TVL: Powerful Growth or Hidden Risk?. TVL is a defining metric in the decentralized finance (DeFi) ecosystem, serving as a benchmark for platform performance and user trust. Whether you’re a crypto investor, DeFi developer, or curious enthusiast, this guide will help you navigate the evolving blockchain landscape. Understanding how TVL works and why it matters is essential for making smart, secure, and profitable decisions in DeFi.

What is TVL (Total Value Locked)?

The Total Value Locked refers to the total amount of assets staked, deposited, or committed to DeFi protocols. It reflects the combined value of all assets locked in smart contracts across platforms like lending apps, exchanges, and yield services.

Measured in USD, TVL helps users assess a DeFi project’s liquidity and trustworthiness. The higher the Total Value Locked, the more capital users have entrusted to the protocol, indicating strength, adoption, and security of the user funds.

Types of TVL

TVL varies based on asset use within DeFi:

1. Lending Protocols

Users deposit tokens to earn interest or enable borrowing.

2. Decentralized Exchanges (DEXs)

Tokens are locked into pools for peer-to-peer trading.

3. Yield Farming

Funds are staked in contracts to earn reward tokens.

4. Staking

Assets are locked to secure networks and earn rewards.

5. Derivatives Platforms

Collateral is used in trading synthetic or leveraged assets.

Each type plays a key role in driving platform utility and overall DeFi performance.

Why Companies Offer TVL Opportunities

DeFi platforms promote TVL for several reasons:

- Liquidity: Higher TVL ensures efficient transactions.

- Trust: It signals platform reliability and adoption.

- Growth: More locked assets support scaling efforts.

- Incentives: Users receive token rewards or interest.

- Visibility: High Total Value Locked attracts users and media attention.

Platforms benefit by attracting liquidity providers, which directly influences transaction volume, trading fees, and protocol sustainability.

How to Qualify for TVL Programs

To participate in Total Value Locked:

- Use a Wallet: MetaMask or Trust Wallet works well.

- Hold Tokens: ETH, USDC, or DAI are often accepted.

- Choose a Protocol: Select a DeFi platform offering staking or farming.

- Connect and Authorize: Access the platform and approve token use.

- Deposit Funds: Lock your tokens in a supported pool or smart contract.

Most protocols are open to everyone, with no traditional credit checks or identity restrictions, making DeFi inclusive by design.

Benefits of Participating in TVL

Benefits of engaging in TVL include:

- Passive Income: Earn rewards through staking or farming.

- Early Access: Unlock platform features or airdrops.

- Protocol Governance: Gain voting rights.

- Diversification: Spread capital across DeFi services.

- Enhanced Earnings: Bonuses and high APYs for contributors.

In addition, TVL participation supports decentralized ecosystems, allowing users to be part of innovation in global finance.

Risks and Precautions

TVL comes with risks:

- Smart Contract Bugs: May lead to asset loss.

- Impermanent Loss: Liquidity providers can lose value.

- Platform Failure: Protocols may collapse or rug-pull.

- Volatility: Token values can drop sharply.

- Legal Risks: Regulatory changes may affect platforms.

Protect your assets by using audited platforms, avoiding high-risk tokens, and keeping funds diversified across multiple protocols.

Where to Find Legit TVL Platforms

To find safe Total Value Locked opportunities:

- Use Verified Projects: Popular platforms are often safer.

- Check Community Feedback: Look for transparency and engagement.

- Review Audits: Choose audited and well-documented protocols.

- Avoid Hype Traps: If returns look too good, proceed cautiously.

Reputation, development activity, and user base are strong indicators of protocol legitimacy and future sustainability.

Best Strategies to Maximize TVL

Use these strategies to boost Total Value Locked returns:

- Diversify: Use multiple protocols.

- Compound: Reinvest yield for higher gains.

- Watch Fees: Optimize timing to avoid high gas costs.

- Balance Risk: Combine stable and high-yield options.

- Stay Informed: Follow updates and governance votes.

Regularly reviewing your positions and adjusting to market trends can help improve profitability and reduce unnecessary losses.

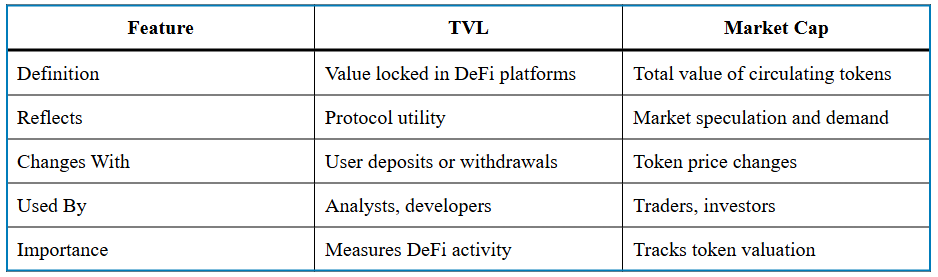

Difference Between TVL and Market Cap

Total Value Locked focuses on usage and functionality, while market cap highlights token popularity and speculation.

Tax Implications

Understanding TVL’s tax effects is vital:

- Yield Income: Often considered taxable.

- Capital Gains: Triggered when you sell or swap.

- Token Rewards: May be taxed on receipt.

- Track Activity: Keep detailed records for reports.

Failure to report income from DeFi protocols can result in penalties. Accurate reporting and awareness of your local tax laws are crucial.

Future Outlook for TVL

Total Value Locked is poised for long-term expansion. As traditional finance begins integrating blockchain infrastructure, Total Value Locked will represent not just crypto-native value, but also tokenized real-world assets. Cross-chain compatibility, institutional adoption, and regulatory clarity will likely reshape how users interact with DeFi protocols and measure platform strength.

Developers may also introduce new metrics to evaluate platform efficiency and user engagement beyond raw Total Value Locked numbers, leading to better financial analytics and improved investment tools.

Conclusion

Total Value Locked plays a key role in DeFi, signaling platform health, liquidity, and user trust. From passive earning to governance and risk management, Total Value Locked serves as a gateway to the broader decentralized economy. Understanding how it works helps you participate more confidently and strategically in the future of finance.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.