Let’s admit, financial investments have never been easy. It can be time-consuming and requires hands-on experience, substantial upfront capital, and your undivided attention.

In recent years, cryptocurrency investments have emerged as one of the most popular avenues to generate steady and high returns, offer flexibility, and do not always involve active crypto trading.

Whether you are a seasoned trader or a casual investor, simple strategies can help you earn passive crypto income without frequent market monitoring, professional expertise, or unnecessary stress.

Too lazy to trade? Earn crypto passively with these 5 proven ways and convert your crypto holdings into steady returns. Intrigued? Let’s explore.

What is Passive Crypto Income?

Passive income is a secondary source of money or income that does not require active participation, hefty investments, or resources. Individuals can put in minimal effort and time and earn without actively working or managing assets.

Similarly, crypto offers multiple ways to earn passively and enjoy long-term returns with the help of staking, yield farming, or play-to-earn games. This is an excellent opportunity for “lazy” investors or “busy” people who want to generate passive crypto income without actual trading, buying, or selling digital assets.

In addition, since these investments do not always involve high stakes, they can offset portfolio risks and financial losses and safeguard your crypto holdings from market volatility.

Earn Crypto Passively with these 5 Proven Ways

You do not have to be an expert to grow your passive crypto income. Understanding the crypto industry and choosing the correct strategy can boost your income.

Here are the 5 proven ways to earn passive crypto income:

Staking

Crypto staking is one of the most popular ways to generate passive income.

In this method, you “stake” or lock a certain amount of crypto in a digital wallet. These “staked cryptocurrencies” support the operations or validate transactions of proof-of-stake-based blockchain networks like Ethereum, Cardano, or Solana. As a stakeholder, you receive regular staking rewards.

Some popular platforms for staking are Binance, KuCoin, and Coinbase.

Staking can be broadly classified into:

- Direct staking: You lock your crypto assets into the blockchain network and become an active participant. You validate transactions and contribute to enhancing network security and performance. In return, the network gives you rewards. This needs a relatively high entry fee and technical expertise.

- Delegated staking: As the name implies, you delegate staking authority to a trusted validator who stakes on your behalf. This is less time-consuming. The rewards are low and shared between you (the delegator) and the validator.

- Pool staking: A group or pool of stakeholders accumulates their staking resources or crypto holdings to share the rewards.

Factors that influence staking rewards:

- Holding period: The longer the lock-up or holding period, the more the yields.

- Total amount staked: The reward is directly related to the amount staked.

- Network fees: Each blockchain network imposes a specific transaction fee. Infrastructure fees or other associated fees can impact staking rewards.

- Market conditions: Like any other investment, rewards are influenced by inflation, market volatility, and price movements.

Step-by-step guide to staking:

- Select the right crypto: Choose a cryptocurrency that supports staking, like Ethereum (ETH), Cardano (ADA), or Polkadot (DOT). Also consider factors like lock-up periods, token performance, network fees, and returns.

- Link the wallet: Choose a secure and staking-compatible wallet and deposit the staking amount.

- Staking type: The reward depends on whether you stake directly, through a staking pool, or an exchange.

- Start getting rewards: It depends on the amount staked and the lock-up period.

Benefits:

- Stake multiple assets and diversify your portfolio. This reduces financial risks and enhances your passive crypto income.

- Entry fees are low in staking. It is not energy-consuming like mining and requires minimal initial investments.

- Reinvest and multiply profits by reinvesting staked rewards.

- Opportunity to engage and participate in a broader crypto community.

- Actively contribute to network security and efficiency.

Risks:

- You cannot withdraw your funds during the lockup period.

- Staking rewards depend on market volatility and crypto inflation.

- Many proof-of-stake (PoS) networks have built-in mechanisms that impose “slashing” or penalties for violating network protocols or security.

- Consider counterparty risks. Some external validator platforms may be unreliable.

Also Read: Earn Early with These 5 Best Altcoins in 2025 (Before the Surge)

Yield Farming

Yield farming is the practice of staking or lending crypto assets across different decentralized finance (DeFi) platforms to earn rewards. This is an attractive strategy for yield farmers to enhance their passive crypto income by shifting assets across platforms that offer greater yields. Yield farmers provide liquidity to exchanges and blockchain networks and, in return, earn interest or rewards. Some popular places for yield farming include Aave, Compound, and Uniswap.

Factors that influence yield farming:

- Market conditions: Market volatility may actually enhance the yield or returns due to high risks.

- Interest rates: High interest rates attract more investors to join the liquidity pool. However, it may decrease the depositor or liquidity providers’ (LPs) profit share.

- Platform technology: A platform with robust smart contracts and protocols is more reliable and can offer secure returns.

- Asset diversification: By diversifying investments across multiple platforms, you can mitigate risks and amplify rewards.

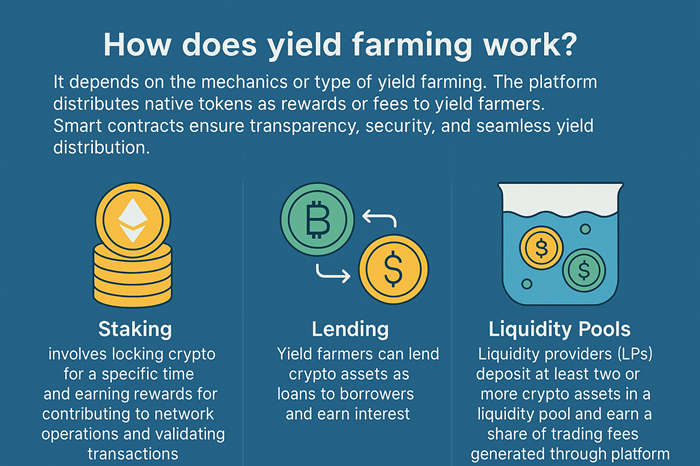

How does yield farming work?

It depends on the mechanics or type of yield farming. The platform distributes native tokens as rewards or fees to the yield farmers. Smart contracts ensure transparency, security, and seamless yield distribution.

Yield farming can be broadly classified into:

- Staking: As discussed above, it involves locking crypto for a specific time and earning rewards for contributing to network operations and validating transactions.

- Lending: Yield farmers can lend crypto assets as loans to borrowers and earn interest.

- Liquidity pools: Liquidity providers (LPs) deposit at least two or more crypto assets in a liquidity pool and earn a share of trading fees generated through the platform.

Benefits:

- High returns as yield farmers can boost their passive crypto income through multiple platforms.

- Diversification of the crypto portfolio minimizes risks and maximizes profits.

Risks:

- Impermanent loss through liquidity pools, where users lock two different tokens and may incur losses when the token value changes.

- Smart contract bugs can cause errors and are susceptible to malicious attacks, causing loss or theft of funds.

Play-to-Earn Games

Play-to-earn or P2E games sparked a lot of attention for their immersive gaming experience and rewarding players with gaming tokens and digital assets with real-world value.

P2E games are blockchain-based gaming platforms that generate a financial incentive for players. Participants can earn cryptocurrencies, NFTs (non-fungible tokens), in-game assets, and other rewards simply by playing games. These rewards can be converted into fiat currencies.

What is the difference between play-to-earn and traditional games?

The fundamental difference is that players in P2E games can monetize by earning crypto or trading their in-game assets in external marketplaces. They have true ownership of in-game assets. Traditional games are designed only for entertainment, and gaming assets have no value outside the gaming platforms.

How do play-to-earn games work?

Players earn and grow their passive crypto income through their gaming experience.

- Tokenizing in-game assets: Tokenization converts these gaming assets, like weapons, skins, or characters, into digital tokens. Token holders get true ownership of the tokenized assets.

- Monetary value: Players can exchange or trade these tokens (tokenized in-game assets) on other platforms or secondary markets. Some exchanges allow players to convert these tokens into fiat currencies like USD or EUR.

- Cashing out: To cash out, transfer tokens into a compatible wallet. List your digital tokens (NFTs or crypto) in decentralized exchanges for sale. Withdraw the earnings in crypto or convert them into fiat currencies.

- Decentralization: P2E games are blockchain-based and are completely decentralized (not controlled by any single entity).

- Community governance: Token holders can participate in important decision-making processes and governance protocols within the gaming communities.

Benefits:

- P2E games are globally accessible, inclusive, and do not require any prior knowledge.

- Token holders get ownership and control of their assets.

- Digital tokens can be easily cashed out or converted into fiat currencies.

Risks:

- Digital wallets are susceptible to scams and hacks. Beware of sending funds to the wrong wallet addresses.

- Players must pay upfront fees to participate in the games.

- Decentralized gaming is subject to country and state regulations. Some countries may prohibit online games and legally treat them as gambling.

Some of the top P2E gaming platforms are Axie Infinity, The Sandbox, and Illuvium.

Affiliate Programs

Do you have friends, family members, or colleagues who are interested in crypto? Then, affiliate programs can be a good way to earn crypto passively.

An affiliate program is a marketing tool that crypto firms use to promote a product, service, or capture more clients. In this program, the referrer shares certain crypto-related referral links. When someone signs up for a crypto project, trade, or stake using that link, then the referrer earns a percentage as a commission for the services rendered.

Affiliate programs give high rewards. Payouts depend on the platform. Exchange platforms like OKK, Coinbase, ByBit, Gate.io, etc., provide high commissions on affiliate programs.

Get started with this step-by-step guide:

- Join the affiliate program: Select and sign up with a reliable platform with a good reputation, high payout, and dedicated affiliate managers.

- Get affiliate marketing links: Pick the platform to promote links, like email newsletters, blogs, websites, and other social media platforms like Reddit, YouTube, Telegram, X (formerly Twitter), Google Advertisements, etc.

- Track performance: Use tools like Google Analytics or affiliate dashboards to track performance metrics like clicks, open rates, and conversions.

- Earn commission: Earn through pay-per-conversion or sign-up processes once someone completes the desired action.

Benefits:

- Top exchanges offer generous payouts like 50-60% commission.

- Low entry barrier and does not require high technical knowledge.

Risks:

- Unreliable affiliate programs may disappear without paying the referrers.

- Many countries have regulatory restrictions on affiliate marketing.

- Some platforms require mandatory KYC (Know Your Customer) verifications.

Crypto Savings Account

This is perhaps one of the easiest ways to earn passive crypto income, especially for beginners. It works like a traditional bank, where you earn interest for depositing money in your savings account. However, compared to banks, a crypto savings account offers higher returns. Once you deposit funds in your crypto savings account, the platform lends the assets to borrowers or liquidity pools. You earn compounded interest that can be paid daily, weekly, or at the end of the month.

How does a crypto savings account work?

- Create an account with a well-known and trusted platform like Binance, ByBit, or KuCoin.

- Deposit funds in a wallet that is compatible with the platform.

- Select a savings account, such as a flexible or a fixed account.

- Withdraw earnings according to your savings account plan.

Benefits:

- High interest rates compared to traditional banks.

- Low effort, and no technical knowledge required.

- Diversify investments and earn more from the same platform.

Risks:

- They may be susceptible to scams and security breaches.

- They are not FDIC-insured (Federal Deposit Insurance Corporation) and are not backed by the government.

Final Thoughts

The above list offers some lucrative and beginner-friendly avenues to earn passive crypto income with minimal time and effort. However, we cannot ignore that the crypto market is volatile and often exposed to fraudulent activities and market manipulation. To maximize returns, research and evaluate the potential risks and rewards, and choose the right platform and strategy that aligns with your investment goals.

Disclaimer: The above content is written for informational purposes only. It does not constitute or endorse any recommendation, solicitation, or financial advice for digital asset investments or trading. Crypto investments are highly risky. We encourage readers to do due diligence or seek expert advice before investments.

Taniya is a Content Writer with over 6 years of experience in the industry, specializing in Web3, crypto, Blockchain, Tokenization, and Decentralized Finance. She is passionate about creating compelling and well-researched narratives, navigating readers through the emerging trends and dynamic world of Web3 and Decentralized Finance.

1 thought on “Lazy to Trade? Earn Passive Crypto Income with these 5 Proven Ways”