Power Guide to Bear Market Meaning & Smart Investing. When people hear the term bear market meaning, it often brings thoughts of falling stock prices, economic uncertainty, and panic in the trading world. But the bear market meaning goes beyond just red charts, it’s a vital concept every investor should understand to make informed decisions during tough market phases.

In this article, we will explore the bear market meaning, its causes, effects, and how you can navigate through it with confidence.

What is the Bear Market Meaning?

The bear market meaning refers to a period when the prices of securities, such as stocks, fall by 20% or more from recent highs over a sustained period. This phase can occur in any financial market, including stocks, cryptocurrencies, real estate, and commodities.

A bear market meaning isn’t just about a temporary dip, it signals a longer-term downtrend caused by investor pessimism, economic slowdown, or external shocks like geopolitical crises.

Key Characteristics of a Bear Market

To fully understand the bear market meaning, here are some of its main characteristics:

- Extended Decline: Prices fall consistently over weeks or months.

- Negative Sentiment: Investors expect further declines and sell assets.

- Economic Slowdown: Often linked with recessions or low GDP growth.

- High Volatility: Daily price swings are common as traders react to news.

- Reduced Trading Volume: Many investors move to cash or safe assets.

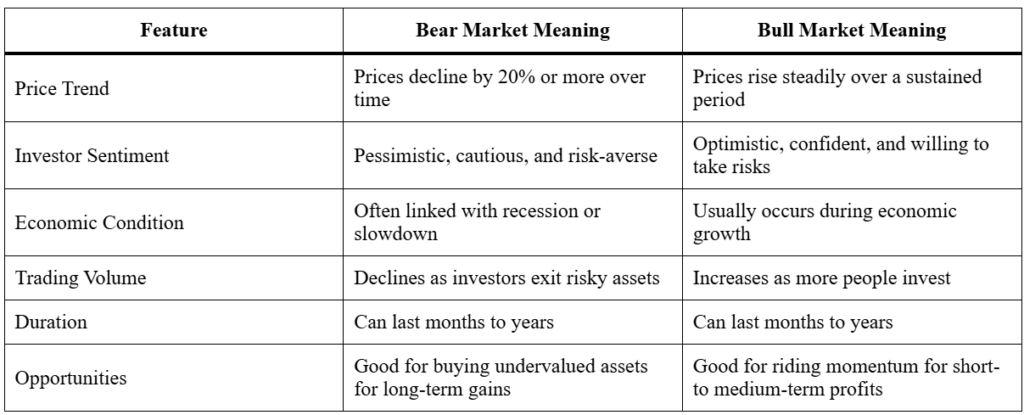

Bear Market vs Bull Market – Comparison Table

Understanding the bear market meaning also requires knowing what causes it. Common reasons include:

- Economic Recession: When GDP contracts, businesses earn less, and stock prices fall.

- High Inflation: Erodes purchasing power, leading to weaker market performance.

- Rising Interest Rates: Borrowing becomes expensive, affecting corporate profits.

- Geopolitical Tensions: Wars, trade disputes, or political instability can spook investors.

- Pandemics or Natural Disasters: Sudden economic disruptions cause panic selling.

Phases of a Bear Market

The bear market meaning can be better understood by breaking it down into four phases:

- High Prices and Optimism: Before the decline starts, markets are usually performing well.

- Early Decline: Prices start falling as investors take profits or react to bad news.

- Capitulation: Panic selling leads to sharp price drops.

- Stabilization: Prices stop falling, and a recovery phase may begin.

Impact of a Bear Market

A bear market meaning also involves understanding its effects on different stakeholders:

- Investors: Portfolio values drop, leading to lower returns.

- Businesses: Funding becomes harder to obtain, affecting expansion plans.

- Economy: Consumer spending decreases, slowing down growth.

- Psychology: Fear and uncertainty lead to emotional decision-making.

How to Survive a Bear Market

Knowing the bear market meaning is just the first step surviving it requires strategy:

- Diversify Your Portfolio: Spread investments across sectors and asset classes.

- Invest in Defensive Stocks: Companies in healthcare, utilities, and consumer staples tend to perform better.

- Use Dollar-Cost Averaging: Invest a fixed amount regularly to reduce timing risks.

- Hold Quality Assets: Focus on companies with strong balance sheets and consistent earnings.

- Stay Calm: Avoid panic selling based on short-term price drops.

Opportunities in a Bear Market

While the bear market meaning often has negative connotations, it also presents opportunities:

- Buy Low: Quality stocks become available at discounted prices.

- Long-Term Gains: History shows markets eventually recover, rewarding patient investors.

- Portfolio Rebalancing: Adjust allocations to better suit future market conditions.

- Dividend Investing: Stable companies often maintain dividends, providing income during downturns.

Bear Market Examples in History

To truly grasp the bear market meaning, here are some notable examples:

- 2008 Financial Crisis: Triggered by the housing market collapse, major indexes fell over 50%.

- Dot-Com Bubble (2000–2002): Tech stocks crashed after extreme overvaluation.

- COVID-19 Crash (2020): Markets dropped over 30% in a matter of weeks before rebounding.

Psychology Behind the Bear Market Meaning

The bear market meaning also has a deep connection to investor psychology. Markets are driven not only by numbers but also by emotions such as fear and greed. When prices start to drop, fear often spreads faster than any financial indicator can measure. This leads to panic selling, where investors offload assets at a loss to “protect” their remaining capital.

However, seasoned investors view the bear market meaning from a different angle. They see it as a natural phase of the market cycle and often prepare for it in advance. This preparation could involve building a cash reserve, studying undervalued companies, or setting limit orders to buy at lower prices. By doing so, they can capitalize on opportunities while others retreat.

Long-Term Benefits of Understanding Bear Market Meaning

While it’s challenging to endure, the bear market meaning also teaches valuable lessons. Investors who experience a bear market often develop stronger discipline, improved research skills, and a better grasp of risk management. They learn that downturns are temporary and that patience is one of the most powerful tools in investing.

Ultimately, understanding the meaning of a bear markethelps you stay grounded during turbulent times. Instead of reacting to fear, you can act on logic, positioning yourself for stronger gains when the next bull market begins.

Final Thoughts on Bear Market Meaning

The bear market meaning isn’t just a textbook term it’s a real-world challenge and opportunity rolled into one. By understanding its definition, causes, and strategies to navigate it, you can make informed investment choices and avoid common pitfalls.

A bear market tests patience, discipline, and decision-making skills. But with the right mindset, it can also be the time when smart investors position themselves for the next wave of growth.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact