Bitcoin Hits $124K, Surpasses Google in Market Value. Bitcoin’s meteoric rise continues, marking yet another historic milestone. As of mid-August 2025, Bitcoin hits $124,000, setting a fresh all-time high, and its market capitalization surpasses that of Google, ranking it among the top five global assets by market value. This isn’t just a headline—it represents a seismic shift in how digital assets are perceived and valued in global finance.

What’s Driving Bitcoin’s Surge?

1. Favorable U.S. Policy Momentum

New U.S. policy developments are fueling investor optimism. The Trump administration has implemented favorable regulations, including allowing retirement accounts (401(k)s) to allocate funds into cryptocurrencies. These reforms are unlocking trillions in potential capital flows into digital assets.

2. Anticipated Fed Rate Cuts

Market sentiment has been buoyed by expectations of interest rate cuts from the Federal Reserve. Chief policymakers have signaled that current levels may be overly restrictive, supporting higher-risk assets like Bitcoin.

3. Institutional Inflows & ETF Growth

Institutional adoption is accelerating. Multiple Bitcoin ETFs are now active in the U.S., attracting mainstream investors and delivering broader market participation—a trend further supported by executive orders easing regulatory barriers.

4. Record-Breaking Whale Accumulation

Major holders (“whales”) are loading up. The number of addresses holding over 100 BTC has surged to historic levels, signaling confidence and diminishing supply availability—an optimistic signal for bullish price action. CryptoRankCoinRank

Comparing Bitcoin vs. Google Market Cap

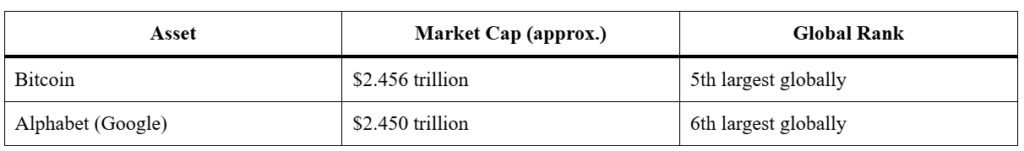

To better understand the significance of Bitcoin’s achievement, here’s a direct comparison:

Bitcoin’s market cap now exceeds Google’s by a narrow margin—solidifying its position as the fifth-largest asset in the world.

Implications of This Milestone

• Mainstream Legitimacy

This milestone enhances Bitcoin’s legitimacy, shifting its narrative beyond speculative hype. It’s increasingly treated as a store of value comparable to traditional assets like gold

• Global Financial Disruption

Bitcoin’s rise to prominence is rewriting rules challenging giants like Alphabet not just in tech, but in valuation. This disruption reflects its growing influence in digital finance.

• Portfolio Diversification & Risk Strategy

As Bitcoin integrates more deeply into institutional portfolios (via ETFs and treasury allocations), its role in asset diversification becomes more pronounced though volatility remains.

• Volatility-Related Caution

Despite its surge, Bitcoin remains highly volatile. Sudden corrections are common, and investors should remain wary even as institutional adoption grows. Know more here for Crypto Market Volatility.

Market Sentiment and Broader Trends

- Crypto Market Cap Total: The broader crypto ecosystem now boasts a combined valuation of over $4.18 trillion highlighting proportionally the enormous footprint that Bitcoin (alone) has achieved.

- Retirement Investment Shift: With retirement plans (401(k)s) gaining crypto access, the structural flow of long-term capital into digital assets is changing the potential is staggering.

- Wall Street and Traditional Finance’s Embrace: Stocks tied to crypto (like Coinbase, Strategy, Robinhood) are surging on optimism, indicating broader overlap between traditional finance and the crypto sector.

Summary Wrap-Up

Bitcoin’s surge past $124,000 and its market cap overtaking Google is more than numeric it’s symbolic. It signals maturation of the crypto ecosystem, deeper integration with mainstream finance, and growing recognition that digital assets can rival established corporate giants. Whether you’re a retail investor, financial professional, or SEO content creator, this milestone invites attention and reflection on the evolving dynamics of value creation.The cryptocurrency market showed mixed movements in the last 24 hours, with FUNToken leading gains after renewed investor interest, followed by Bio Protocol and LayerZero. Meanwhile, Juventus Fan Token, Hashflow, and GMX saw notable losses as traders adjusted positions. Volatility remains high, offering opportunities for short-term crypto traders and long-term investors tracking market trends.

🔺 Top 3 Gainers (24h Performance)

- FUNToken (FUN) – $0.011371 ▲ 27.95%

- Bio Protocol (BIO) – $0.132075 ▲ 14.84%

- LayerZero (ZRO) – $2.338013 ▲ 13.41%

🔻 Top 3 Losers (24h Performance)

- Juventus Fan Token (JUV) – $1.460418 ▼ 10.50%

- Hashflow (HFT) – $0.098455 ▼ 10.15%

- GMX (GMX) – $16.76 ▼ 9.38%

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact