Cryptocurrency Adoption Rises Among Asia’s Wealthy Investors. Over the past few years, the financial landscape in Asia has undergone a remarkable transformation. One of the most notable trends is the increasing adoption of cryptocurrency by high-net-worth individuals (HNWIs). Traditionally, Asia’s wealthy investors relied heavily on real estate, equities, and fixed-income assets to secure their wealth. However, with global markets evolving and technology reshaping financial ecosystems, cryptocurrencies have emerged as a key component in portfolio diversification.

This article explores why cryptocurrency adoption rises among Asia’s wealthy investors, what drives this trend, the benefits and risks involved, and how this shift compares to traditional investment avenues.

Why Asia’s Wealthy Are Turning to Cryptocurrency

1. Portfolio Diversification

One of the primary reasons for this trend is diversification. High-net-worth investors in Asia understand the importance of spreading risk across various asset classes. Cryptocurrencies, though volatile, present an uncorrelated asset that can potentially deliver significant returns.

2. Hedge Against Inflation

With economic uncertainties and currency fluctuations, particularly in emerging Asian economies, digital assets are increasingly viewed as a hedge against inflation. Bitcoin, for example, is often referred to as “digital gold,” attracting investors seeking long-term value preservation.

3. Growing Institutional Support

Another factor boosting confidence is institutional involvement. Major financial firms and family offices in Asia are entering the crypto space, legitimizing digital assets and making them more appealing to conservative investors.

4. Regulatory Clarity in Key Markets

Several Asian countries, including Singapore and Hong Kong, have introduced regulatory frameworks for crypto trading and custody services. These measures provide a secure environment, making wealthy investors more comfortable allocating funds to digital assets.

Popular Cryptocurrencies Among Asia’s Wealthy Investors

While Bitcoin remains the most popular choice, Ethereum and other altcoins are also gaining traction. Here are the top choices:

- Bitcoin (BTC): Often considered a safe store of value.

- Ethereum (ETH): Popular for decentralized finance (DeFi) and NFTs.

- Stablecoins: Used to minimize volatility in crypto holdings.

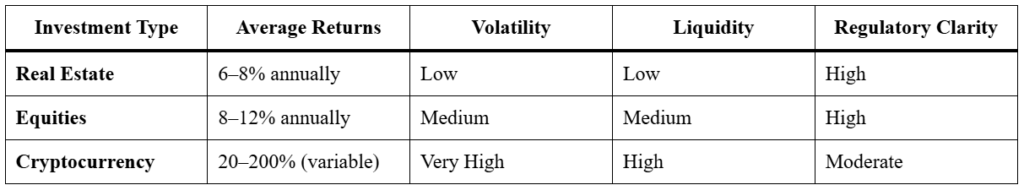

Comparison: Traditional Investments vs. Cryptocurrency

Note: Returns vary based on market conditions and investment strategy.

Benefits of Cryptocurrency Adoption for Wealthy Investors

- High Growth Potential

Unlike traditional investments, cryptocurrencies have shown exponential growth potential, offering substantial returns to early adopters. - Access to Emerging Financial Innovations

By investing in crypto, wealthy individuals can participate in DeFi platforms, NFTs, and Web3 innovations, expanding beyond conventional asset classes. - Global Accessibility

Cryptocurrencies provide borderless transactions, ideal for investors managing assets across multiple countries.

Risks and Challenges

Despite the benefits, there are risks:

- High Volatility: Price swings can result in significant losses.

- Regulatory Uncertainty: While some countries have clear regulations, others impose restrictions or sudden policy changes.

- Security Concerns: Crypto wallets and exchanges can be vulnerable to hacks if not properly secured.

Wealth managers often recommend limiting crypto exposure to 5–10% of the overall portfolio to manage risk effectively.

How Wealth Managers Are Responding

Private banks and wealth management firms in Asia are adapting to meet client demand. Many now offer crypto advisory services, custodian solutions, and structured products linked to blockchain technology. This shift highlights a broader acceptance of digital assets as part of sophisticated investment strategies.

Future Outlook: Will This Trend Continue?

Industry experts predict continued growth in crypto adoption among Asia’s affluent class. With Web3 innovations, tokenized assets, and blockchain-based financial products gaining traction, wealthy investors are expected to allocate even larger portions of their portfolios to digital assets.

Furthermore, as central banks in Asia explore Central Bank Digital Currencies (CBDCs), the legitimacy of digital finance will strengthen, encouraging more high-net-worth individuals to embrace cryptocurrency investments.

Conclusion

Cryptocurrency adoption rises among Asia’s wealthy investors for a reason: diversification, inflation hedging, and exposure to emerging technologies. While risks remain, proper planning and professional guidance can help investors capitalize on the growth potential of digital assets without jeopardizing financial stability.

For those looking to stay ahead, combining traditional wealth-building strategies with a calculated crypto allocation may be the smartest move in today’s evolving economic landscape.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact