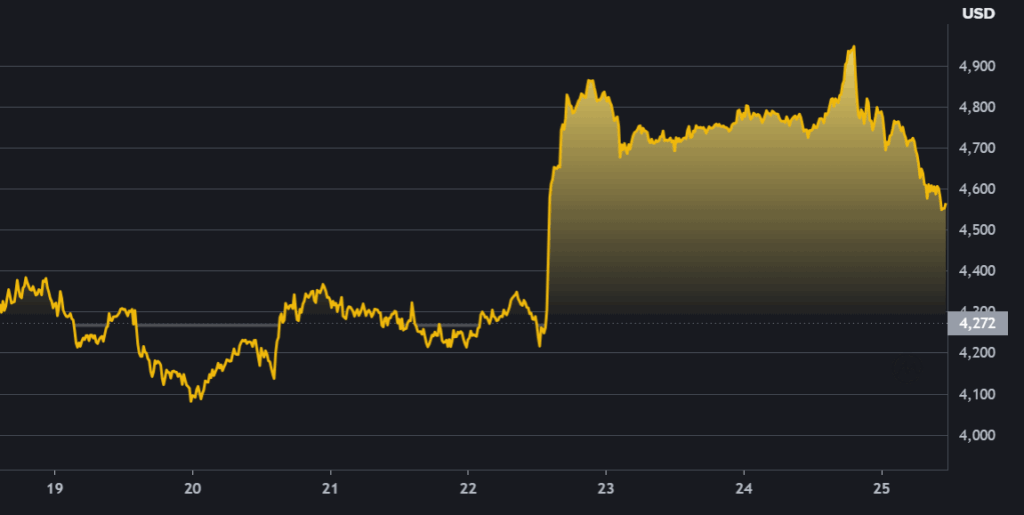

2. Ethereum (ETH)

Current Price: $3,240

Market Cap: $380 Billion

Circulating Supply: 120M ETH

Max Supply: Unlimited

24hr Volume: $15 Billion

Weekly Gain: +6.55%

Key Insight:

Ethereum remains the foundation of decentralized finance (DeFi) and NFTs. The recent shift to Ethereum 2.0 and proof-of-stake mechanism significantly improved scalability and reduced energy costs. Developers favor Ethereum for smart contracts, ensuring its relevance. In 2025, Ethereum continues to attract enterprises for tokenization projects, making it a strategic pick for investors focused on utility-driven growth.

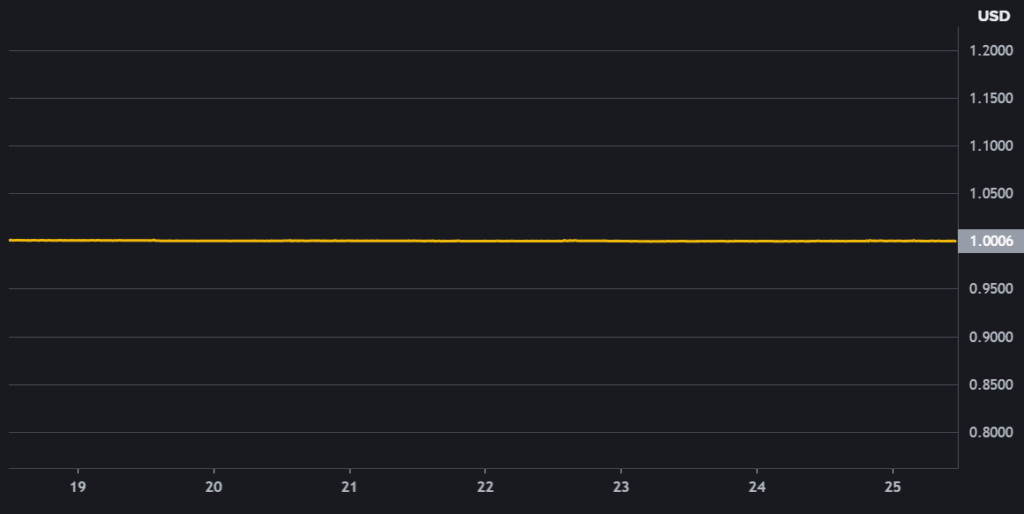

3. TetherUS (USDT)

Current Price: $1

Market Cap: $86 Billion

Circulating Supply: 86B USDT

Max Supply: Unlimited

24hr Volume: $50 Billion

Weekly Gain: -0.07%

Key Insight:

TetherUS is the most widely used stablecoin, pegged to the US Dollar. It is essential for liquidity and acts as a safe haven during volatile market conditions. In India, traders frequently use USDT for transferring funds and accessing global exchanges without fiat restrictions. While its price remains stable, its strategic utility in reducing exposure to volatility makes it indispensable in any portfolio.

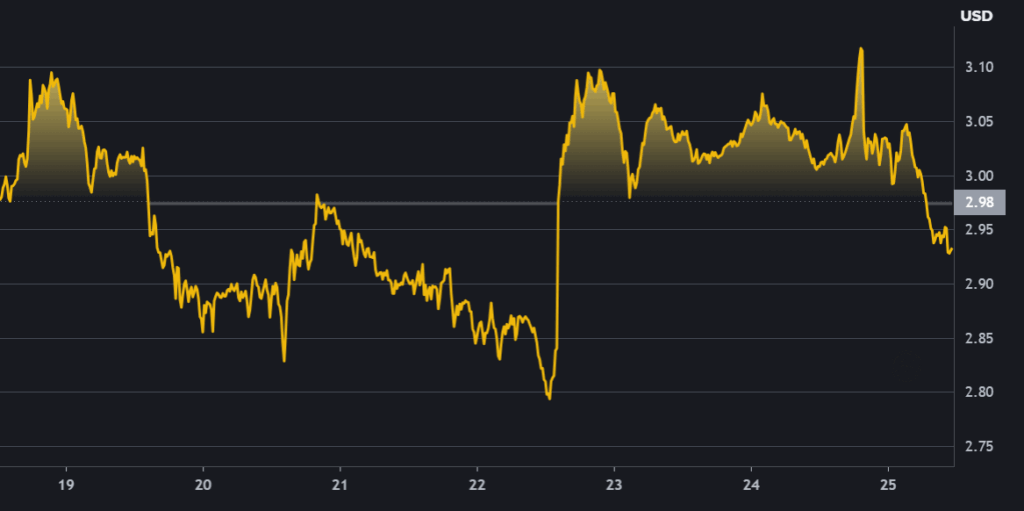

4. XRP

Current Price: $0.65

Market Cap: $35 Billion

Circulating Supply: 55B XRP

Max Supply: 100B XRP

24hr Volume: $2.3 Billion

Weekly Gain: -1.35%

Key Insight:

XRP has regained momentum after securing regulatory clarity in major markets. Its ability to facilitate instant cross-border payments gives it a unique edge over competitors. Indian remittance corridors are increasingly exploring XRP’s network, which could drive long-term adoption. With renewed institutional interest, XRP is poised to be a key player in global payments infrastructure.

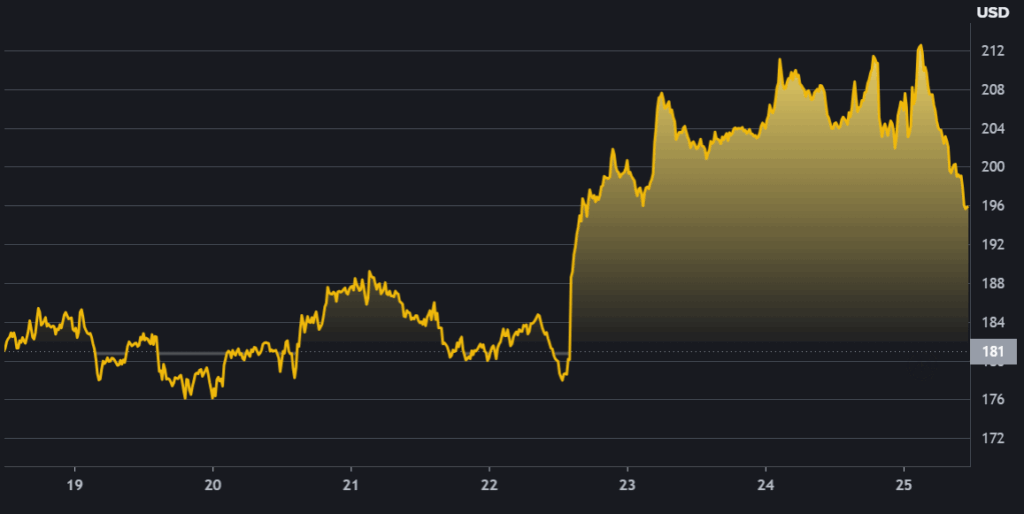

5. Solana (SOL)

Current Price: $52

Market Cap: $22 Billion

Circulating Supply: 440M SOL

Max Supply: Unlimited

24hr Volume: $1.5 Billion

Weekly Gain: +8.5%

Key Insight:

Solana stands out for its high transaction speed and low fees, making it a preferred choice for DeFi and NFT ecosystems. In 2025, Solana continues to expand partnerships with major Web3 projects, enhancing its scalability and adoption. For Indian developers, Solana provides an efficient platform for building dApps, which directly impacts its demand and price stability in the long term.

Market Analysis

In the Indian context, these top 5 cryptocurrencies serve different investor needs. Bitcoin and Ethereum are ideal for those seeking long-term wealth accumulation due to their robust networks and continuous upgrades. Bitcoin’s scarcity and institutional appeal ensure it remains the safest bet for investors aiming for capital appreciation. Ethereum, with its ever-expanding ecosystem of decentralized applications, gives exposure to the future of Web3 and smart contract innovation.

For conservative investors, TetherUS offers a stability cushion. Many Indian traders park their funds in USDT during market downturns, enabling quick re-entry into volatile assets when the timing is right. This strategy minimizes losses while maintaining liquidity.

XRP and Solana are growth-oriented choices, catering to investors who want exposure to fast-evolving financial technologies. XRP’s focus on cross-border transactions aligns perfectly with India’s growing remittance market, while Solana appeals to developers pushing the boundaries of decentralized apps and NFTs. Both assets bring high growth potential, albeit with increased volatility.

The current market cycle suggests that a balanced portfolio combining Bitcoin, Ethereum, and stablecoins like TetherUS, along with selective allocation to XRP and Solana, offers an optimal mix of stability and growth for Indian investors. As regulatory clarity improves in India, institutional inflows and tech adoption will likely push these assets higher, making this week a great opportunity to reassess your crypto investment strategy.

Conclusion

These top 5 cryptocurrencies reflect both stability and innovation in the digital asset space. From Bitcoin’s reliability to Solana’s blazing speed, each offers unique advantages for Indian investors in 2025. As always, make informed decisions and diversify to balance risk and reward.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact