Types of Crypto Staking: Which One Should You Choose?. Crypto staking has grown into a popular side hustle to put your idle crypto assets to work and boost passive income without active trading. The best part? There are multiple ways to stake your crypto. The key is to find the ideal approach that aligns with your needs, goals, and investment strategies.

This article uncovers the various types of crypto staking and their benefits. Let’s explore!

What is Staking in Crypto and How Does it Work?

Crypto staking involves committing crypto assets to a blockchain network that runs on a Proof-of-Stake consensus mechanism like Ethereum, Solana, or Polkadot. During this process, you stake or lock your funds in supported wallets to verify and confirm transactions, optimize efficiency, and security of the blockchain network. In return, the network incentivizes you with staking rewards.

Network participants or crypto stakers must stake a minimum number of tokens to qualify for crypto staking.

In crypto staking, there are mainly two parties:

Validator: An individual or an entity that verifies transactions to add new blocks to the blockchain. A validator must stake a minimum amount of crypto assets as collateral. For example, Ethereum requires validators to stake at least 32 ETH to qualify.

The network may penalize a validator for poor performance, misbehaviour, or indulging in fraudulent activities through “slashing,” where a portion or even the entire staked amount is removed penalty. These rules secure network operations and ensure that the validators act responsibly.

Validators are chosen randomly. It also depends on the size of the staked collateral. It is like a security deposit that ensures that validators perform their duties in good faith. So, the more you stake, the greater the chances of being chosen as a validator.

Delegator: A delegator is a user who delegates or authorizes staking power to another individual or third-party service provider. Both the delegator and the validator earn staking rewards after completing the staking process. The validator receives a percentage of the staking reward as commission or validator fees for performing staking duties and creating a new block.

A PoS network incentivizes mainly for 3 reasons:

- To validate transactions and new blocks.

- To safeguard the network from malicious activities.

- To issue and circulate new tokens.

What are the Types of Crypto Staking?

There are several ways to stake crypto and earn rewards. Here is a breakdown.

Solo-staking

Also called self-staking, where you actively participate in the staking process. You run the node on your own, validate transactions, and are in complete control of your staked assets and the staking process. This is a form of native staking where significant technical knowledge for running the node and understanding the staking process is needed. Since no third-party service provider or external validator is involved, it reduces counterparty risks. You are the sole owner of the staking rewards.

Delegated staking

You choose a trusted validator to stake on your behalf. The delegator runs the validator node. The rewards generated are shared between you (delegator) and the validator. This crypto staking type helps if you lack the resources (software or hardware) for running the node, technical knowledge, or time. However, some counterparty risks are involved. If the validator performs poorly or maliciously, the network may penalize it, and as a result, you may lose a portion or the entire staking reward.

Staking pool

Multiple crypto stakers combine and deposit their resources in a common staking pool. This helps if a solo user does not have enough staked assets, resources, or technical setup to perform staking independently. The rewards are distributed fairly among the participants in proportion to their staked assets, ensuring predictable returns. Examples: Marinade Finance (for SOL), Lido Finance, etc.

StaaS (Staking-as-a-Service) platforms

They are all-in-one service providers that provide the infrastructure, tech stack, and customer support. It simplifies the process of staking, where users can earn staking rewards by delegating staked assets. StaaS platforms can be custodial or non-custodial.

1. Custodial staking: You entrust a third-party platform, like a decentralized or centralized exchange, to stake assets on your behalf. You deposit your staked funds in the platform-supported wallet. The custody platform has access to your funds and private keys and handles the entire process from managing your funds, staking, to reward distribution. The custodian stakes the assets directly or hires external validators. Custodial staking is beneficial for less experienced people, but they lose control over their funds and even private keys. The service charges are also relatively high as the platforms handle everything from tech support to reward distribution. Examples: Binance Earn, CoinDCX (India).

2. Non-custodial staking: Users maintain full control of funds and private keys. It is typically done through a wallet interface like Ledger Live or Trezor, or a liquid staking protocol like Lido, Allnodes Team, or Rocket Pool. There are no intermediaries, unlike centralized exchanges, which reduces counterparty risks. Fees are competitive and deducted as a percentage from the staking rewards.

Liquid staking

This is an emerging concept that allows users to stake assets without locking their liquidity. You stake assets through a staking platform like Rocket Pool or Lido and receive liquid staking tokens or LSTs. These LSTs can be traded, bought, sold, and used in other DeFi applications. The advantage of liquid staking is that it offers greater flexibility and opportunity to multiply your crypto returns.

Which Crypto Staking Type Should You Choose for Beginners?

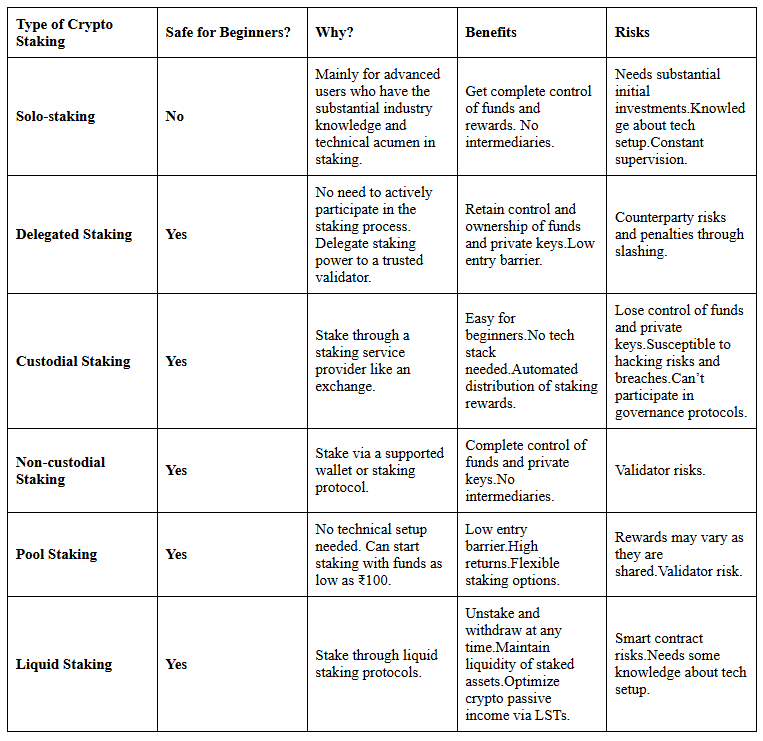

Crypto staking might seem overwhelming, especially if you are a beginner and venturing into the market for the first time. Here is a comparative analysis that can help you narrow down your choice.

Types of Crypto Staking: Comparative Analysis

Note: Beginners can avoid solo staking. It requires substantial technical expertise and minimum initial investments. Custodial staking is the best option for first-timers. However, stay vigilant and choose a reputable staking platform, implement strong security settings, and track your investments to avoid counterparty risks and fund losses.

Is Crypto Staking Profitable?

Yes, it is profitable. It is one of the most popular and easiest ways to generate passive income, especially for long-term holders.

- Earn rewards from idle crypto assets.

- Low entry barrier. Earn with minimal investments.

- Eco-friendly compared to energy-intensive mining.

- Earn passively. No need for active trading.

- Contribute and support the network.

- Participate in network governance.

- Reinvest staked rewards and multiply earnings.

Final Thoughts

There are several types of crypto staking, but which one is best for you? Well, it depends on your risk tolerance, experience, technical acumen, and preference. Each type of crypto staking carries some inherent benefits and risks.

If you are a new investor, you may choose a StaaS provider like a custodial platform or liquid staking protocols for their robust technical support, beginner-friendly interface, and infrastructure for a seamless experience.

On a final note, do not rely blindly. The solution to long-term success is to stay informed and research the platform’s reputation and performance, security protocols, fee structure, and verify previous customer testimonials before investing.

Taniya is a Content Writer with over 6 years of experience in the industry, specializing in Web3, crypto, Blockchain, Tokenization, and Decentralized Finance. She is passionate about creating compelling and well-researched narratives, navigating readers through the emerging trends and dynamic world of Web3 and Decentralized Finance.