Smart & Secure Earning with Bitcoin Suisse Crypto Staking is a straightforward way to earn passive income from proof-of-stake assets while keeping a Swiss touch. As part of our Earn with crypto series, this guide explains how Bitcoin Suisse crypto staking works, what you can earn, and how to set up a repeatable process. Throughout, we focus on clarity so traders and researchers can evaluate Bitcoin Suisse crypto staking with confidence.

What is Bitcoin Suisse Crypto Staking?

Bitcoin Suisse crypto staking means delegating supported proof-of-stake coins to institutional validator nodes operated by Bitcoin Suisse so the network can process blocks. In return, you receive protocol rewards. With Bitcoin Suisse crypto staking, the provider handles node uptime, slashing prevention, and reward distribution so you don’t need to run infrastructure. The service is designed for both private clients and institutions who prefer a regulated counterparty in Switzerland.

Why Choose Bitcoin Suisse for Staking?

When comparing providers, the key questions are security, operational excellence, and transparency. Bitcoin Suisse crypto staking emphasizes all three:

- Swiss oversight and reputation – Strong compliance and clear onboarding build trust.

- Institutional validators – Professionally run nodes target high uptime and stable rewards.

- Flexible custody – Choice of secure custody arrangements, with segregated accounts and reporting.

- Simple accounting – Consolidated statements help auditors and researchers.

- Support for multiple assets – You can diversify beyond a single chain while keeping one provider.

Earning Potential with Bitcoin Suisse

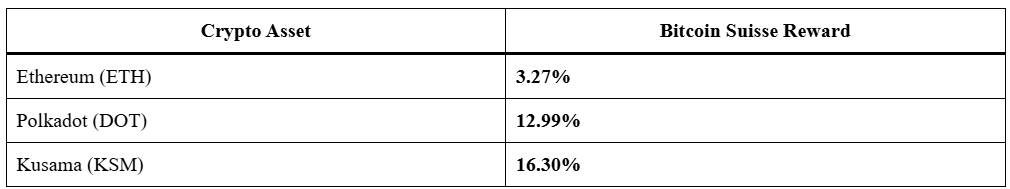

One of the biggest advantages of Bitcoin Suisse crypto staking is attractive reward rates on supported assets. Here is a current snapshot of yields available through the platform:

Rates fluctuate by network conditions, but these figures illustrate why many holders choose Bitcoin Suisse crypto staking to turn idle coins into an income stream.

Earning Structure: How Rewards Become Take-Home Yield

Understanding the flow from gross protocol rewards to your credited balance makes it easier to forecast and audit performance.

1) Gross protocol reward (APR/APY) – Each chain emits inflation or fees to stakers. Published figures, such as 12.99% for DOT or 16.30% for KSM, are the starting point.

2) Validator commission – Validators typically keep a small percentage of rewards for operating the nodes. This is deducted before rewards hit your account.

3) Service or custody fees – A provider may charge a separate service fee. Always confirm the current schedule in your mandate.

4) Payout cadence and compounding – Rewards may accrue daily, weekly, or per epoch. If you restake them, your effective APY rises compared to simple APR.

5) Lock-ups and unbonding – Some networks impose an activation delay and an unbonding period. During unbonding you usually stop earning.

6) Slashing risk management – Professional validators implement monitoring and key management to minimize slashing. Review any risk-sharing or insurance terms.

7) Tax treatment and reporting – Depending on your jurisdiction, rewards may be taxable on receipt. Accurate statements simplify filings.

Useful formula (illustrative):

Net annual yield ≈ (Gross protocol APR × (1 − validator commission)) − service fees.Price changes of the underlying coin are separate from staking yield and affect portfolio value.

Illustrative scenario (numbers for demonstration only): You stake 1,000 DOT at 12.99% gross. If validator commission were 10% of rewards and service fees were 1% of rewards, your net reward would be roughly 12.99% × 0.90 × 0.99 ≈ 11.57%, or ~115.7 DOT for the year, before taxes. Always check your actual agreed fees. This framework applies across assets and helps evaluate Bitcoin Suisse crypto staking alongside alternatives.

Step-by-Step: Earning with Bitcoin Suisse

Follow this checklist to establish a clean, auditable staking workflow.

Onboard and verify. Complete KYC/AML, funding source declarations, and choose custody preferences.

Choose your asset mix. Decide weights for ETH, DOT, KSM, and others based on risk tolerance and time horizon.

Fund your account or transfer coins. Move assets you wish to stake. Maintain a buffer for network fees where applicable.

Initiate staking. Instruct the provider to stake specific balances. For chains with activation delays, note the date when rewards start.

Track accruals. Use dashboards and statements to monitor credited rewards, effective APY, and validator performance.

Enable compounding. If available, opt to restake rewards periodically. Compounding can lift effective returns over time.

Manage liquidity. Record unbonding periods (e.g., days or weeks) for each asset and plan exits accordingly.

Review fees and limits quarterly. Confirm commission levels, service fees, and any minimum balance requirements.

Rebalance. Shift allocations between networks as conditions change while keeping risk in check.

Document for taxes and audit. Export annual reports, reward histories, and wallet proofs for compliance. Completing these steps creates a repeatable process for Bitcoin Suisse crypto staking that suits both professional portfolios and long-term holders.

Owner, Founding Team & Establishment Year

Bitcoin Suisse was founded in 2013 in Zug, Switzerland (Crypto Valley) by entrepreneur Niklas Nikolajsen. Over the last decade the firm has expanded into a full-service crypto financial intermediary with trading, custody, and staking solutions.

Benefits at a Glance

- Regulated Swiss counterparty for institutional and private clients.

- Professional validator operations and monitoring.

- Clear statements for accounting and research.

- Multi-asset support to diversify staking income.

Key Risks to Weigh

- Market risk: Coin prices can move sharply and affect portfolio value.

- Operational risk: Downtime or slashing events can reduce rewards, though professional setups aim to minimize them.

- Liquidity risk: Unbonding delays reduce flexibility during exits.

- Regulatory risk: Staking rules and tax treatment evolve across jurisdictions. Risk-aware position sizing and diversification help align Bitcoin Suisse crypto staking with broader portfolio goals.

Who Should Consider This?

- Long-term holders who prefer yield to trading.

- Funds and treasuries seeking a regulated operational partner.

- Analysts and researchers who need transparent, auditable reporting.

- Beginners who want a guided path into staking without running hardware. If you value stability, reporting clarity, and professional operations, Bitcoin Suisse crypto staking is a strong fit.

Pro Tips to Maximize Earnings

- Automate compounding: If your mandate allows auto-restaking, enable it so rewards from Bitcoin Suisse crypto staking start earning on day one.

- Stagger unbonding: Split allocations so parts of your Bitcoin Suisse crypto staking positions unlock at different times, improving liquidity.

- Monitor validator metrics: High uptime and low missed blocks support steady Bitcoin Suisse crypto staking results.

- Set policy limits: Define maximum exposure per chain for your Bitcoin Suisse crypto staking strategy to avoid concentration risk.

- Keep fee notes: Track any changes to commissions in your Bitcoin Suisse crypto staking agreement; small differences compound over time.

Compliance & Reporting Checklist

- Retain onboarding documents and service terms for Bitcoin Suisse crypto staking.

- Export monthly and annual reward statements.

- Record activation dates, unbonding requests, and payout timestamps for Bitcoin Suisse crypto staking positions.

- Maintain a price feed snapshot methodology for valuing rewards from Bitcoin Suisse crypto staking at receipt time.

Use Cases & Scenarios

- Treasury management: A project treasury can use Bitcoin Suisse crypto staking to earn while keeping assets custodied with a Swiss provider.

- Hedged long holders: Investors long the asset can pair Bitcoin Suisse crypto staking with risk controls and cash buffers.

- Research portfolios: Analysts can benchmark Bitcoin Suisse crypto staking against self-run validators to test cost/benefit.

With disciplined execution, Bitcoin Suisse crypto staking can complement trading strategies by adding a predictable yield line to P&L. For long-horizon investors, Bitcoin Suisse crypto staking also reinforces network security while compounding holdings.

Final Thoughts

As proof-of-stake matures, professionally run services help convert idle balances into yield. Bitcoin Suisse crypto staking delivers a simple path to participate in network security while earning. Combine prudent diversification, compounding, and disciplined risk controls, and Bitcoin Suisse crypto staking can become a durable income pillar in a modern crypto portfolio.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.