Altcoin Season Index Drops to 38 as Bitcoin Dominates Market.The cryptocurrency market is witnessing a notable shift as the Altcoin Season Index has declined to 38, down from 42 just a day ago, signaling increasing Bitcoin dominance over altcoins.

According to BlockBeats, data retrieved from CoinMarketCap (CMC) indicates that out of the top 100 cryptocurrencies by market capitalization, only 38 have managed to outperform Bitcoin in the last 90 days. This change marks a significant downturn for altcoins, many of which had been gaining ground earlier this year.

What is the Altcoin Season Index?

The Altcoin Season Index, powered by CoinMarketCap, serves as a market sentiment indicator to help traders and analysts identify whether we are currently in a “Bitcoin season” or an “altcoin season.”

How the Index Works

- Range: The index ranges from 0 to 100.

- Above 75: Indicates an Altcoin Season, meaning 75 or more of the top 100 altcoins have outperformed Bitcoin in the past 90 days.

- Below 25: Suggests a Bitcoin Season.

- Between 25–75: Represents a neutral phase with no clear dominance.

Today’s reading of 38 reflects that the market is moving away from altcoin gains and heading toward stronger Bitcoin performance.

Why the Drop Matters

A drop in the Altcoin Season Index typically signals that investors are reallocating capital away from high-risk altcoins and back into Bitcoin, which is perceived as a safer asset within the volatile crypto market. The index dropping from 42 to 38 in just 24 hours is a rapid shift and may be reflective of growing macroeconomic concerns, inflation hedging, or regulatory uncertainties affecting altcoins more than Bitcoin.

Bitcoin’s Renewed Strength

Dominance Metrics

The Bitcoin Dominance Index, which measures Bitcoin’s share of the overall crypto market cap, has climbed steadily over the past few weeks. This indicates that Bitcoin is capturing more investor attention and capital, likely due to its established infrastructure and broader institutional acceptance.

Performance Comparison

- Bitcoin (BTC): Up 8% over the past 30 days

- Top Altcoins (e.g., ETH, SOL, ADA): Many have underperformed or moved sideways

- Smaller-cap altcoins: Seeing increased volatility and declining volumes

This disparity reinforces the current risk-off sentiment in the market.

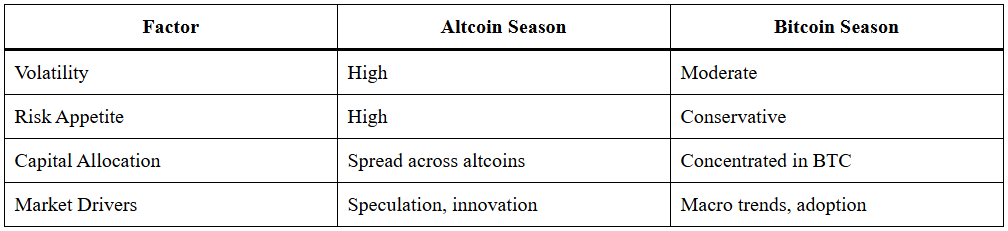

Altcoin Season vs. Bitcoin Season: What’s the Difference?

Understanding the difference between these two market phases can help both retail and institutional investors refine their trading strategies.

What’s Driving Bitcoin’s Current Dominance?

Several factors are influencing the market’s tilt toward Bitcoin, including:

- ETF Inflows – Bitcoin spot ETFs have seen consistent inflows, increasing institutional interest.

- Macro Trends – With rising interest rates and global economic uncertainty, BTC is being viewed as a store of value.

- Regulatory Clarity – While altcoins face scrutiny, Bitcoin remains relatively insulated from most regulatory debates.

- Historical Performance – Bitcoin often leads recovery cycles post-bear markets.

Reaad All About: Top 5 Best Crypto to Invest on Binance

Founding & Ownership of CoinMarketCap

CoinMarketCap, the data provider behind the Altcoin Season Index, was founded by Brandon Chez in 2013. The platform quickly grew into one of the most trusted crypto data aggregators globally. In April 2020, CoinMarketCap was acquired by Binance, the world’s largest cryptocurrency exchange by trading volume.

Under Binance’s umbrella, CoinMarketCap has enhanced its data transparency, real-time updates, and analytical tools — including the Altcoin Season Index, which is now widely referenced by traders and analysts.

Market Implications for Traders

Strategic Shifts

With the index sliding, traders and investors may consider:

- Rebalancing portfolios to reduce altcoin exposure

- Monitoring Bitcoin technical indicators for bullish confirmations

- Avoiding low-cap altcoins with declining volumes

Altcoin Risks

Altcoins often suffer from:

- Lower liquidity

- Higher volatility

- Project uncertainty and team inexperience

Hence, during non-altcoin seasons, altcoins tend to underperform sharply relative to Bitcoin.

Historical Context: When Was the Last Altcoin Season?

The last confirmed Altcoin Season was observed in early 2024, when the index surged past 75. This period was marked by:

- Explosive gains in AI and DeFi tokens

- ETH outperforming BTC

- High risk appetite across retail investors

Since then, tightening monetary policy and risk aversion have led to a consistent decline in altcoin momentum, paving the way for Bitcoin’s continued dominance.

What to Expect Next?

Unless altcoins begin to outperform BTC significantly over the next few weeks, it is likely the Altcoin Season Index will fall further. Some analysts believe this shift could persist until a new wave of innovation or regulatory clarity re-energizes the altcoin market.

Investors should keep a close watch on:

- Layer 2 solutions

- Ethereum upgrades

- Stablecoin regulations

- Real-world asset tokenization (RWA)

These may serve as catalysts for a potential altcoin resurgence in the next cycle.

Conclusion

The recent decline in the Altcoin Season Index to 38 marks a clear shift in market momentum toward Bitcoin dominance. With macroeconomic concerns, stronger BTC fundamentals, and reduced altcoin enthusiasm, traders are recalibrating their strategies. Whether this trend persists or altcoins regain ground depends largely on upcoming market catalysts, regulatory developments, and institutional participation.

Investors should stay informed, manage risks, and watch the index closely as it continues to reflect the market’s evolving sentiment.

🔺 Top 3 Gainers (24h Performance)

1. PROVE (PROVE) – $1.290 (+329.53%)

PROVE surged as renewed institutional interest and recent protocol upgrades boosted investor sentiment. Its unique Proof-of-Value model drew attention from DeFi users looking for sustainable yield generation, powering PROVE’s short-term rally.

2. TOWNS (TOWNS) – $003971 (+61.38%)

TOWNS gained momentum driven by rising demand for decentralized social communities. Recent updates to its DAO governance framework and increased user onboarding have amplified visibility, spurring fresh buying interest.

3. OG (OG) – $6.66 (+15.56%)

OG saw sharp gains thanks to a spike in fan token trading volume and renewed partnerships with sports franchises. The platform’s push to expand real-world utility for fan engagement helped fuel bullish sentiment.

🔻 Top 3 Losers (24h Performance)

1. BROCCOLI714 (BRO) – $0.029 (–11.53%)

BROCCOLI714 continued its downward spiral after failing to deliver on development promises. Investor concerns about roadmap delays and lack of ecosystem transparency drove a major sell-off.

2. KERNEL (KERN) – $0.22 (–9.14%)

KERNEL slumped after rumors of leadership instability and token misallocation emerged. Weak communication from the core team caused a dip in investor trust, leading to significant outflows.

3. FUN (FUN) – $0.0090 (–8.93%)

FUN faced headwinds as user activity on its gaming platform plateaued. Lower transaction volumes and waning interest in blockchain gaming sectors contributed to the decline in its token price.

I work as a content writer in the blockchain and cryptocurrency domain. I have a keen interest in exploring the world of digital assets, Web3, and emerging crypto technologies. My goal is to provide readers with easy-to-understand, engaging, and trustworthy insights, helping them stay informed and confident in the rapidly evolving world of crypto and blockchain.