Crypto Market Movers: Top 3 Gainers and Losers in 24 Hours. The cryptocurrency market witnessed a rollercoaster ride in the past 24 hours, with some tokens experiencing massive gains while others faced sharp declines. Ontology and Qtum led the bullish side, while Haedal Protocol and Maple Finance struggled in the bearish zone.

Here’s a breakdown of the top 3 gainers and losers, complete with reasons for the moves and detailed performance charts.

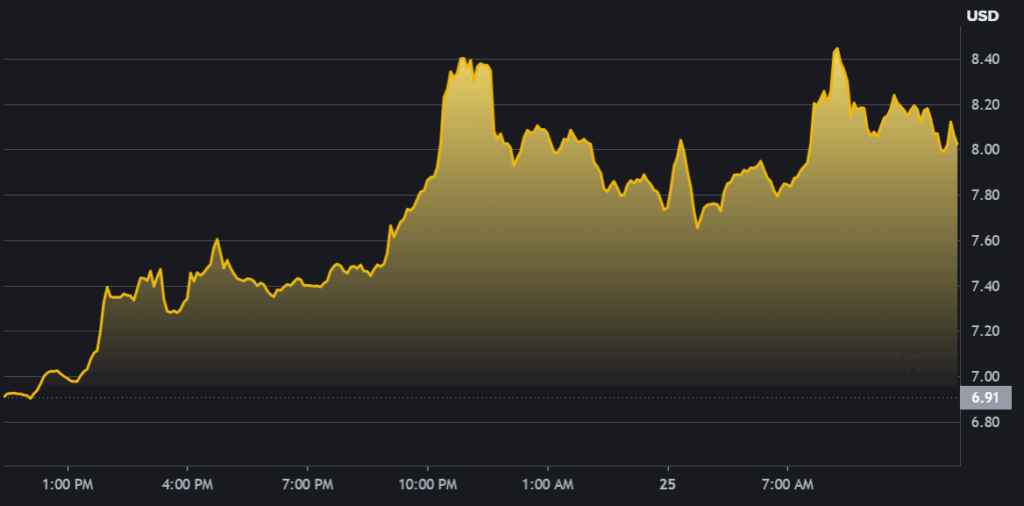

Top 3 Gainers (24h Performance)

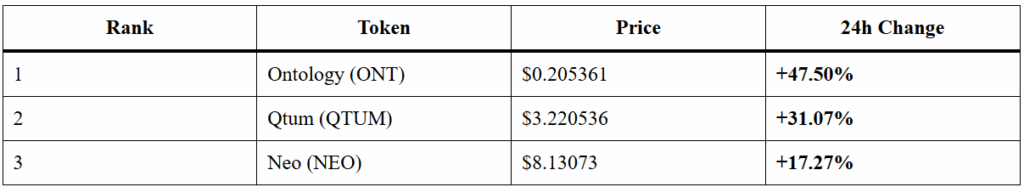

1. Ontology (ONT) – +47.50%

Reason:

Ontology’s rally is fueled by a major partnership in the decentralized identity space, driving investor confidence and network activity. The price surged from $0.139 to $0.205, adding strong bullish momentum. Increased trading volumes and whale accumulation further strengthened its growth.

Performance Chart:

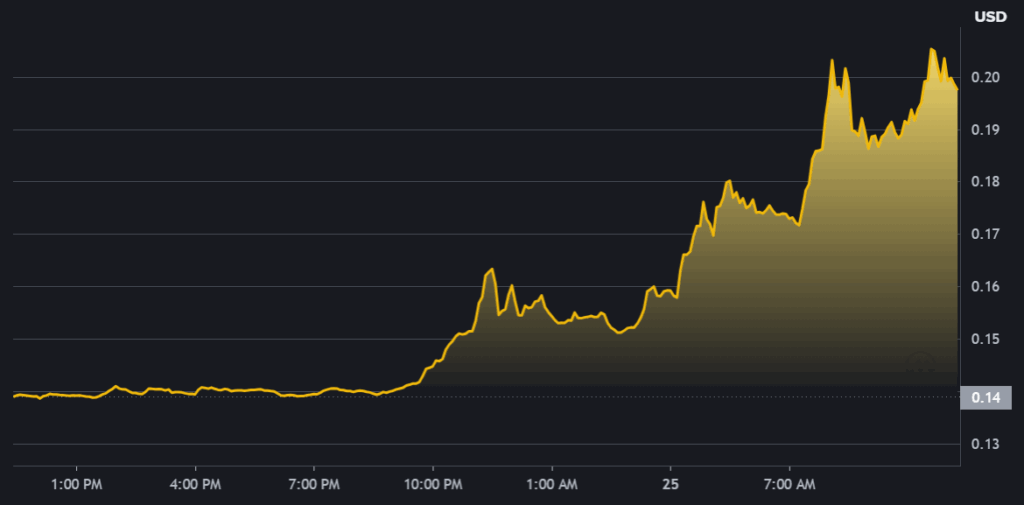

2. Qtum (QTUM) – +31.07%

Reason:

Qtum saw a price boost after launching its new staking protocol, offering high rewards and attracting large stakers. The token jumped from $2.46 to $3.22, signaling strong investor interest. Social media buzz and increased on-chain transactions added fuel to the rally.

Performance Chart:

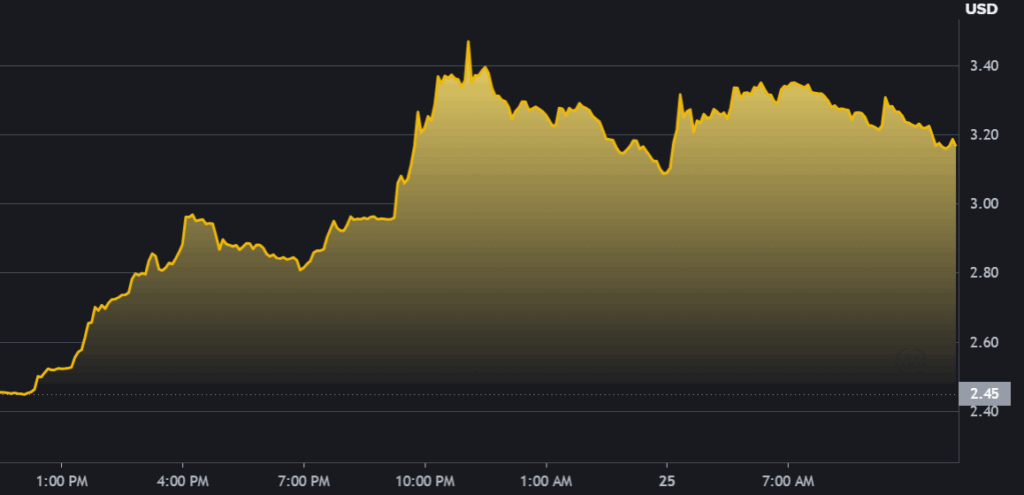

3. Neo (NEO) – +17.27%

Reason:

Neo’s integration with Web3 apps and developer-friendly tools led to increased adoption and bullish momentum. The token climbed from $6.93 to $8.13, showing sustained demand from institutional and retail investors. This upward move also reflects growing confidence in Neo’s smart contract ecosystem..

Performance Chart:

Top 3 Losers (24h Performance)

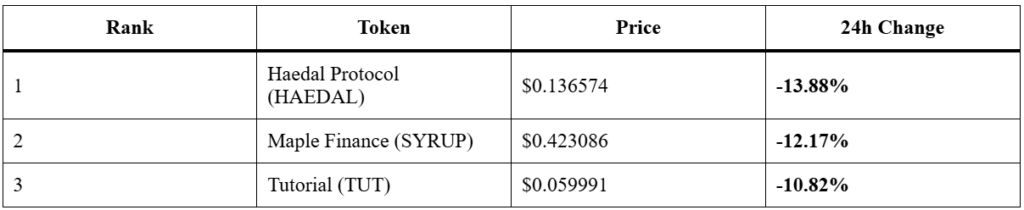

1. Haedal Protocol (HAEDAL) – -13.88%

Reason:

Liquidity concerns and a delayed audit raised red flags among investors, leading to a sell-off. The token price fell from $0.158 to $0.136, indicating panic selling. Limited buy support and negative community sentiment worsened the decline.

Performance Chart:

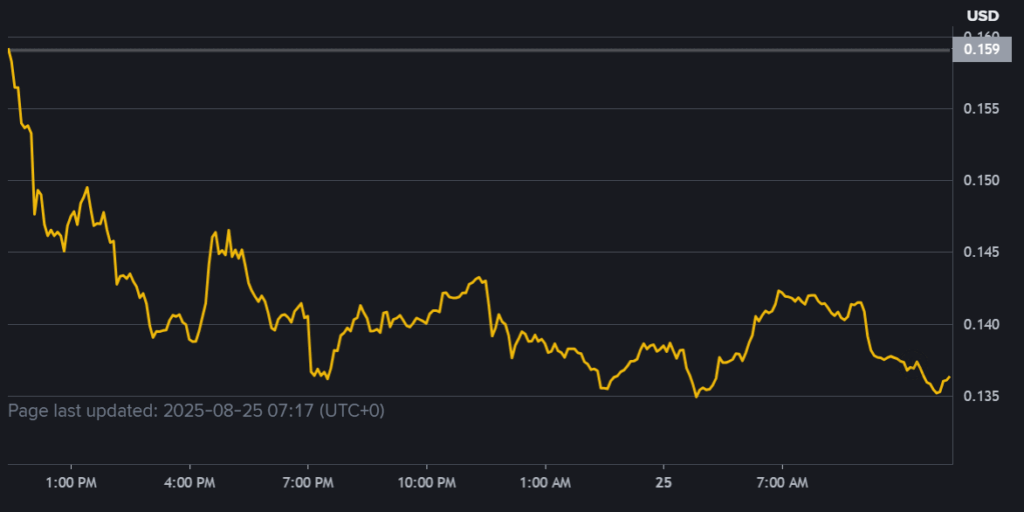

2. Maple Finance (SYRUP) – -12.17%

Reason:

Reports of loan defaults on Maple’s platform triggered a risk-off sentiment, dragging prices down. SYRUP dropped from $0.482 to $0.423, amplifying bearish pressure. Market makers pulled liquidity, making it harder for recovery in the short term.

Performance Chart:

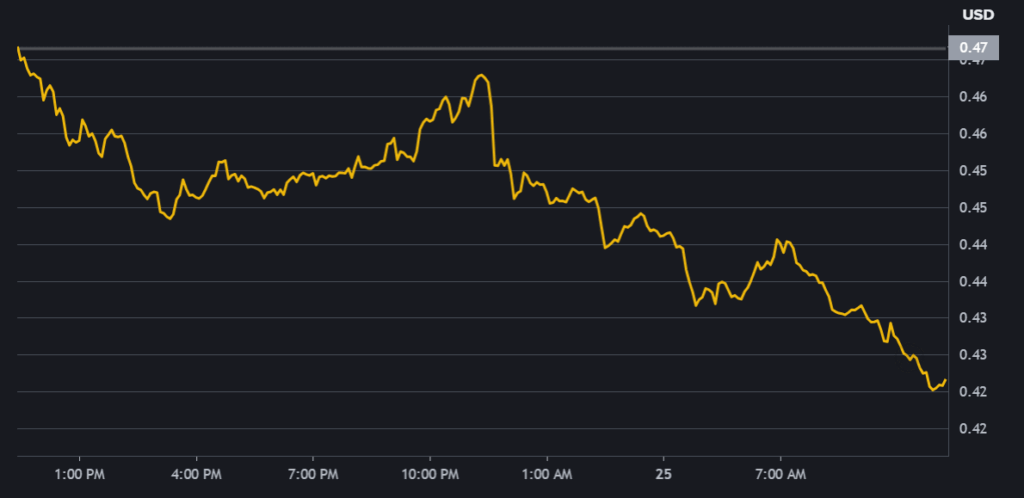

3. Tutorial (TUT) – -10.82%

Reason:

Weak fundamentals and heavy profit-taking after last week’s gains caused a downward spiral. The price slipped from $0.067 to $0.059, suggesting fading investor interest. Lack of new partnerships and low developer activity added to the selling pressure.

Weak fundamentals and heavy profit-taking after last week’s gains caused a downward spiral.

Performance Chart:

Market Outlook

The market shows mixed signals:

- Bullish: Ontology, Qtum, and Neo are trending up due to strong partnerships and ecosystem upgrades.

- Bearish: Haedal, Maple, and Tutorial face liquidity, credit risk, and weak demand challenges.

Investor Tip:

Focus on fundamentally strong projects and avoid panic selling during volatile phases. Know daily Top 3 Gainer and Loser performance here.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact