Cryptocurrency has evolved from a niche tech experiment to a growing global financial asset. In just over a decade, digital currencies have shifted from being ignored by traditional finance to becoming a serious topic of discussion among governments, corporations, and everyday investors. Once viewed with skepticism, cryptocurrencies are now seen as both an opportunity and a challenge to the global financial system.

Among all forms of digital assets, cryptocurrency investment has become one of the most popular and talked-about opportunities. Some see it as a ticket to wealth, while others view it as a risky gamble. In this guide, we’ll explore everything you need to know about cryptocurrency investment in 2025, from the basics and history to benefits, risks, strategies, and future trends.

What is Cryptocurrency Investment?

At its core, cryptocurrency is a digital form of money that uses blockchain technology to ensure security, transparency, and decentralization. Central banks do not issue cryptocurrencies unlike traditional currencies. Instead, they operate on peer-to-peer networks where transactions are validated by users through cryptography.

Popular cryptocurrencies include Bitcoin, Ethereum, Ripple, Cardano, and Solana, along with thousands of smaller altcoins.

When we talk about cryptocurrency investment, it refers to purchasing these digital assets with the expectation that their value will rise over time. Some investors buy and hold coins for long term profits, while others trade actively for short-term profits.

Why Has Cryptocurrency Investment Become Popular?

Cryptocurrency Investment’s popularity can be traced to multiple factors:

- High Return Potential – Bitcoin turned early adopters into millionaires, and coins like Ethereum gave massive returns, drawing attention worldwide.

- Decentralization – Unlike stocks or bonds, no single authority controls cryptocurrencies.

- Accessibility – With just a smartphone, internet, and ₹100, anyone can step into the world of investing.

- Innovation – Technologies like smart contracts, NFTs, and DeFi (Decentralized Finance) make crypto more than just “digital money.”

Benefits of Cryptocurrency Investment

- Portfolio Diversification – Adding crypto reduces reliance on traditional assets like stocks and gold.

- Liquidity – Major cryptocurrencies can be bought or sold instantly, 24/7, across the globe.

- Inflation Hedge – Bitcoin, with its limited supply of 21 million coins, is often seen as “digital gold.”

- Direct Ownership – With wallets, investors control their assets without needing a middleman.

- Global Reach – Crypto isn’t bound by borders; it allows participation in a global economy.

Risks of Cryptocurrency Investment

While exciting, cryptocurrency investment comes with significant risks:

- Extreme Volatility – Prices can change drastically within minutes.

- Regulatory Uncertainty – Governments worldwide are still debating how to regulate cryptocurrencies.

- Security Threats – Though blockchain is secure, exchanges and wallets have been hacked.

- Scams & Frauds – Fake projects and Ponzi schemes exist in the market.

- Lack of Awareness – Many beginners invest blindly, often falling for hype.

The golden rule: Never invest money you can’t afford to lose.

Types of Cryptocurrency Investment

There are multiple ways to invest:

- Buying and Holding (HODLing) – Long-term strategy, waiting for price appreciation.

- Trading – Short-term buying and selling to profit from volatility.

- Staking – Locking your coins in a blockchain network to help it run smoothly, and in return, you earn rewards, almost like earning interest on savings.

- Mining – Using computer power to generate new coins.

- DeFi & NFTs – Investing in decentralized finance platforms or unique digital assets.

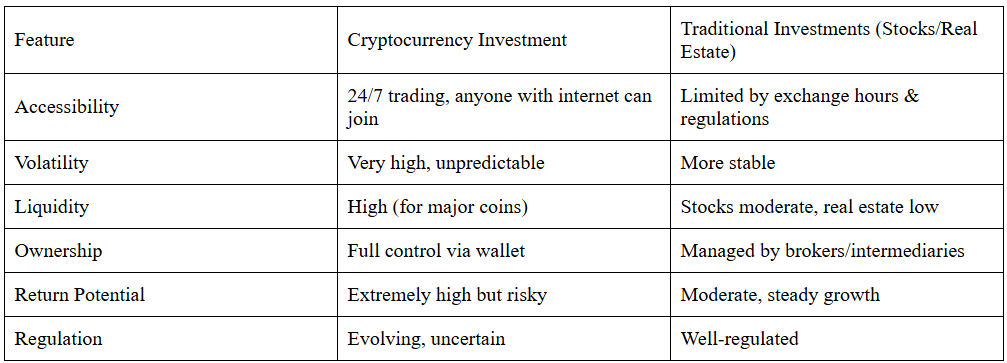

Cryptocurrency vs. Traditional Investments

This comparison shows why cryptocurrency investment excites investors, but also why caution is needed.

Strategies for Successful Cryptocurrency Investment

- Do Your Research (DYOR) – Study a coin’s purpose, technology, and credibility before investing.

- Diversify Portfolio – Don’t invest everything in one coin. Spread across multiple assets.

- Manage Risk – Set a budget; only invest what you can afford to lose.

- Use Trusted Platforms – Stick to reliable exchanges like WazirX, CoinDCX, Binance, or Coinbase.

- Stay Updated – The crypto space shifts fast, and staying tuned to news and market trends helps you make smarter moves.

A Brief History of Cryptocurrency in India

- 2013 – Crypto entered India with exchanges like Unocoin (Bangalore) and ZebPay (Ahmedabad).

- 2017 – Bitcoin crossed ₹65,000, sparking massive interest among Indian investors.

- 2018 – RBI banned banks from dealing with crypto businesses.

- 2020 – Supreme Court lifted the ban, reviving the industry.

- 2021 – India saw a huge boom in retail participation, with exchanges like WazirX and CoinDCX growing rapidly.

- 2022 – Government imposed 30% tax on crypto income and 1% TDS on trades, signaling partial recognition.

- 2023–2025 – Despite heavy taxation, India remains one of the top countries in crypto adoption, especially among youth.

The Global Crypto Landscape in 2025

As of 2025, cryptocurrency investment trends include:

- Bitcoin ETFs are gaining traction in the U.S. and Europe.

- CBDCs (Central Bank Digital Currencies) under development by countries like China and India.

- Institutional Investment – Major companies are adding Bitcoin and Ethereum to their balance sheets.

- AI + Blockchain Integration – Creating new possibilities in finance and data security.

- Web3 & Metaverse – Driving innovation and expanding the role of crypto in daily life.

Future of Cryptocurrency Investment

The future looks promising yet uncertain. Regulation will play a key role, balancing investor protection with innovation. Adoption by banks, businesses, and governments will continue to grow, but volatility will remain.

For investors, the mantra should be patience, strategy, and knowledge.

Key Takeaways

- Cryptocurrency Investment is a high-risk, high-reward investment.

- It offers diversification, liquidity, and global accessibility.

- Risks include volatility, regulations, and scams.

- Research, diversification, and risk management are essential.

- India is emerging as a major player in the global crypto space.

Conclusion

Cryptocurrency investment is no longer a passing trend, it has become a serious part of the financial future. While it offers the possibility of massive returns and innovative opportunities, it also demands responsibility, awareness, and caution.

The best approach is to balance curiosity with caution: learn the basics, start small, diversify, and keep updated with trends. Whether you are a beginner or a seasoned investor, crypto can be rewarding if approached wisely.

As we step into 2025 and beyond, cryptocurrency will continue to shape how we think about money, ownership, and financial independence. The question isn’t whether crypto will survive, it’s how well you prepare yourself to be part of its journey.

I’m an enthusiastic content writer passionate about crypto and digital finance. I love creating clear, engaging, and easy-to-understand content that helps readers learn, explore, and grow in the world of crypto and side income.